SITE MAP

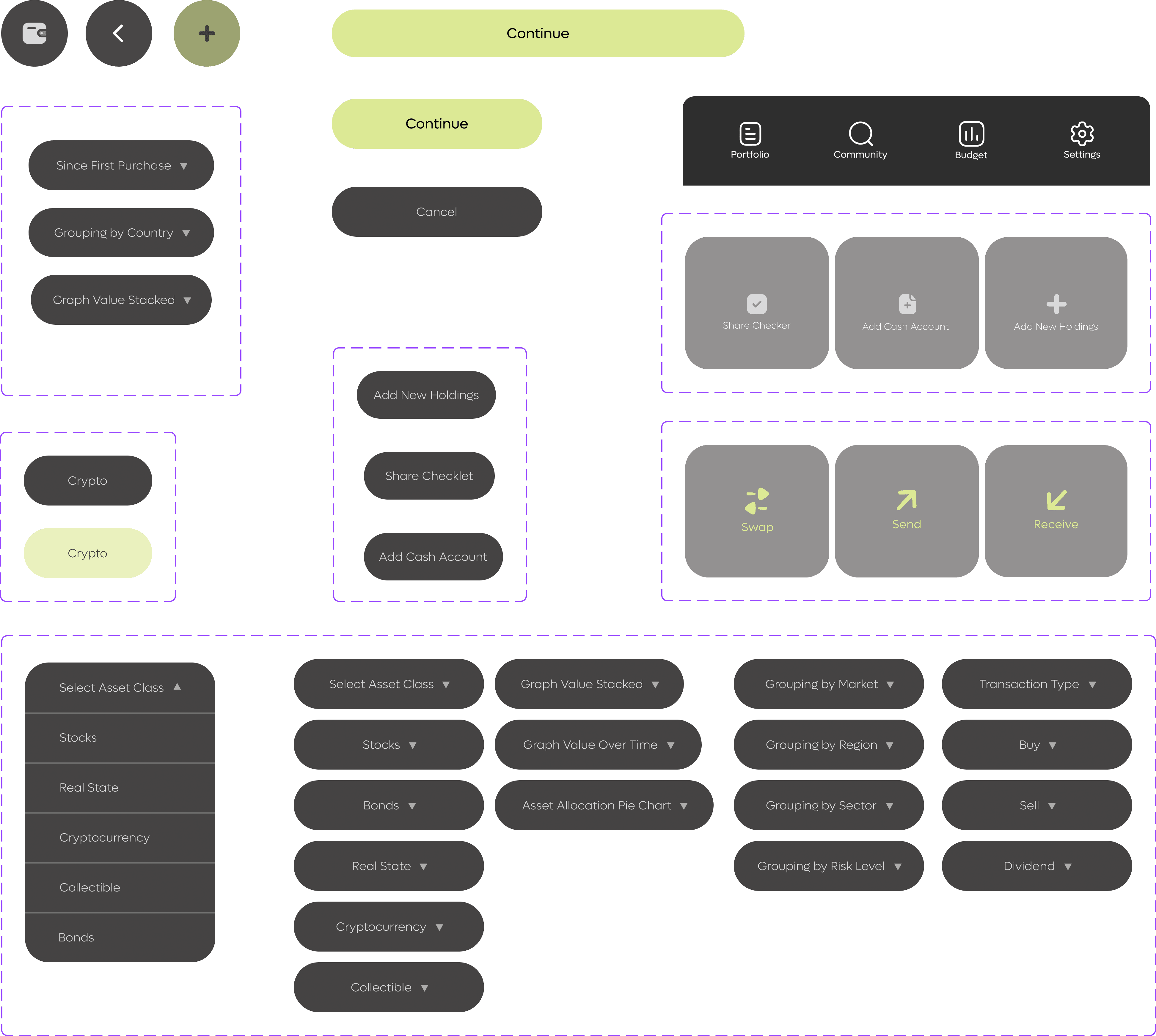

WIREFRAMES

First set of wireframes were created with a vague idea in mind of how all the information could be distributed. The app design went through multiple iterations even after hi-fi designs were made and is still going through changes as new features and feedback are taken into consideration.

Homepage: Initially the idea of having a homepage as a first stop for the user seemed right as in this section tips, news and other features would keep the user up to date about the financial world. Eventually this section was discarded as the same content could be located in the community section as well as in the budget section. it was in the best interest to keep the app simple regarding functionality and information to avoid overwhelming the user with redundant information.

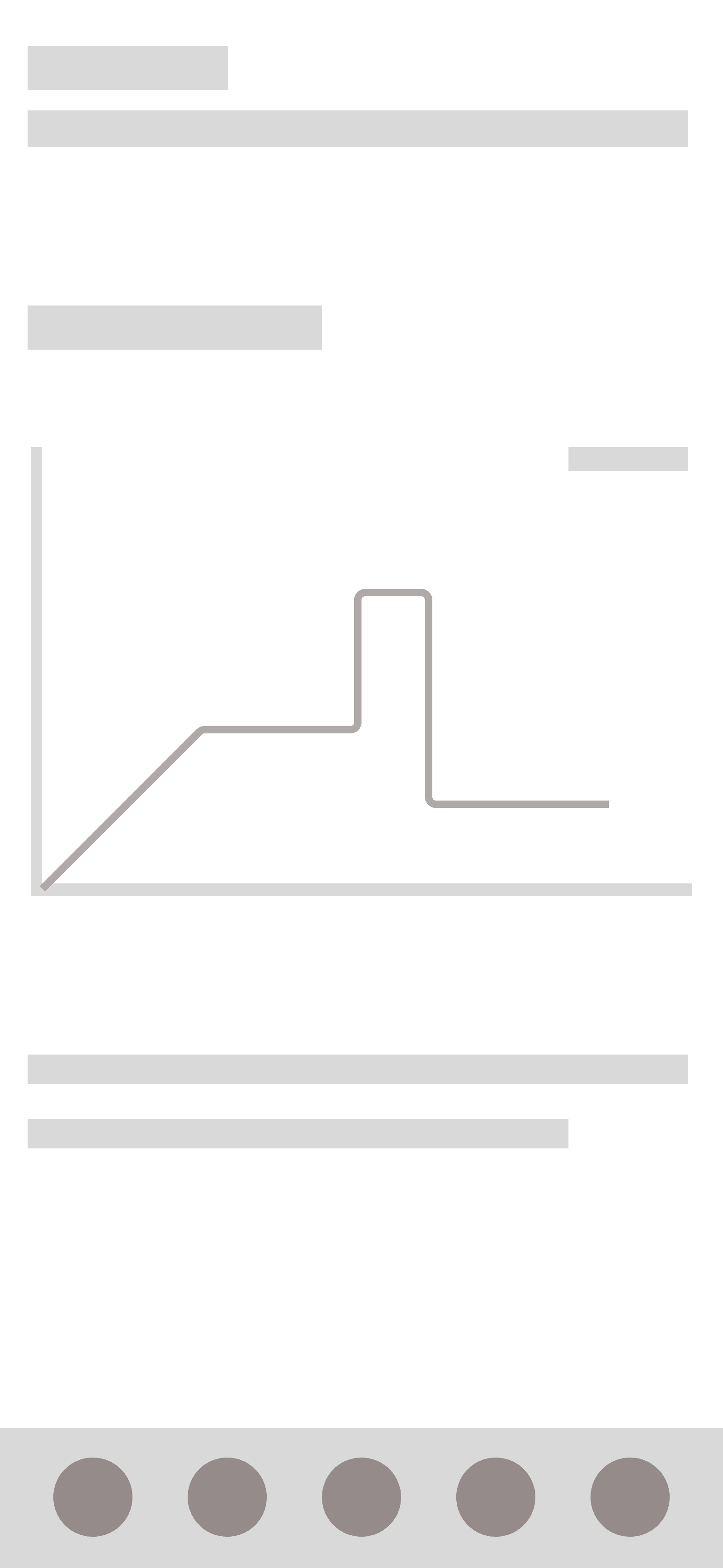

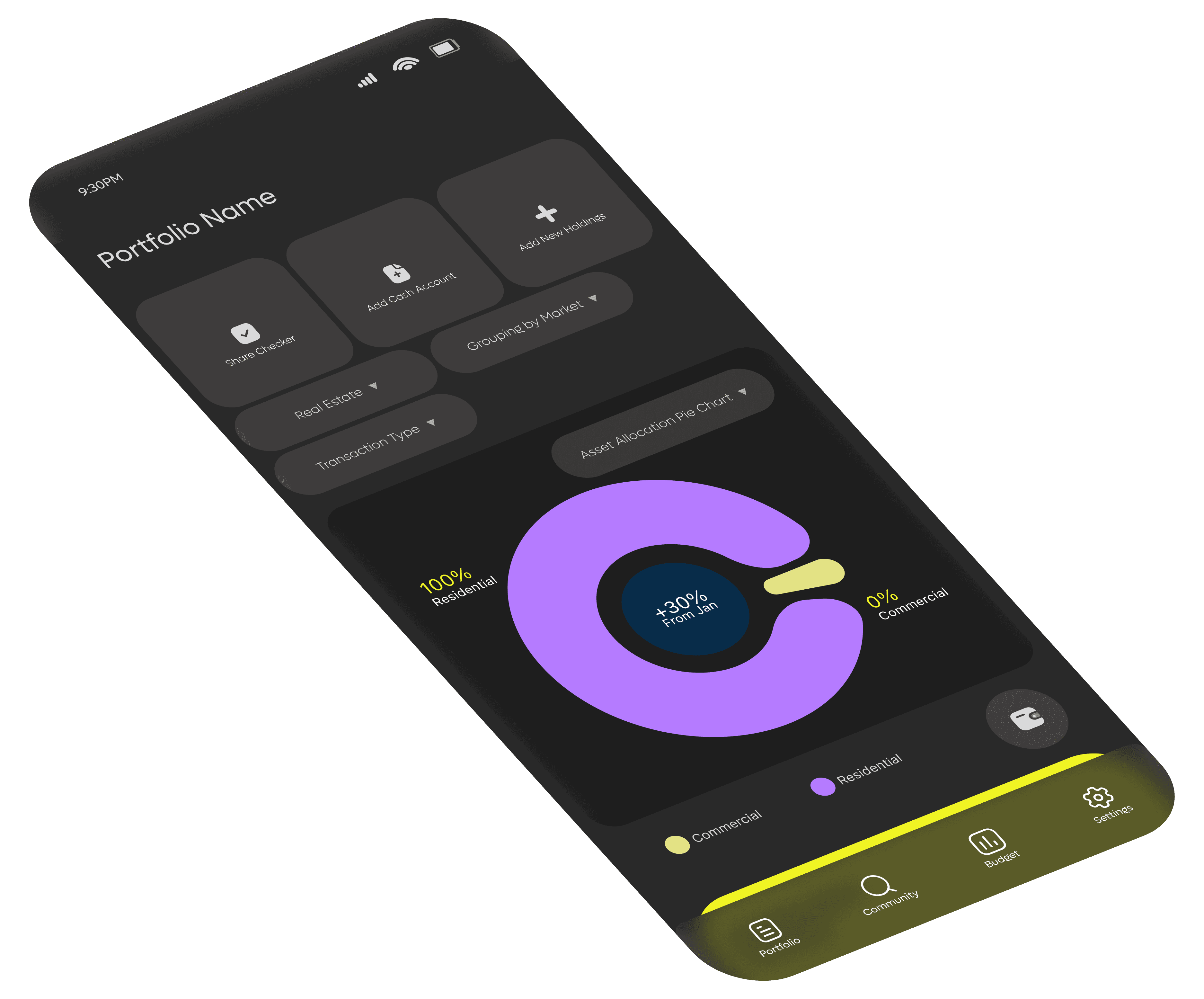

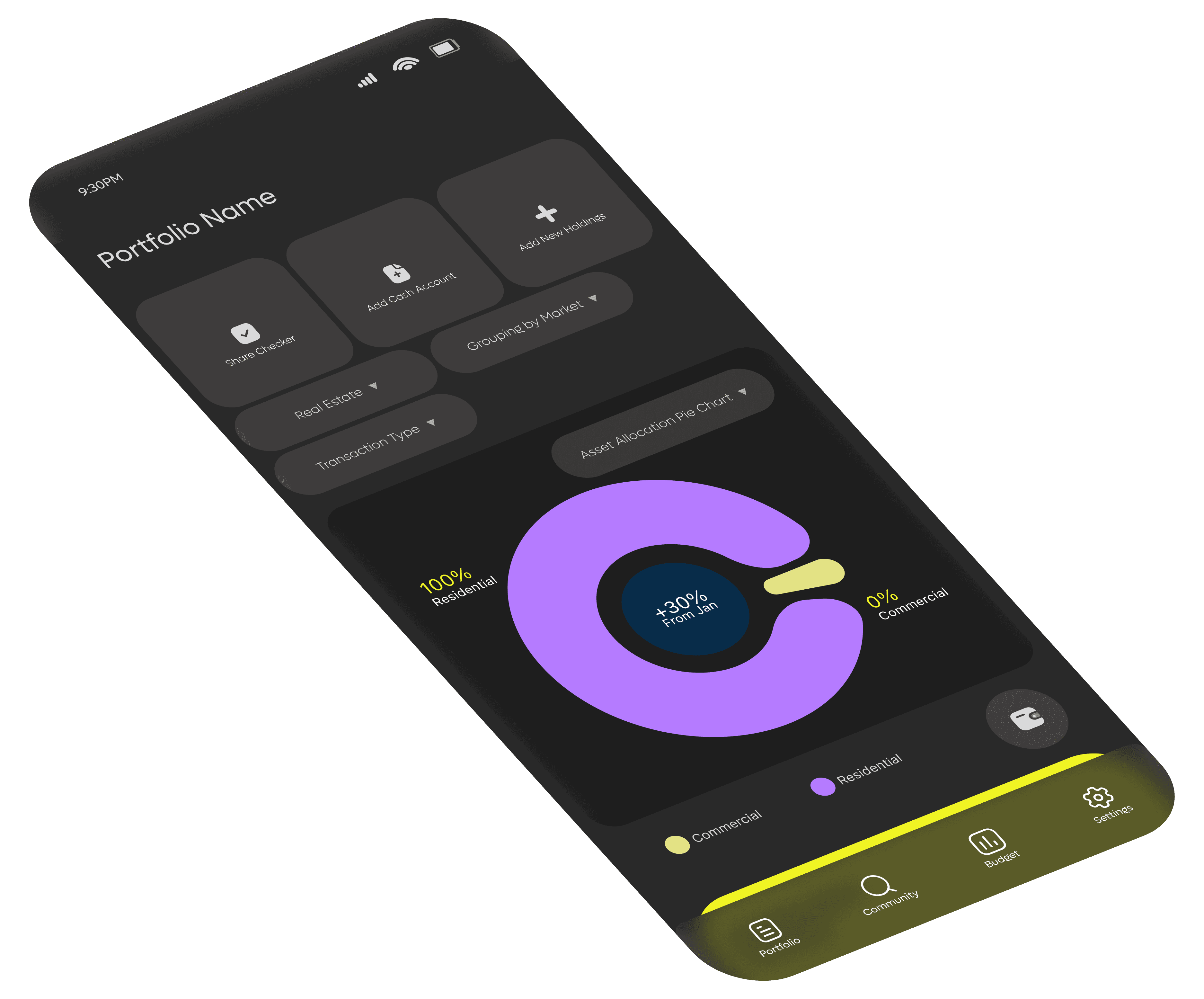

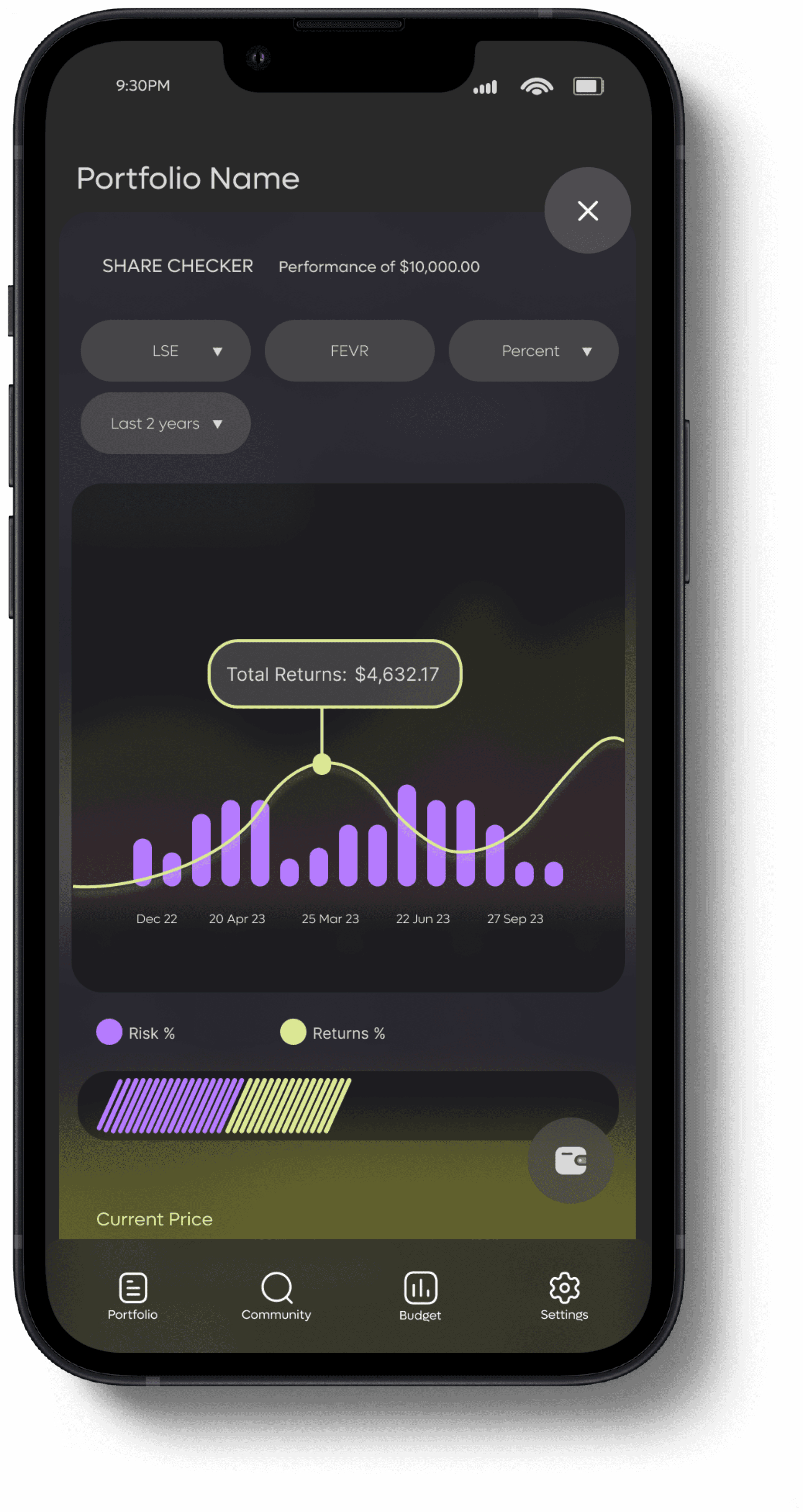

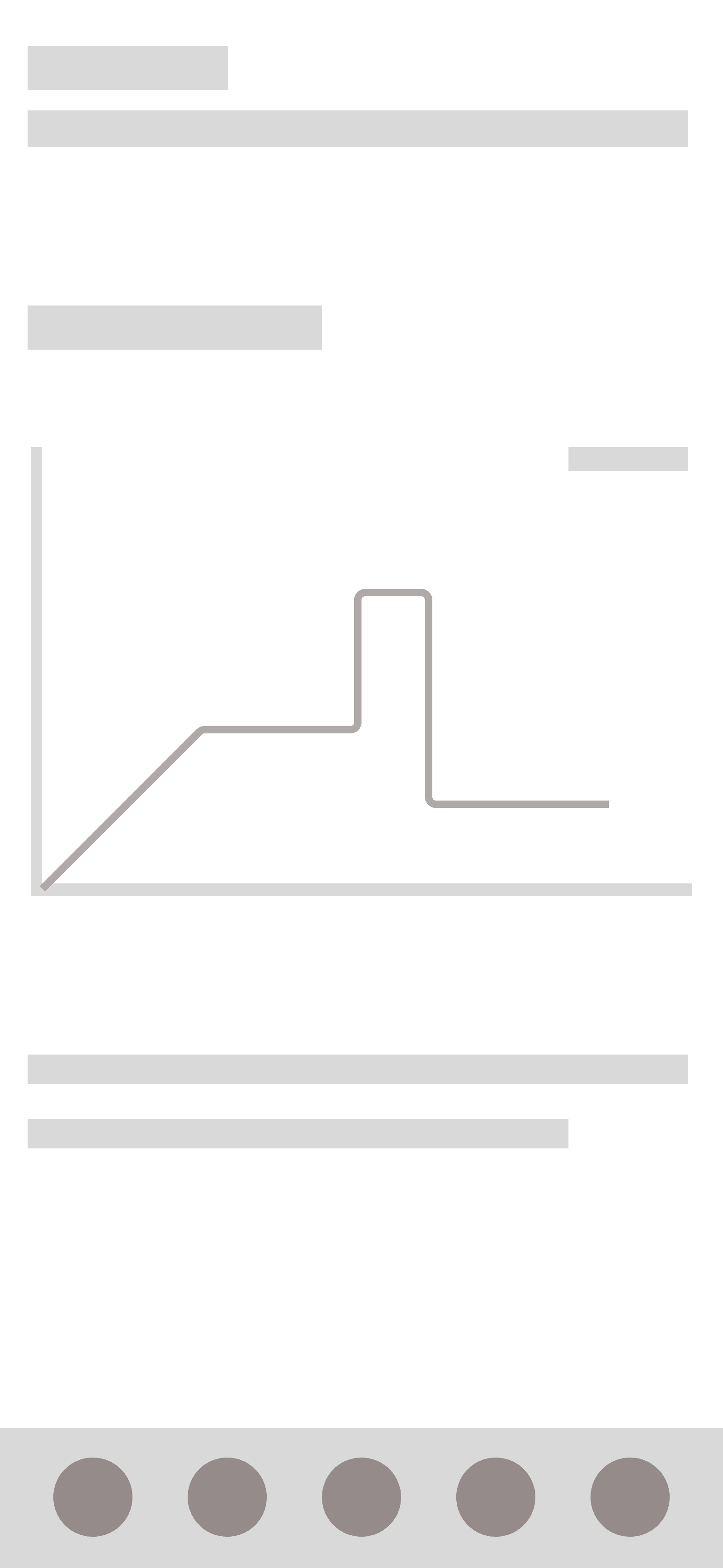

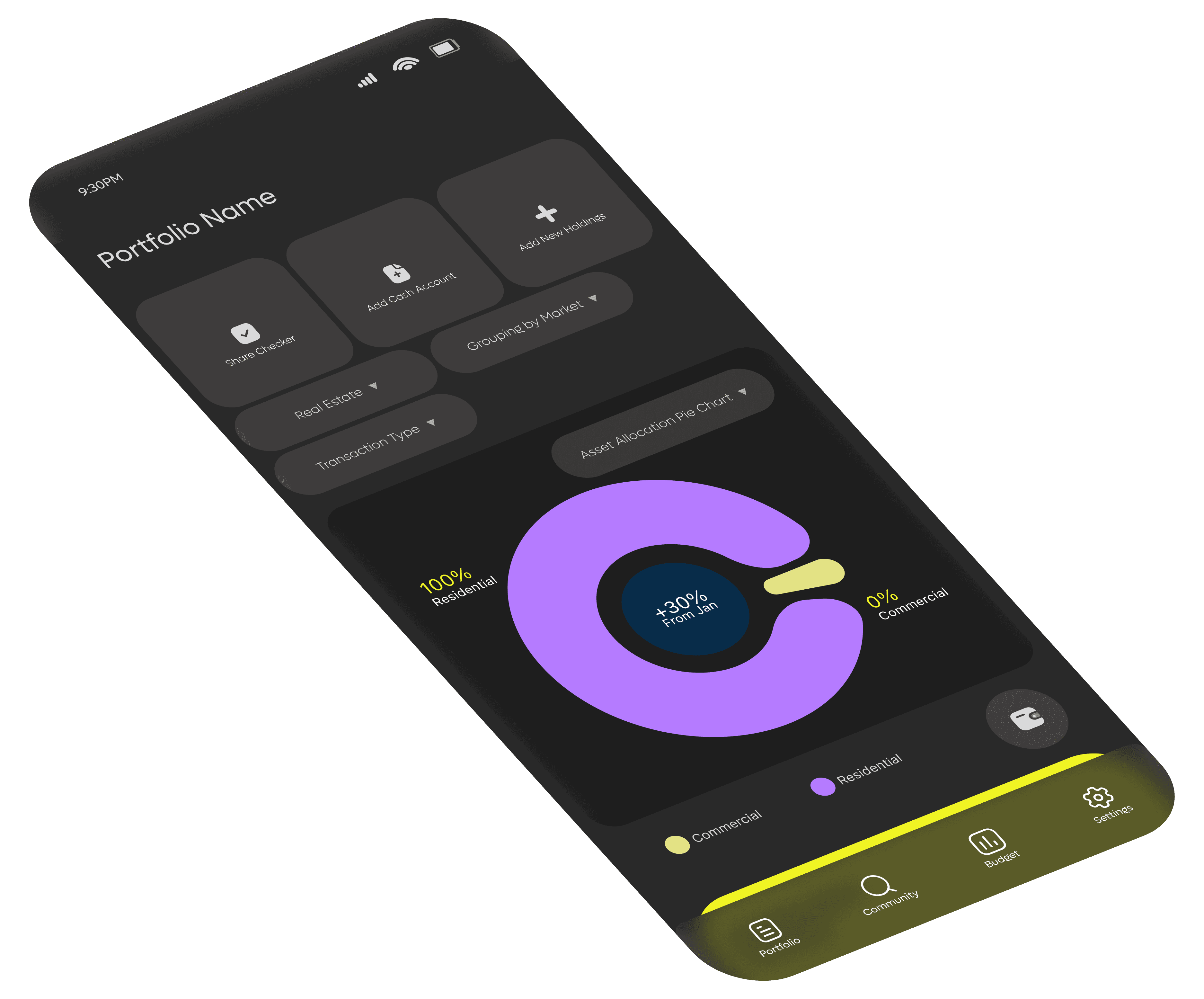

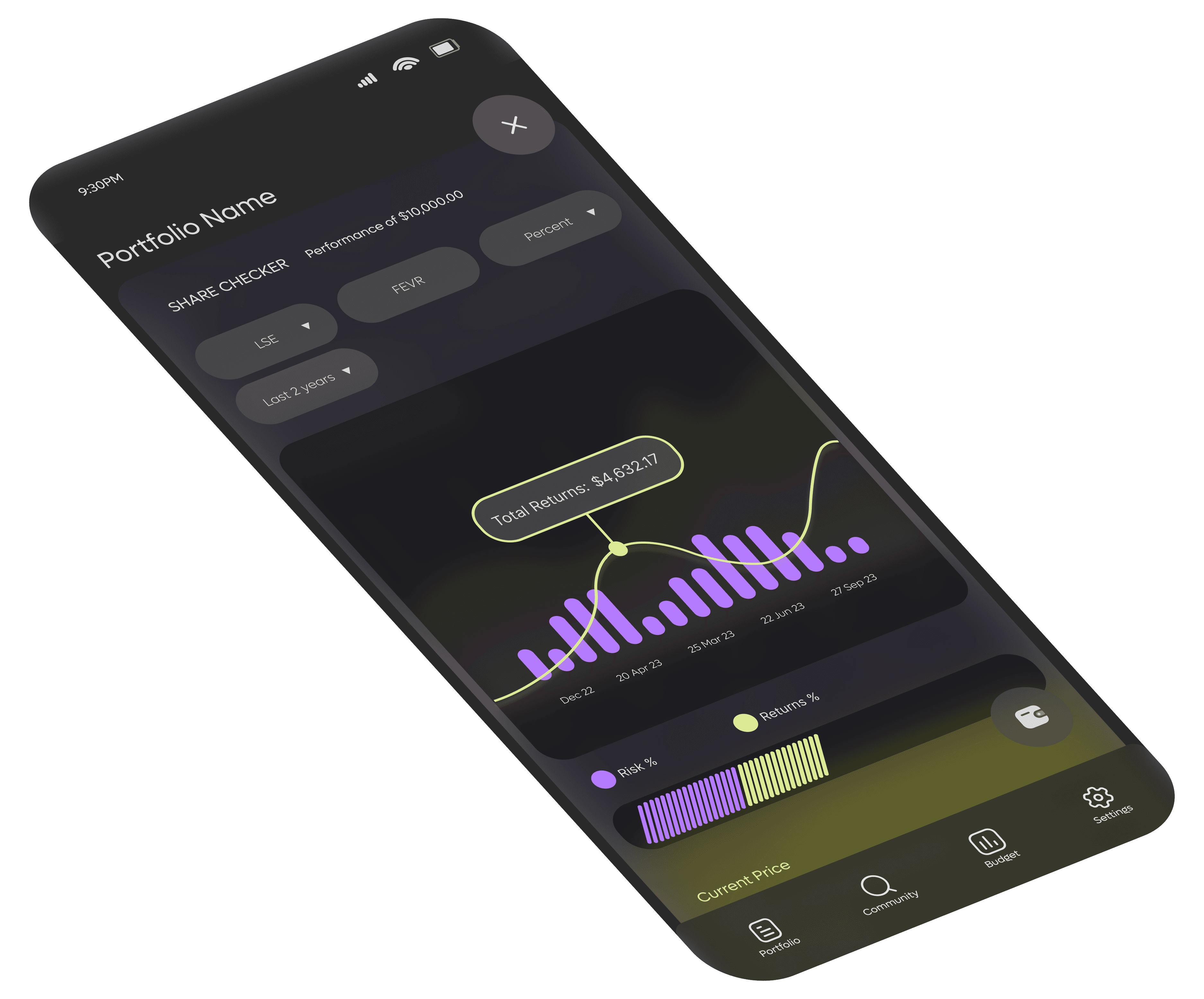

Portfolio: The app will provide the portfolio section with multiple options within to be able to keep track of important information about the users asset such as filters that would help with organization, graphs for visual representation, share checker to evaluate market conditions and options to keep adding holdings or assets to the portfolio.

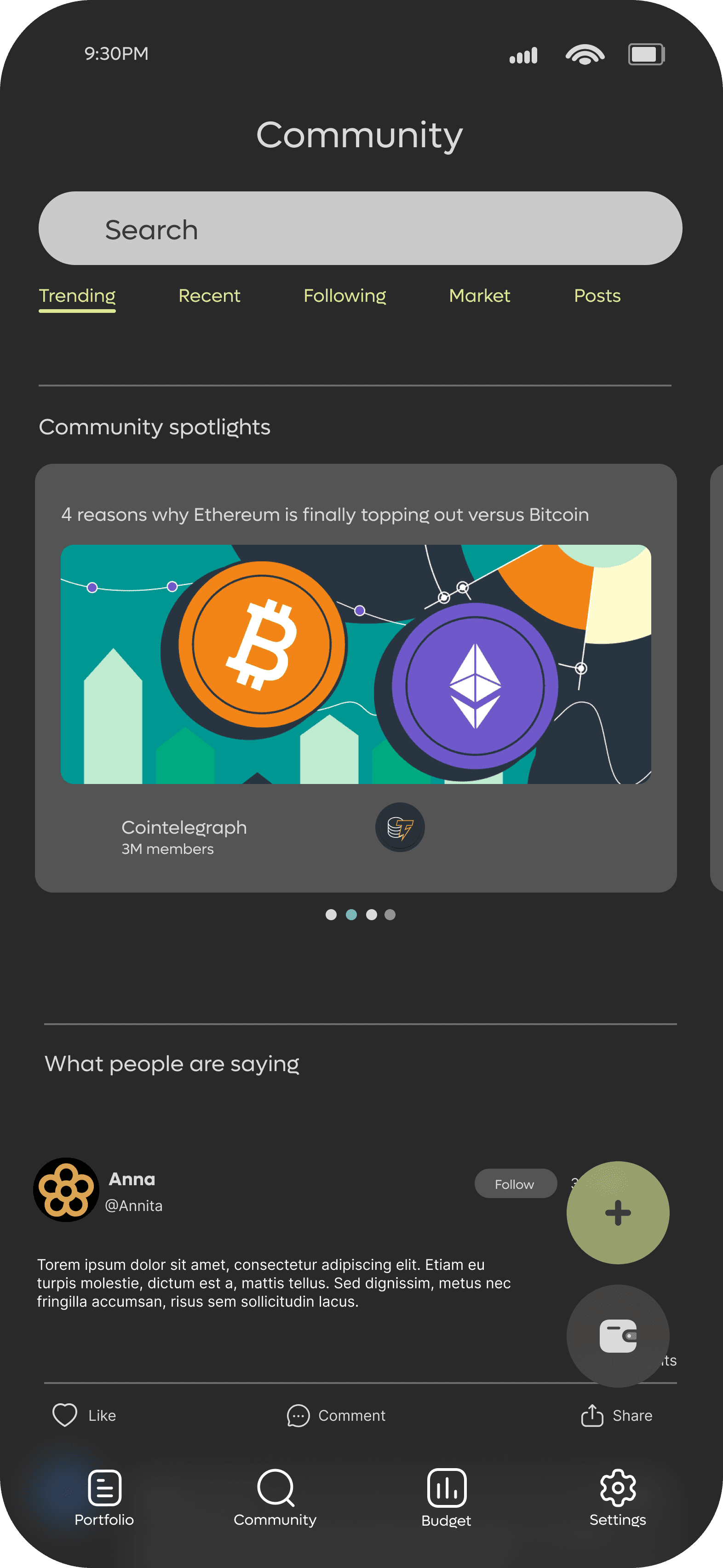

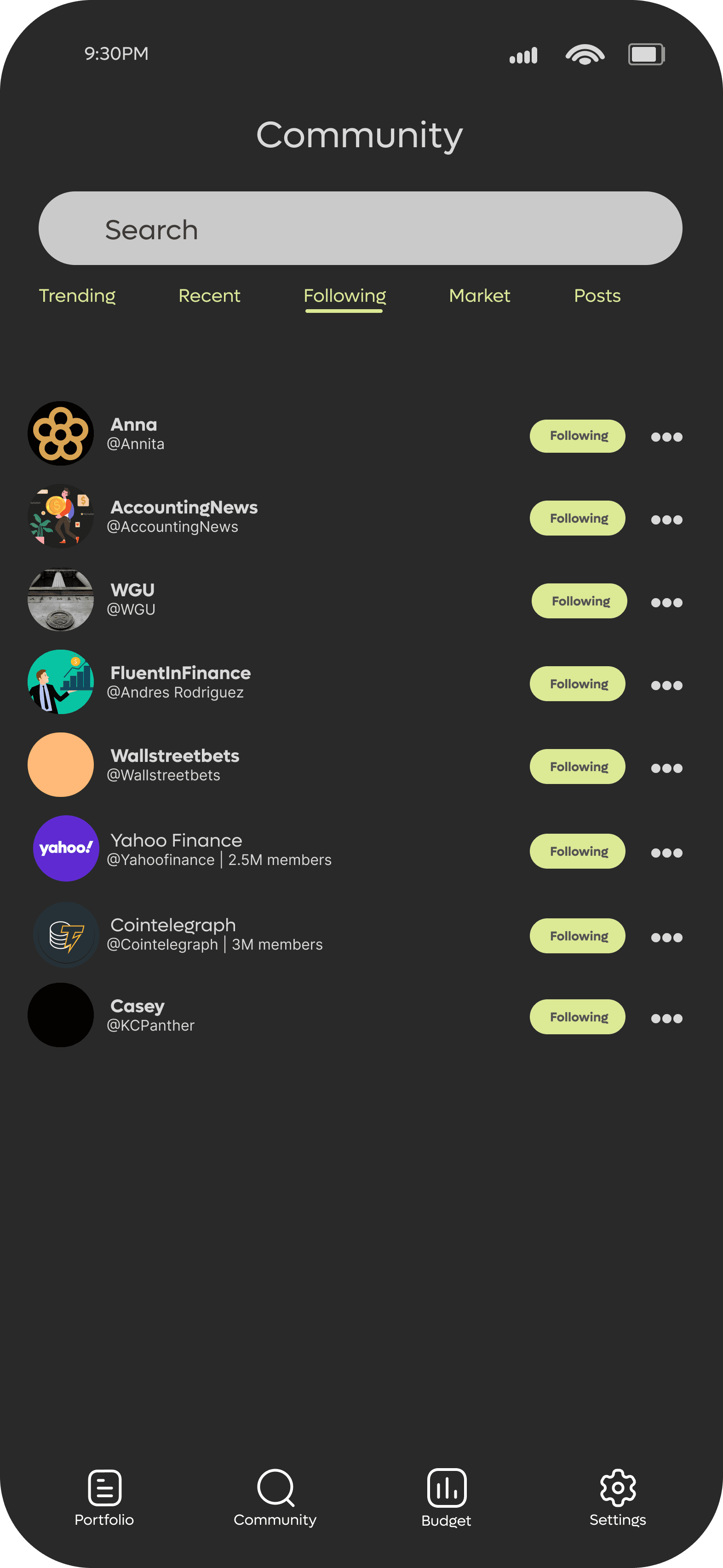

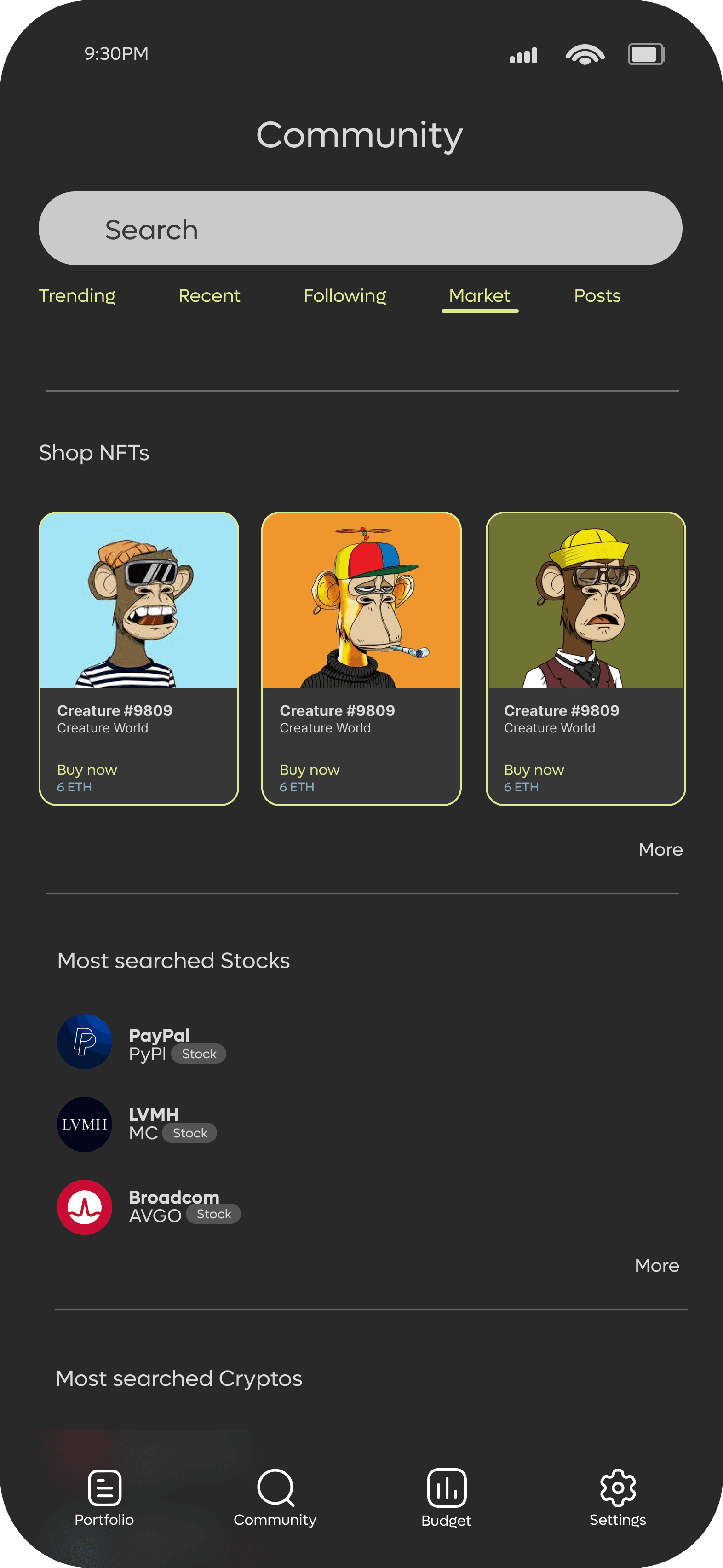

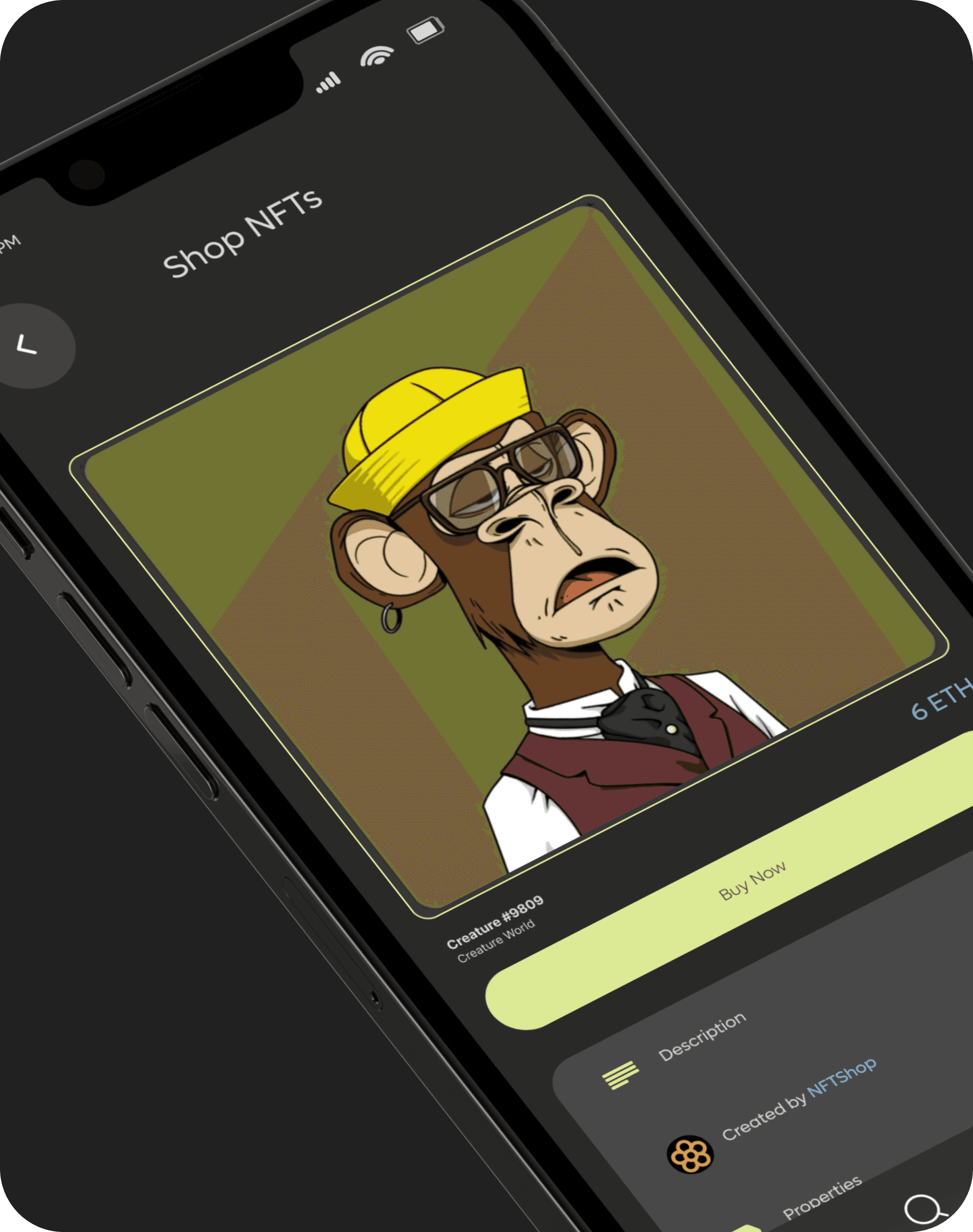

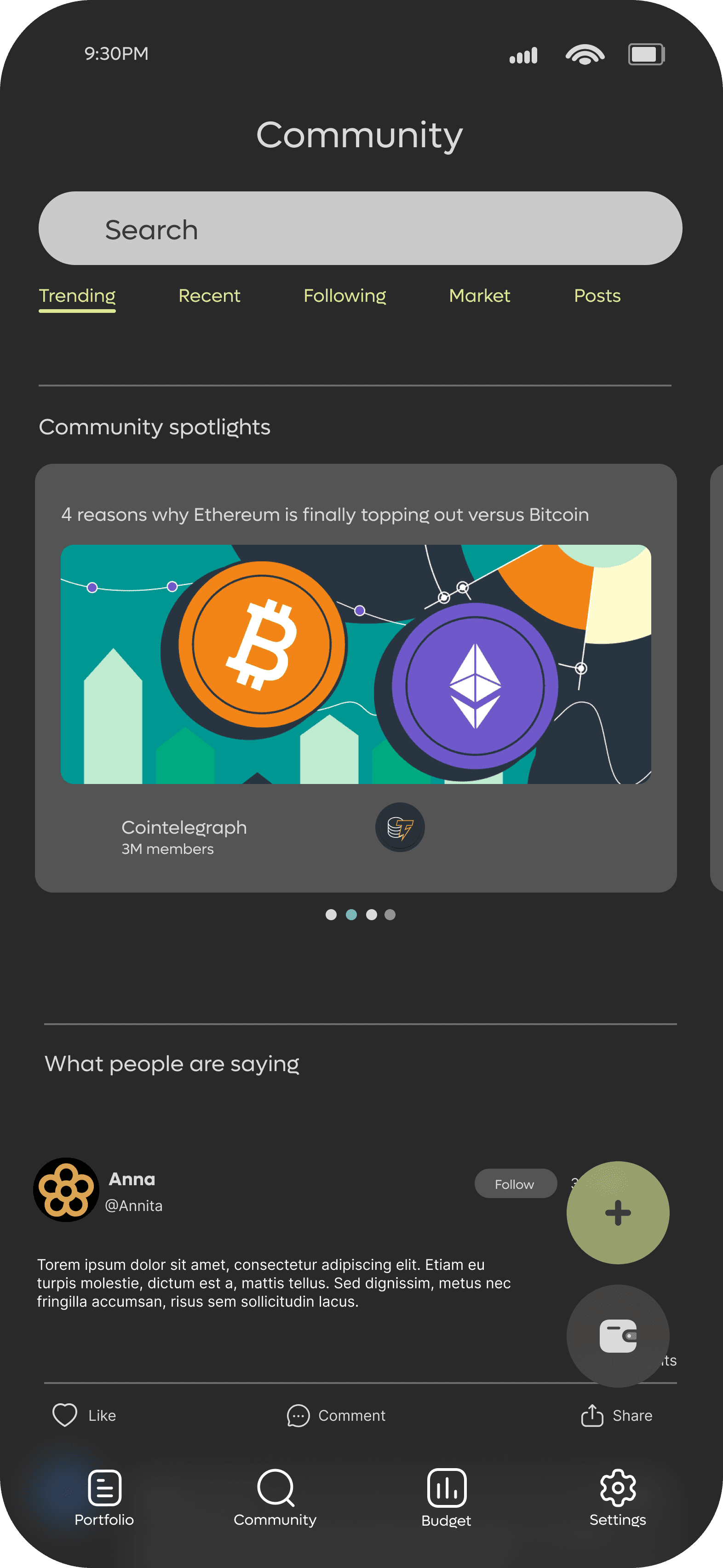

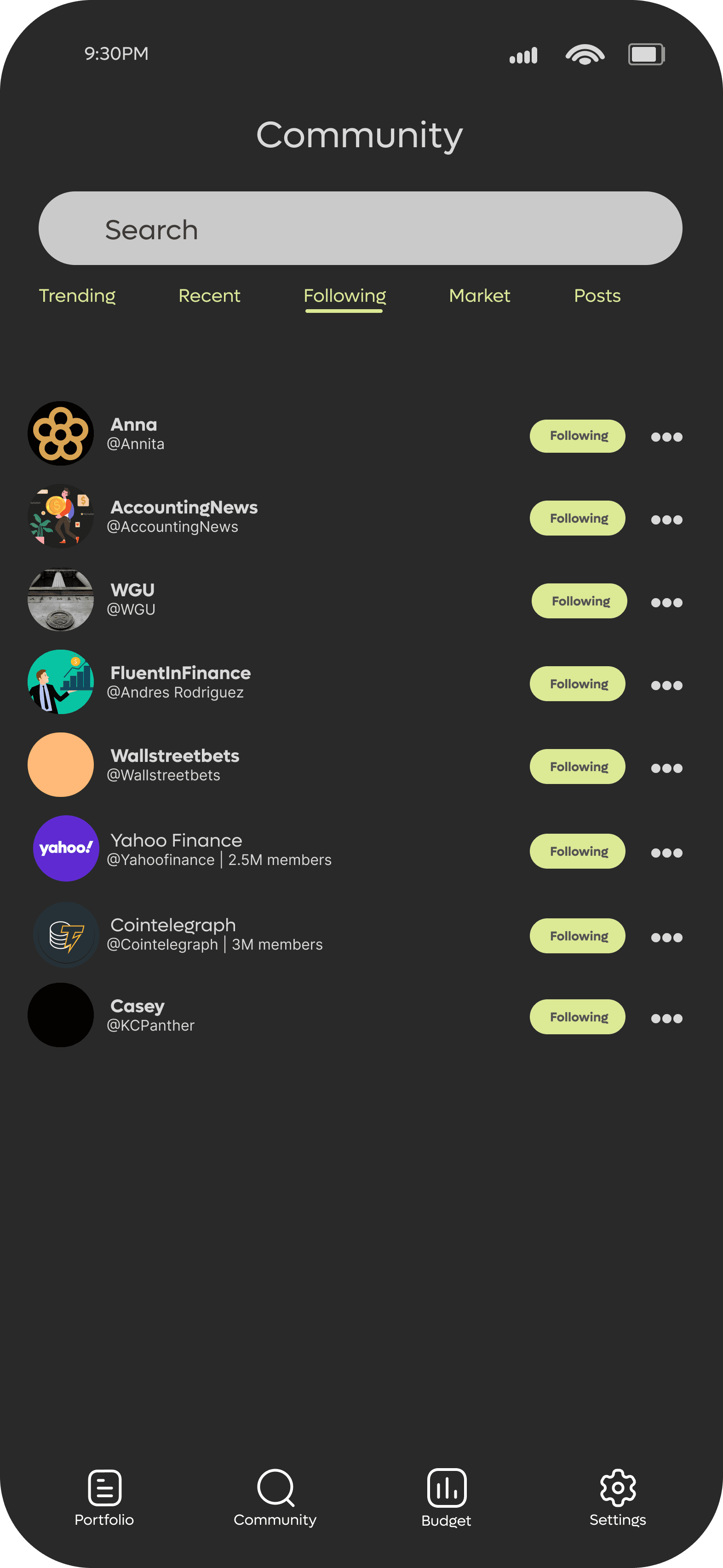

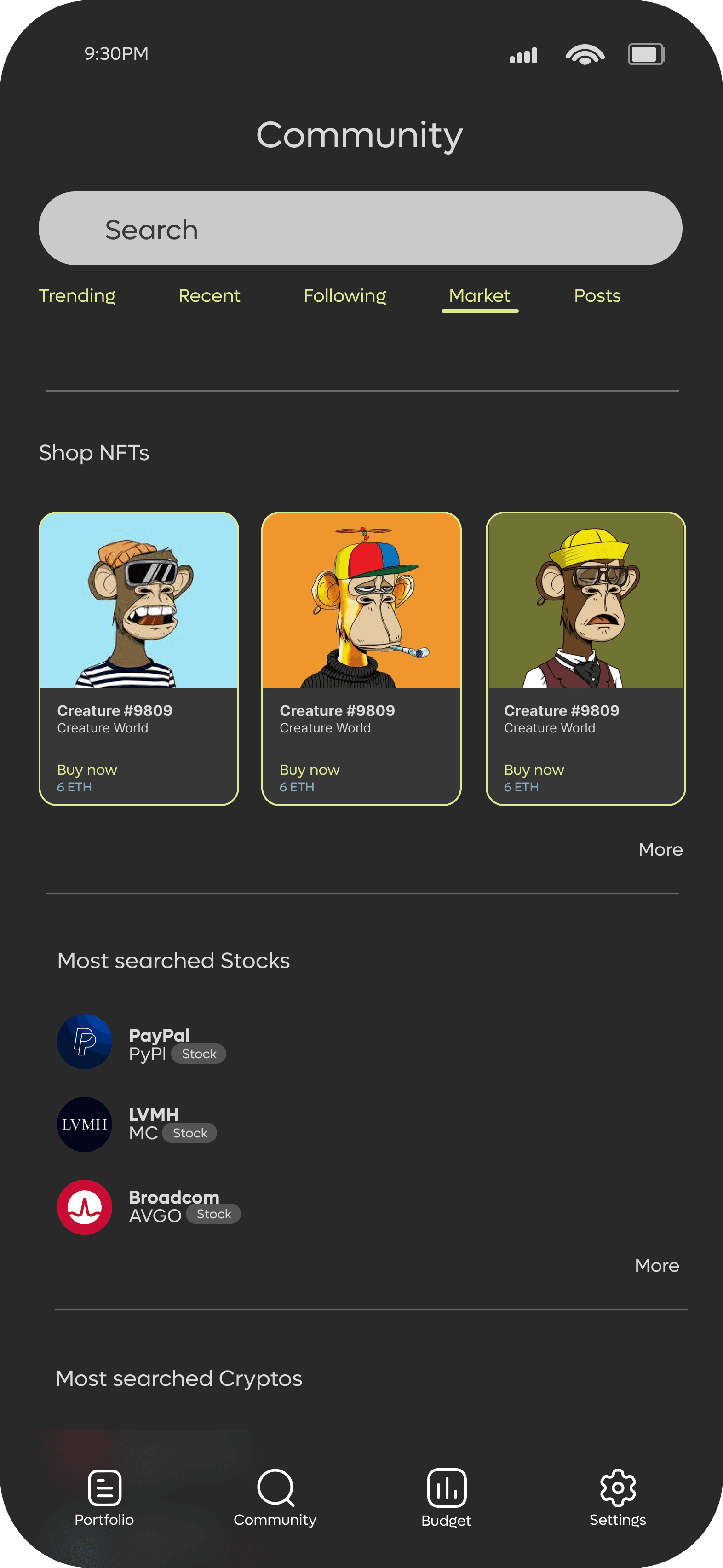

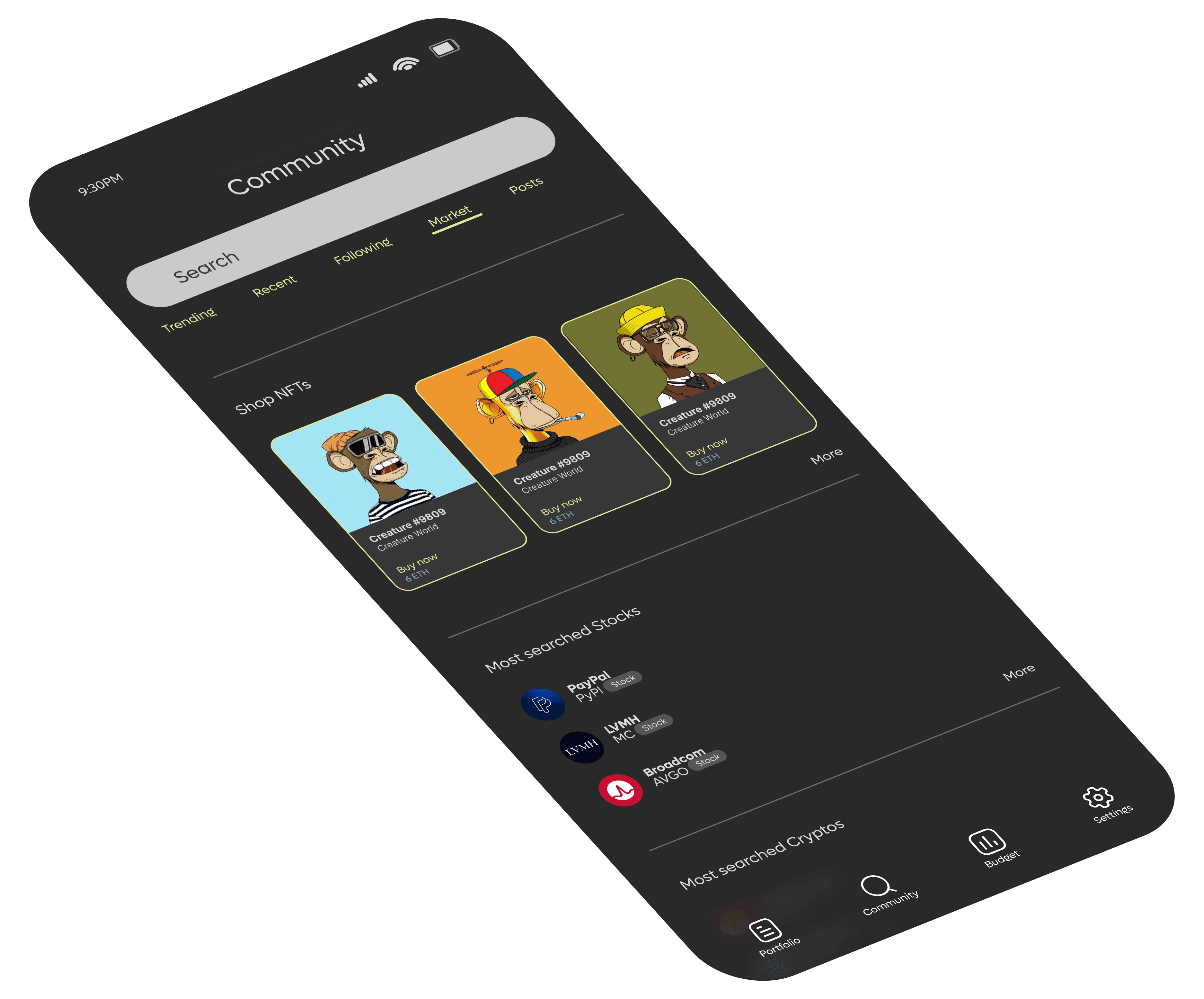

Community: It was ideal to keep in the design a way to maintain the user informed of the market conditions, people’s insights and at the same time providing a place for the user to invest in digital assets. The community provides exactly this, using similar designs of other social networks to keep the familiarity around usability of this new concept app.

Wallet: This is were both traditional banking and digital assets would converge. The user would be able to manage their multiple accounts from this one place. it would provide a summary of the users financial history and provide custom insights and tips on how to advance in future decisions.

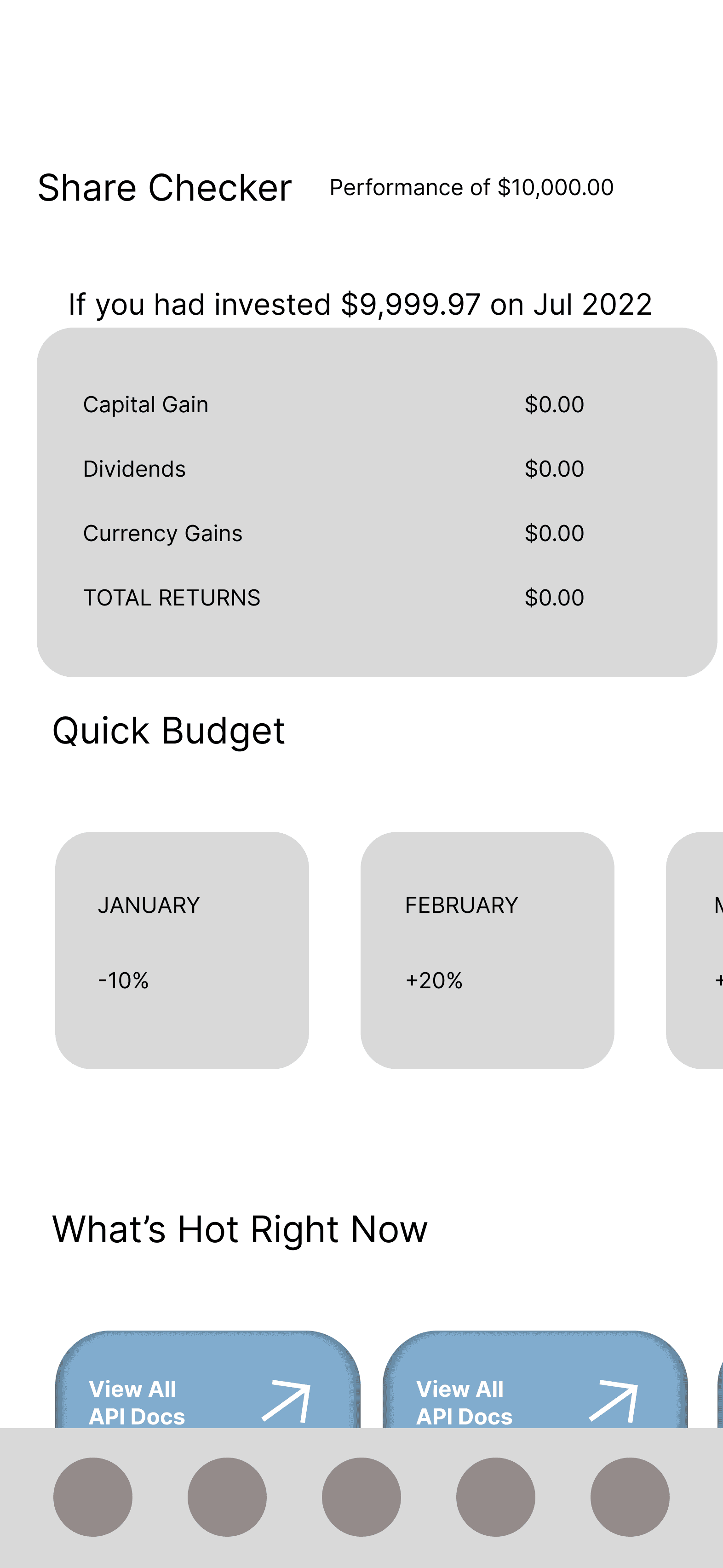

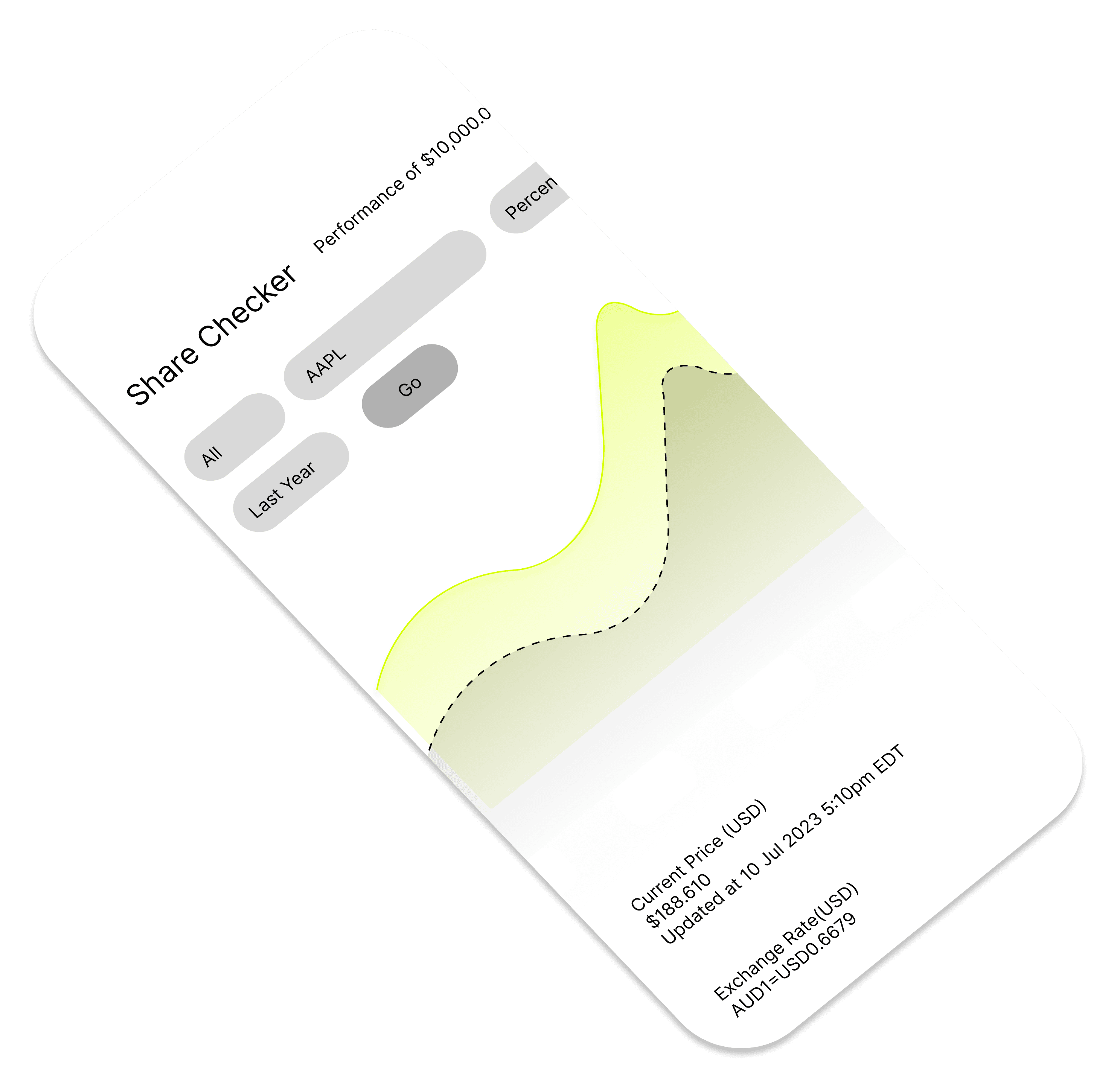

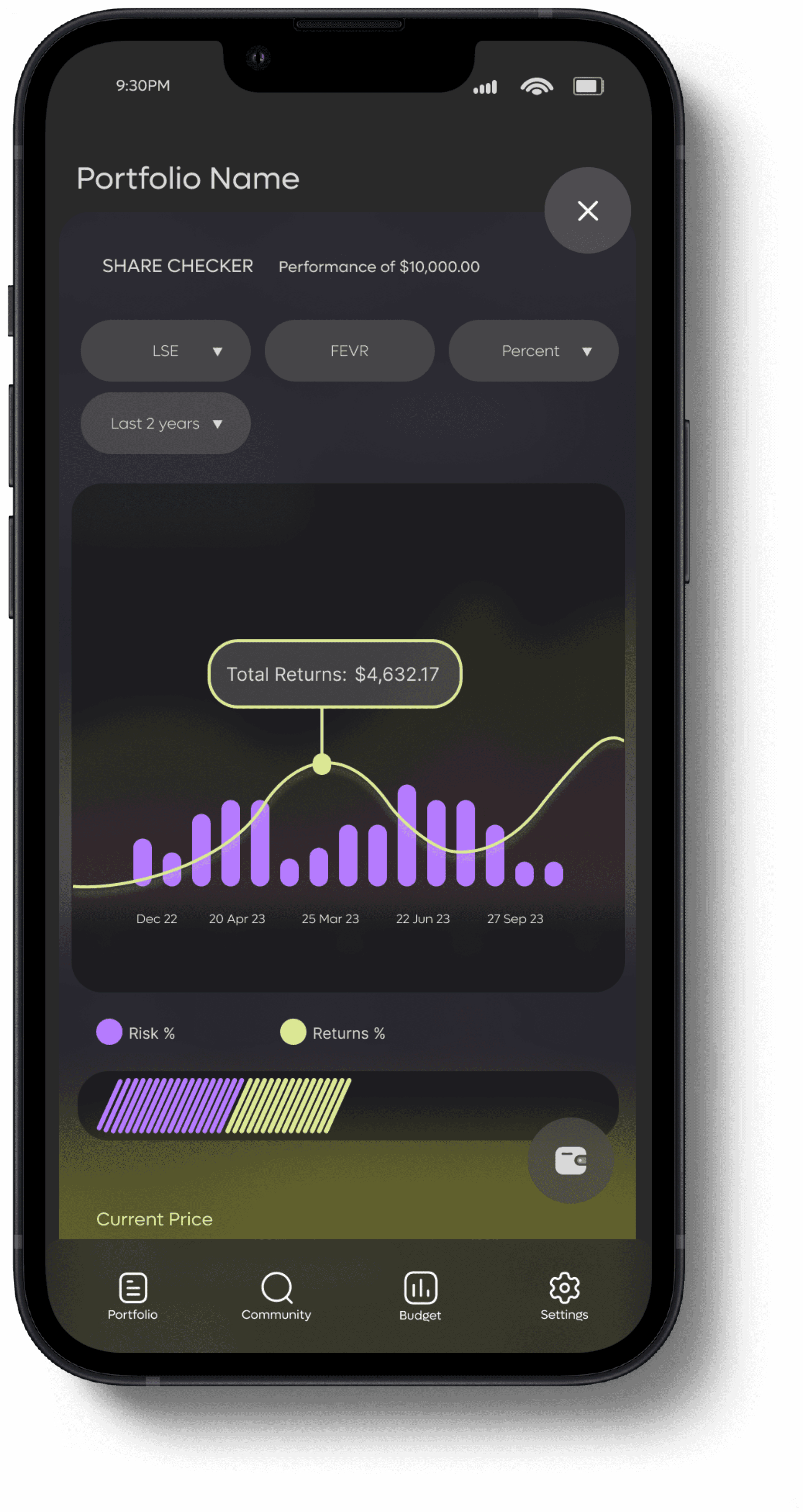

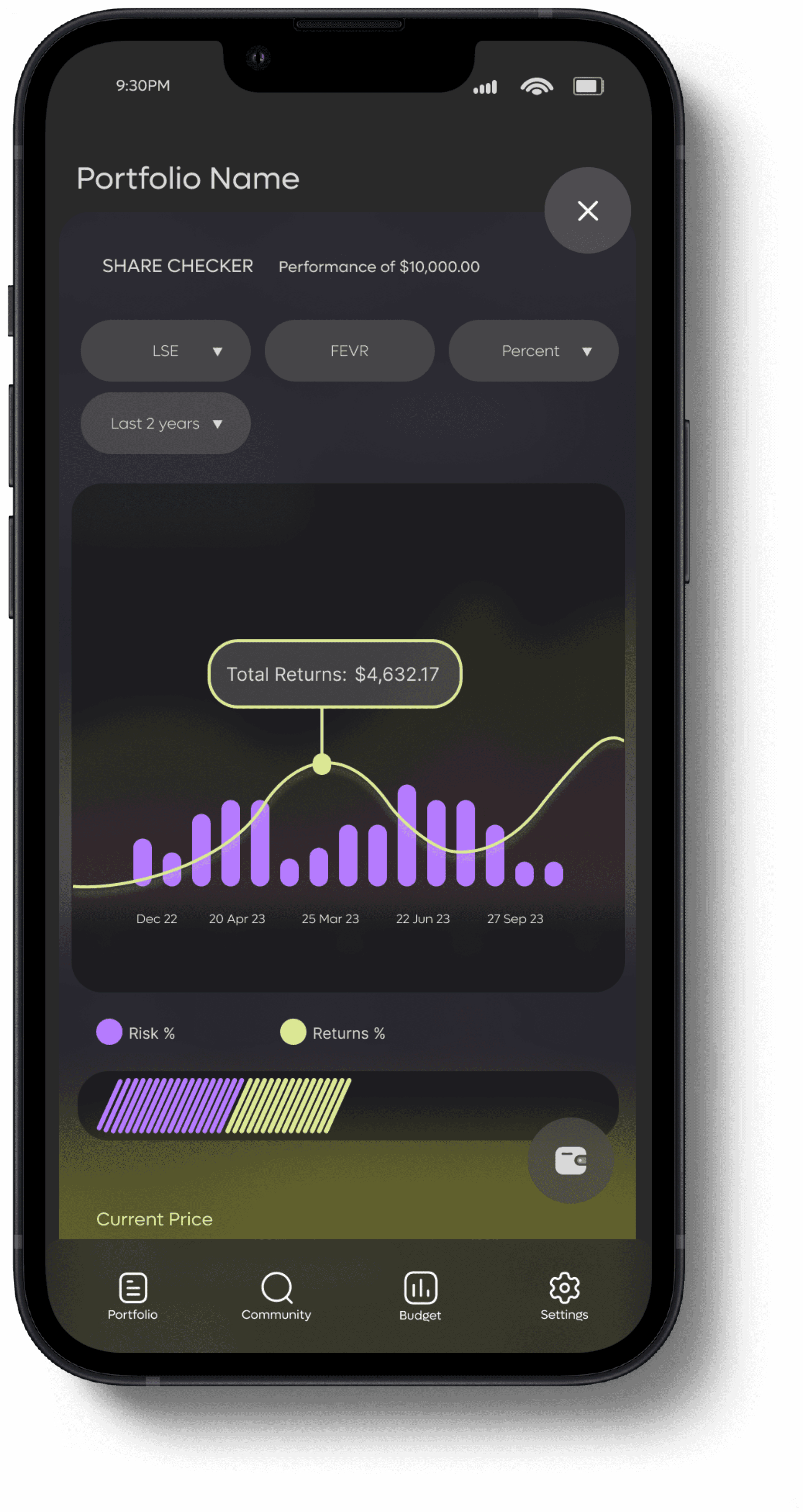

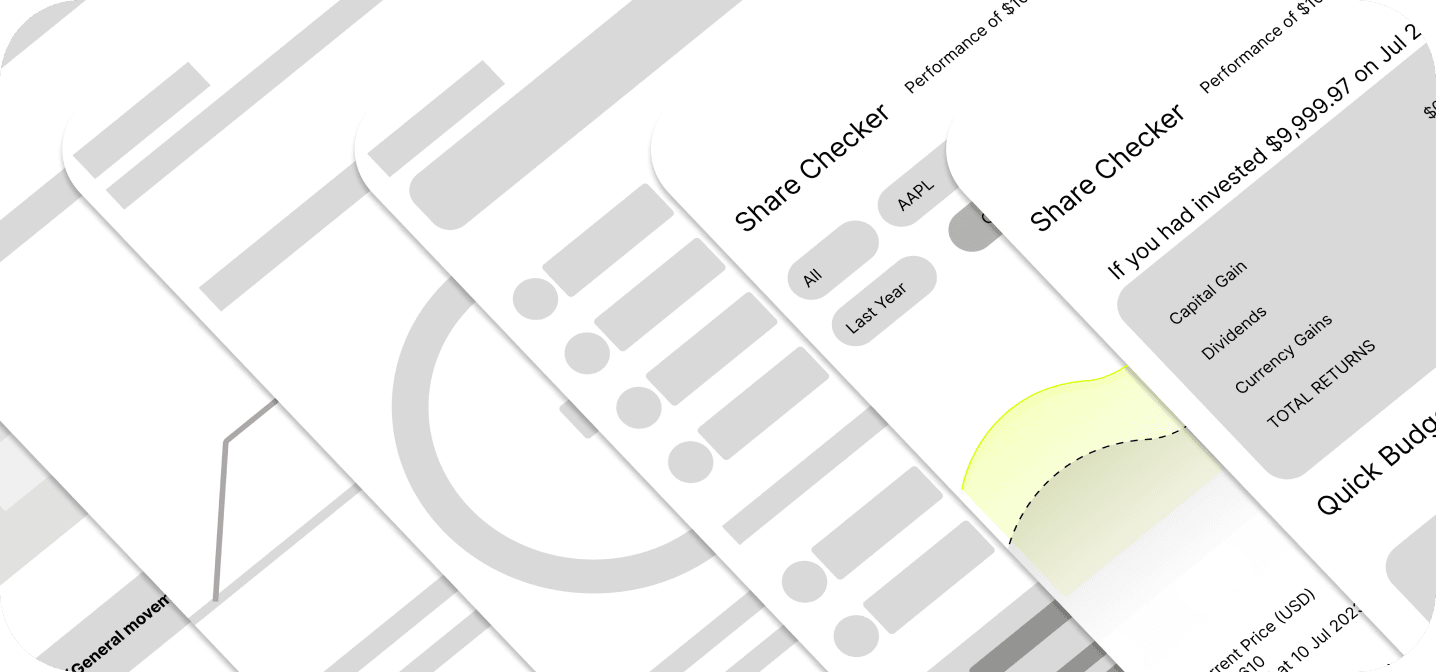

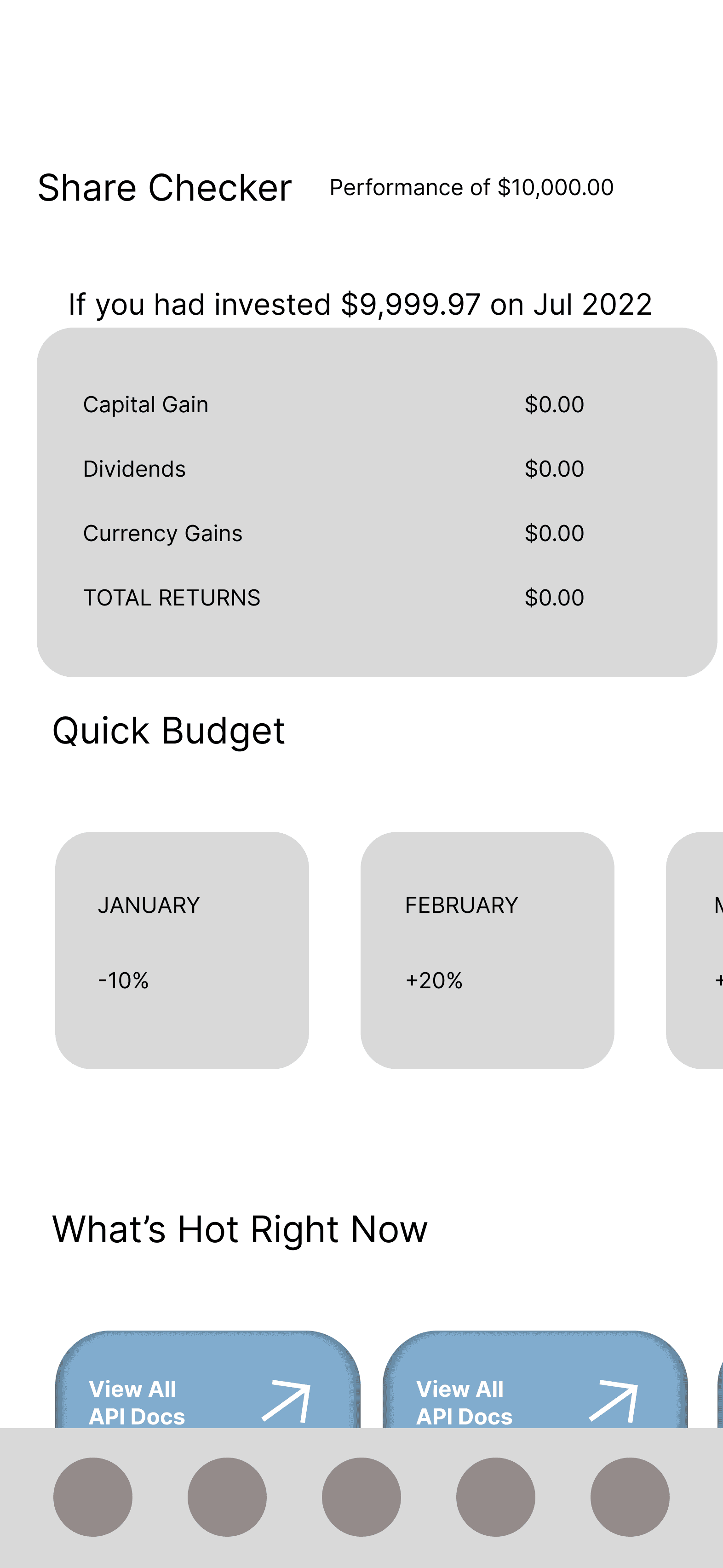

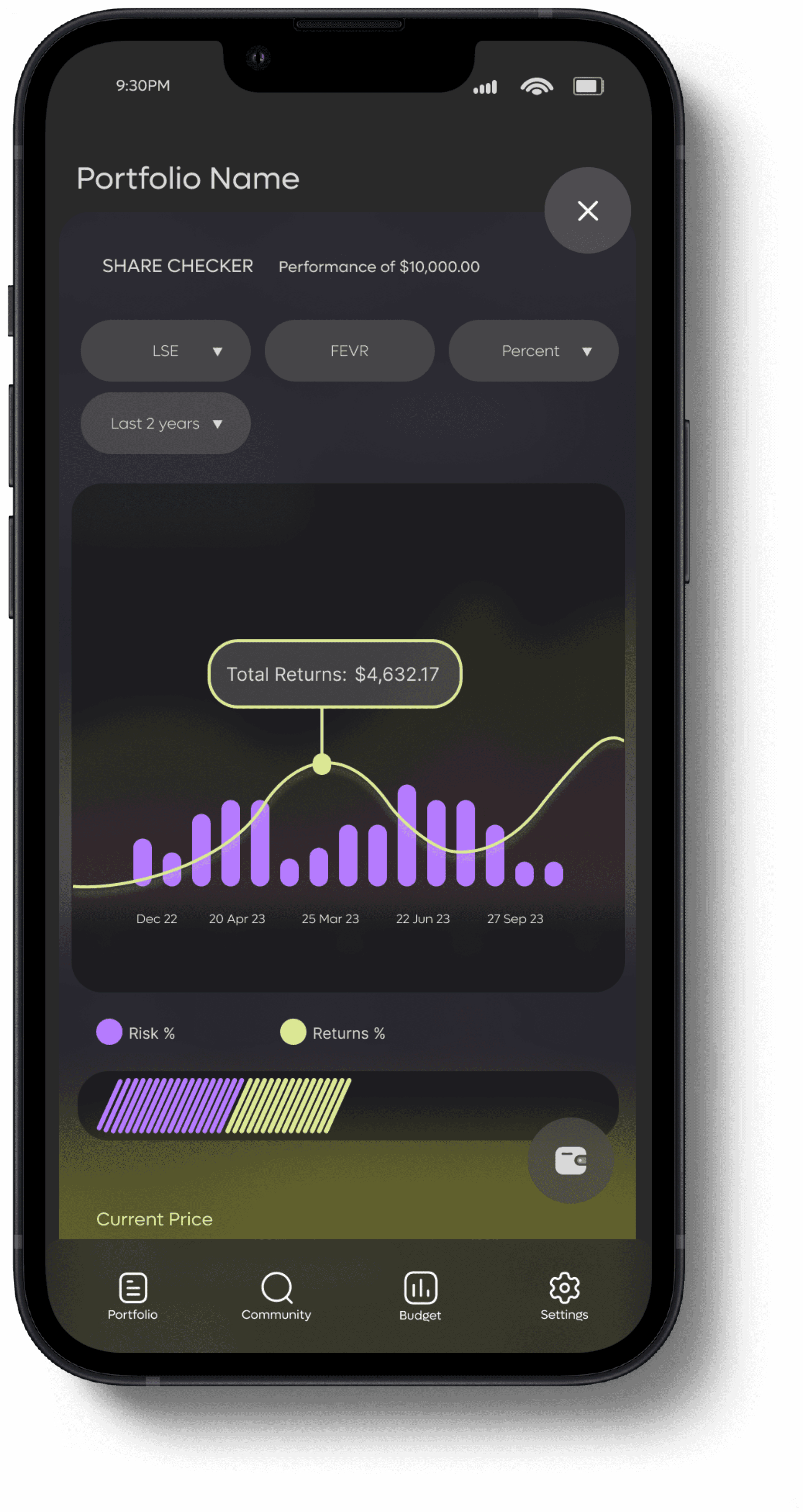

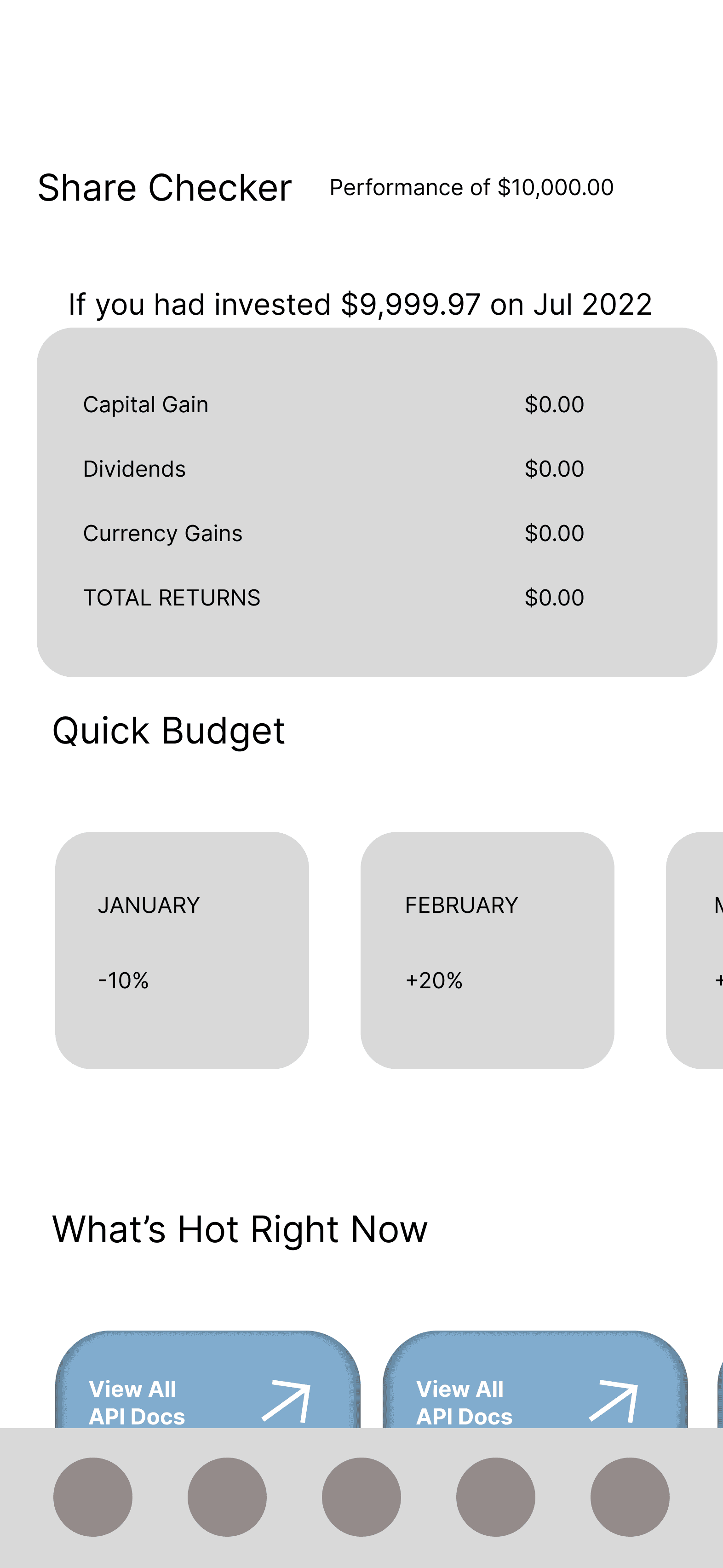

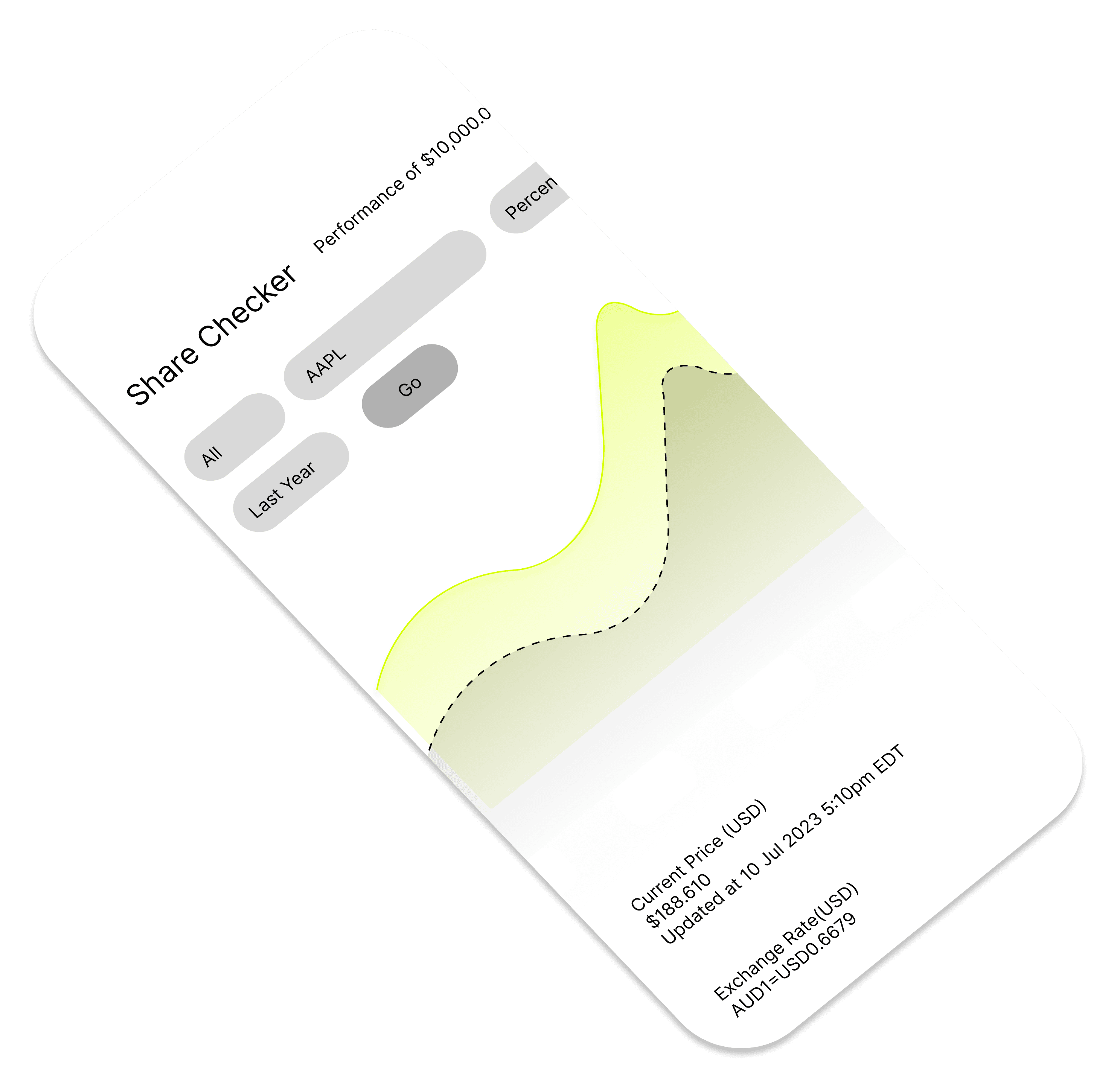

Share Checker: at this stage the idea of incorporating a share checker where the user would be able to get some market insights on specific stocks during a specific period of time was a must. This would provide clarity in the decision making process of the user.

Homepage

Portfolio

Community

Wallet

Share Checker

Share Checker

Solution

To address the challenge of efficiently managing diverse assets across digital and traditional banking platforms, the development of a Unified Asset Management Platform was proposed. This solution integrates digital assets and traditional banking services into a single, user-friendly app, empowering users to streamline their financial management processes effectively.

Problem

In today's ever-evolving world of finance, where digital assets and traditional banking coexist, there's a growing need for a seamless solution that bridges the gap between these two realms.

About Project

This platform aims to empower and facilitates users to efficiently manage their diverse portfolio of assets across digital and bank platforms, providing them with a seamless and comprehensive financial management experience.

PROJECT PROCESS

The best approach to tackling the issue of bridging the gap between digital assets and traditional banking involves a combination of strategic planning, innovative technology solutions, and user-centric design.

To better understand our users, we completed a competitive analysis, surveys, white paper research and analyzed the results later.

USER RESEARCH

TYPOGRAPHY

COLORS

UI KIT

LUFGA

Font 1

SF PRO TEXT

Font 2

Header 1

Size: 20px wight: regular

Header 2

Size: 15px weight: regular

Header 3

Size: 12px weight: regular

Header 4

Size: 12px weight: regular

Header 5

Size: 10px weight: regular

Paragraph

Size: 10px weight: regular

Header 1

Size: 20px wight: regular

Header 2

Size: 15px weight: regular

Header 3

Size: 12px weight: regular

Header 4

Size: 12px weight: regular

Header 5

Size: 10px weight: regular

Paragraph

Size: 10px weight: regular

#F0F424

Primary Green

#DCE995

Primary Washed Green

#B57BFF

Accent purple

#D9D9D9

Light Grey

#4B4949

Washed Grey

#292929

Dark Grey

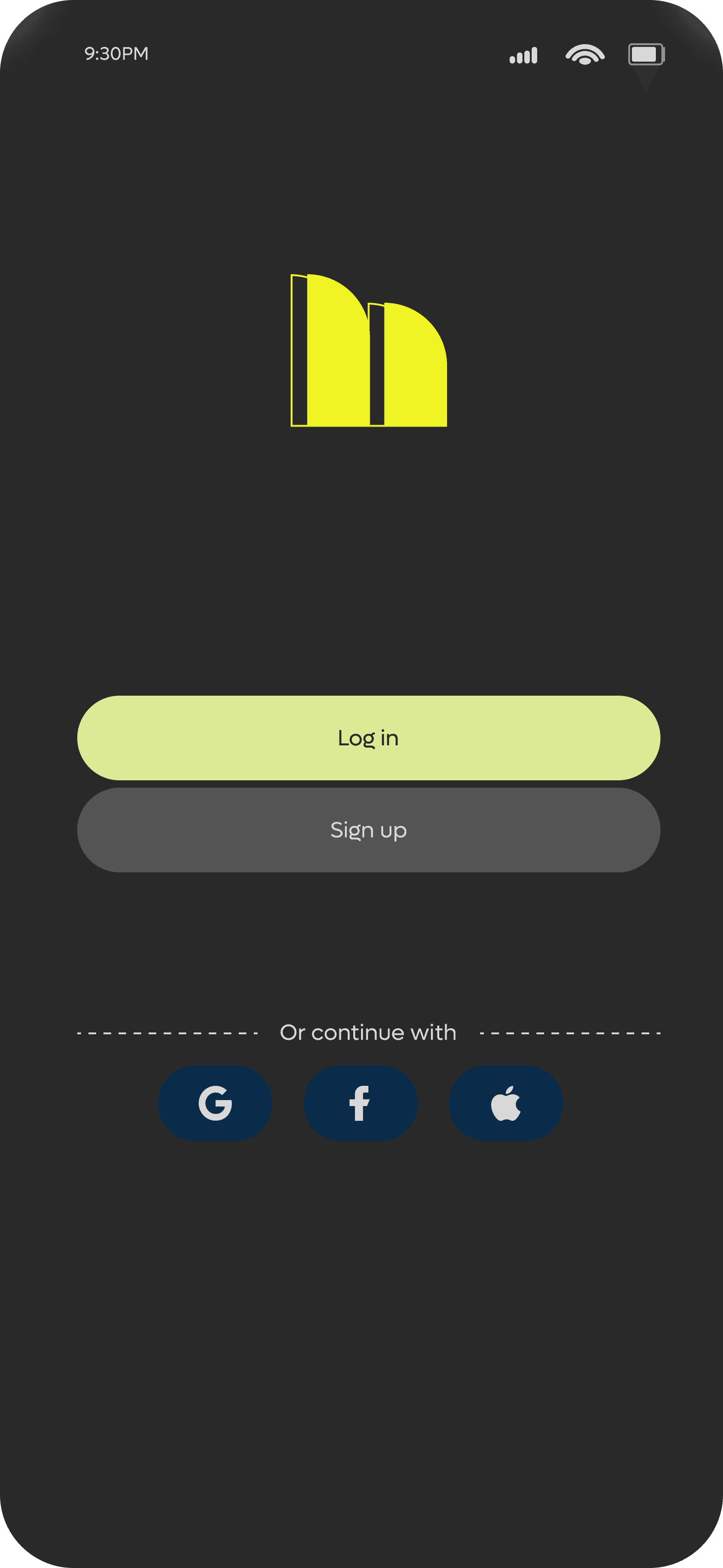

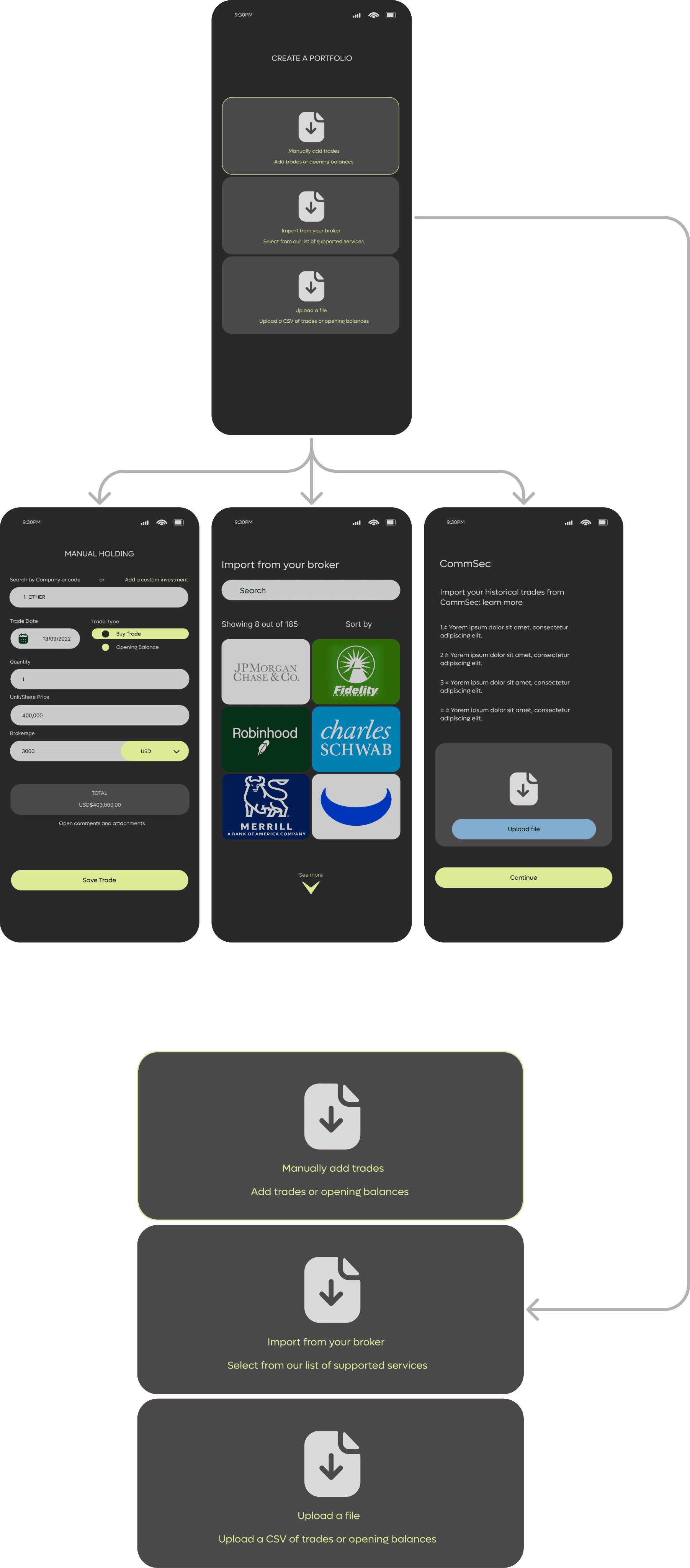

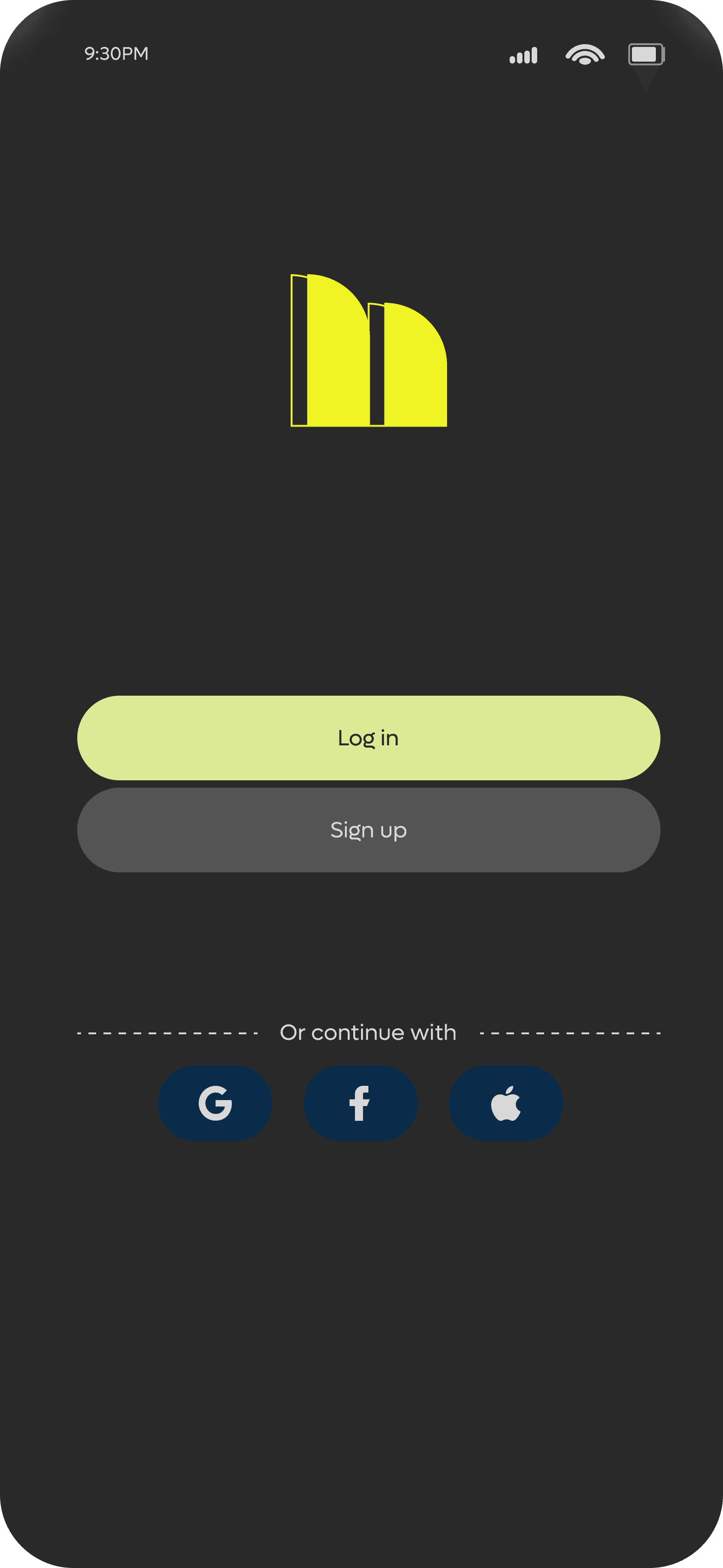

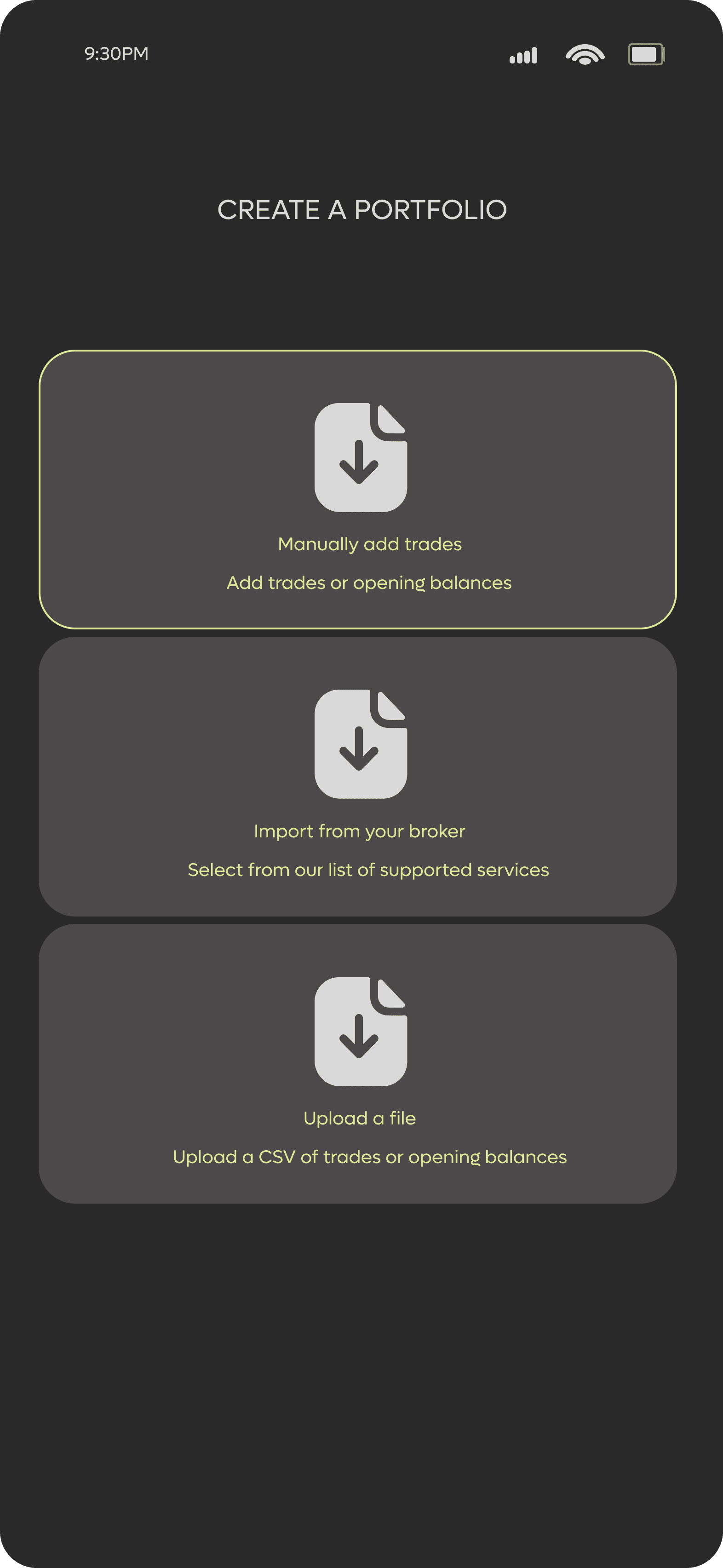

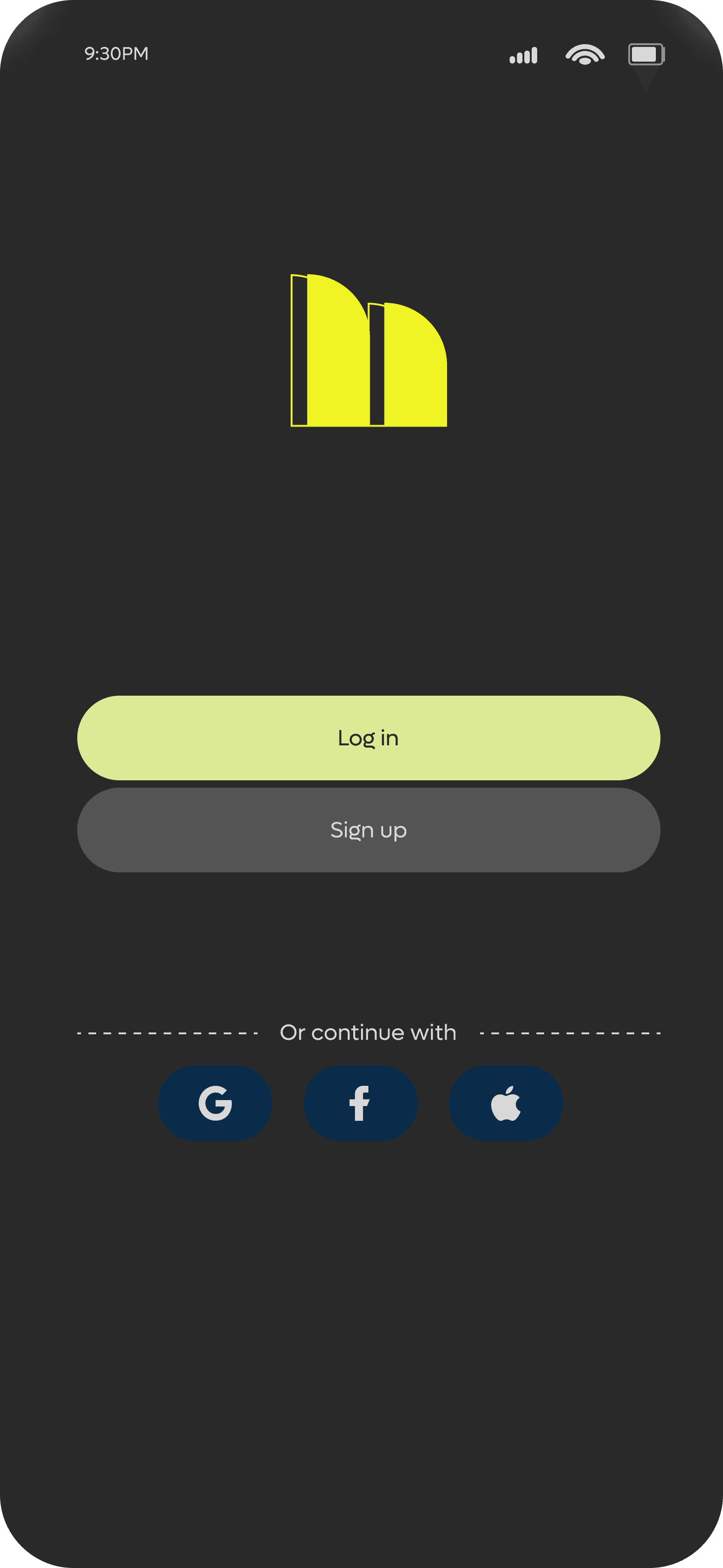

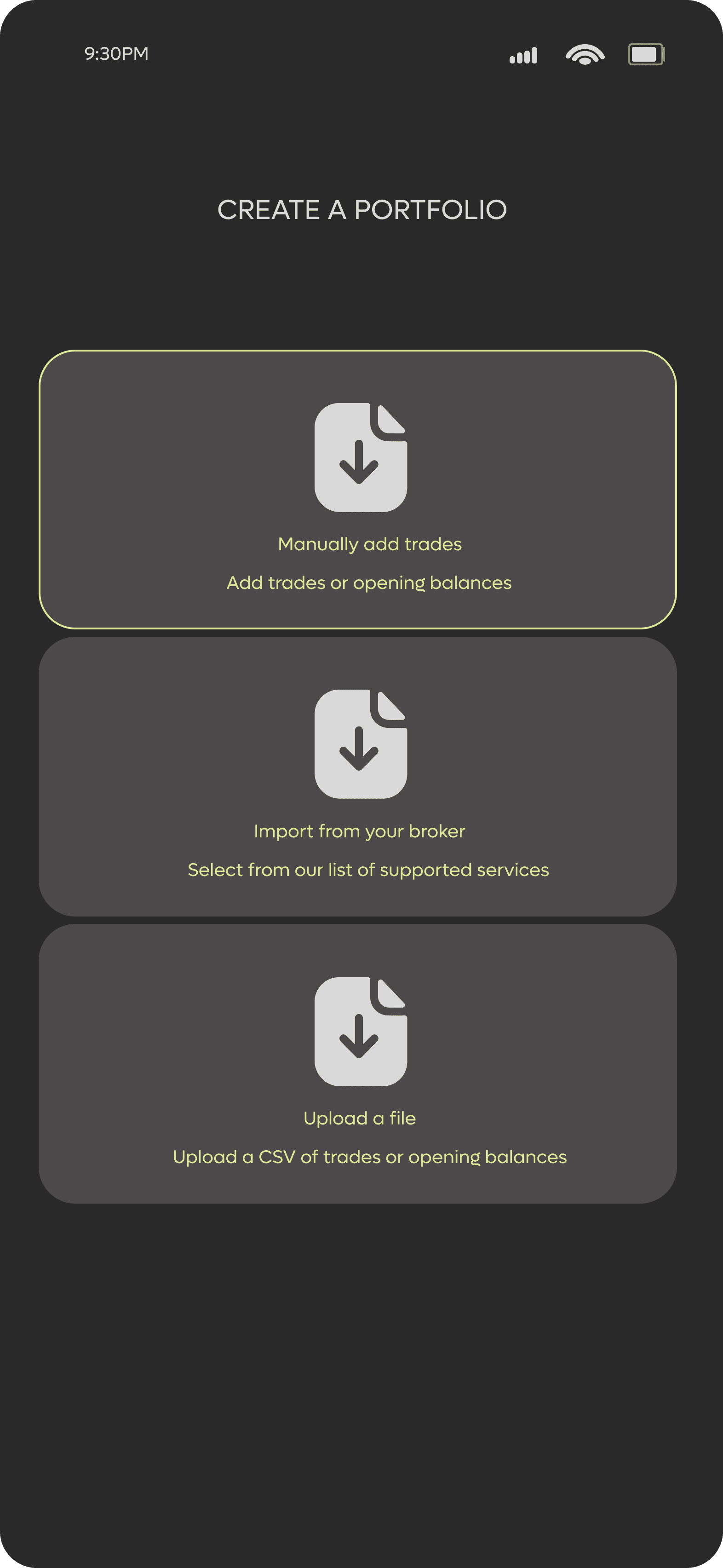

ONBOARDING

In the case of a new user, once they signed in they will be immediately prompted to create a portfolio, after placing general information such as name of portfolio, country, etc. the user will start uploading the corresponded information of their investments. In this case the user will have 3 options to facilitate the process by manually adding trades, importing from a broker or by uploading a file such as an excel document where all the information was previously located.

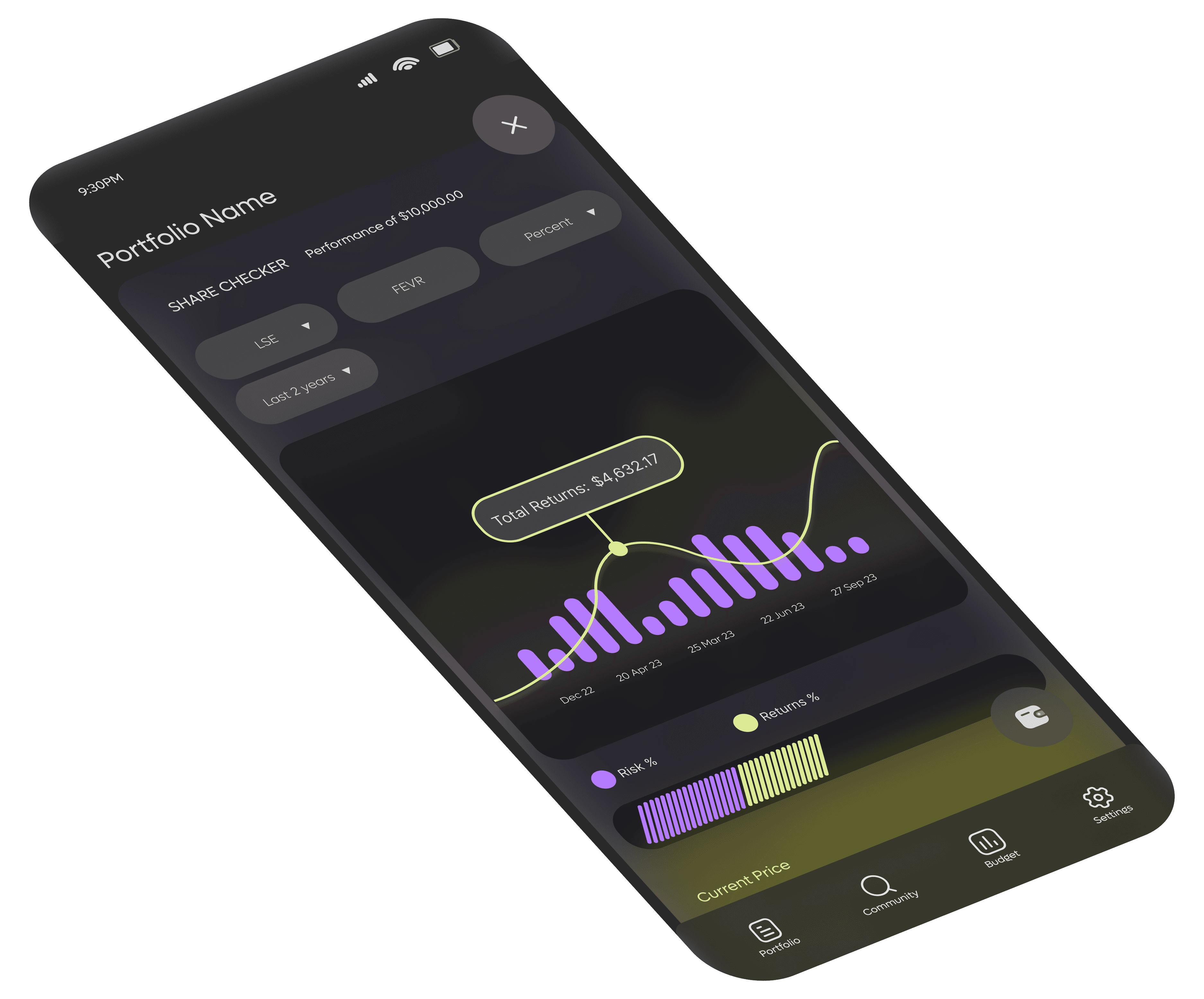

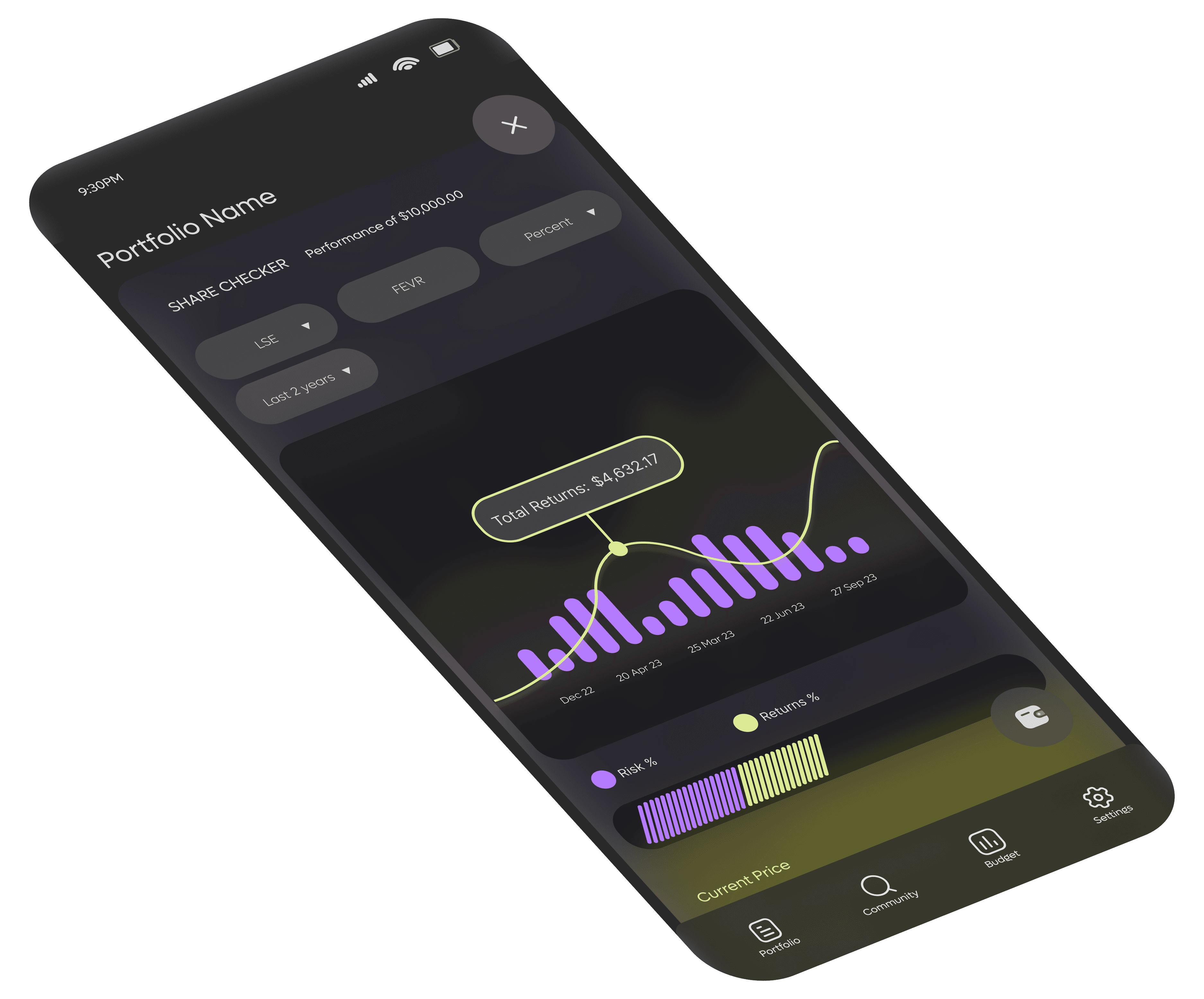

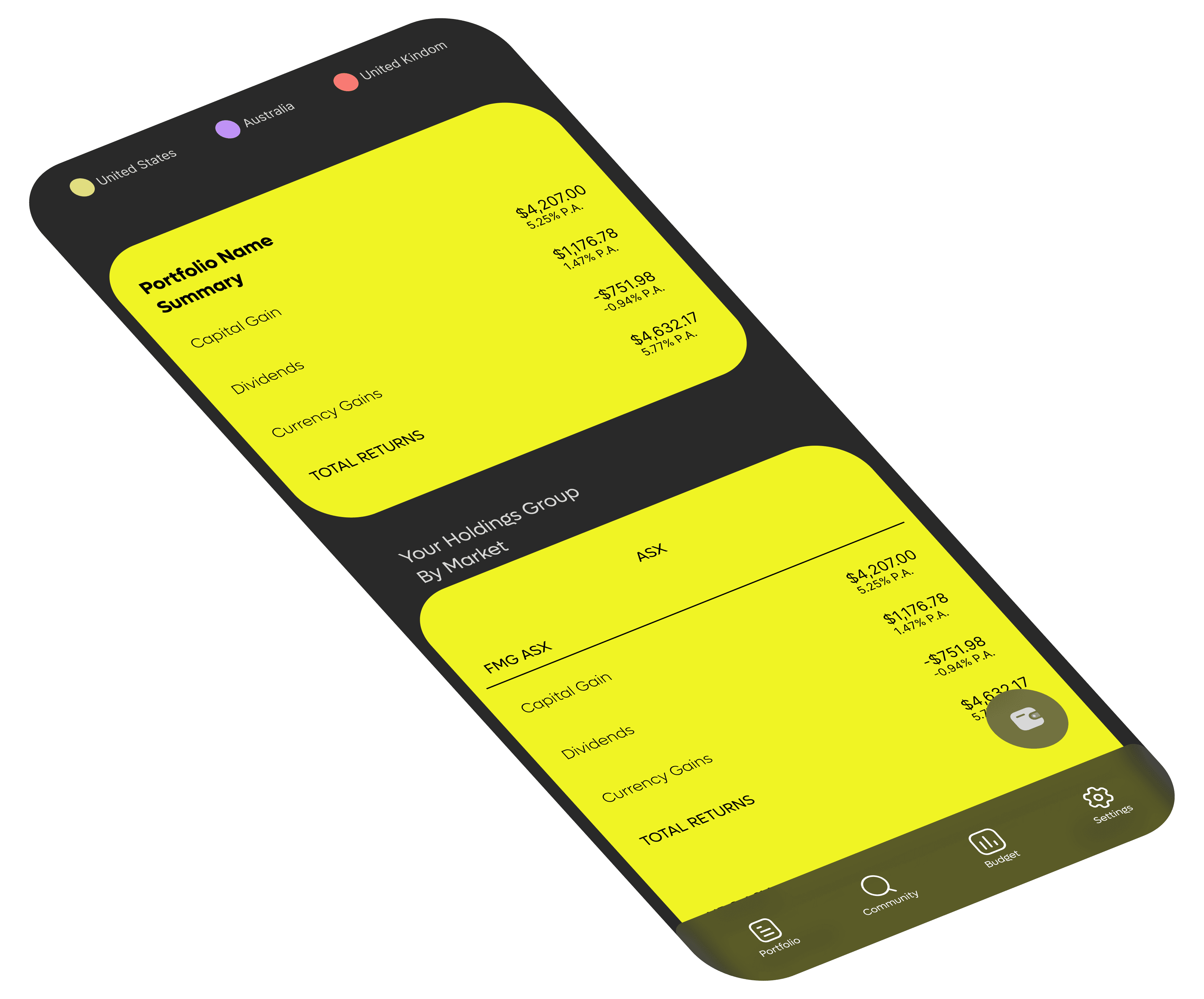

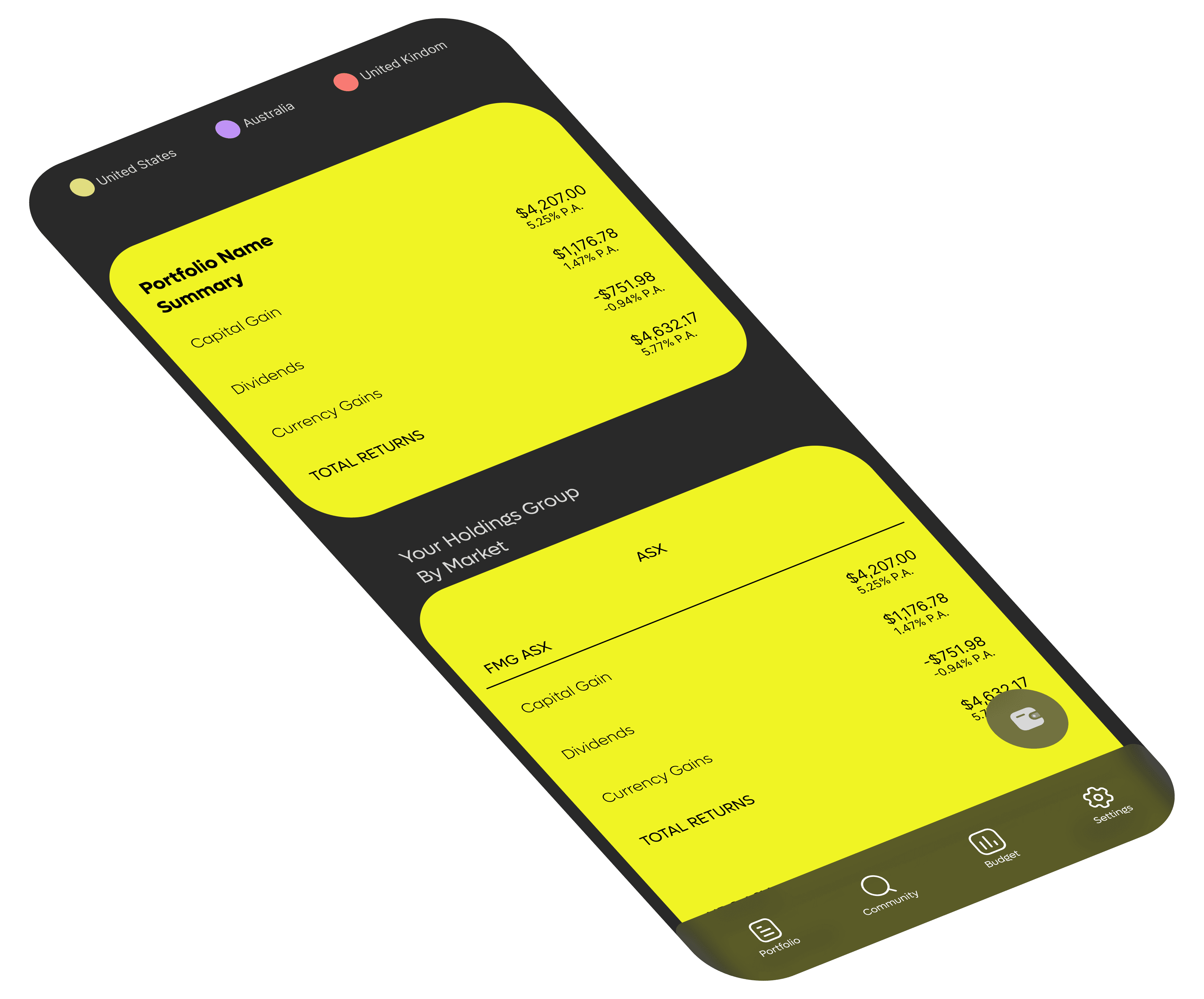

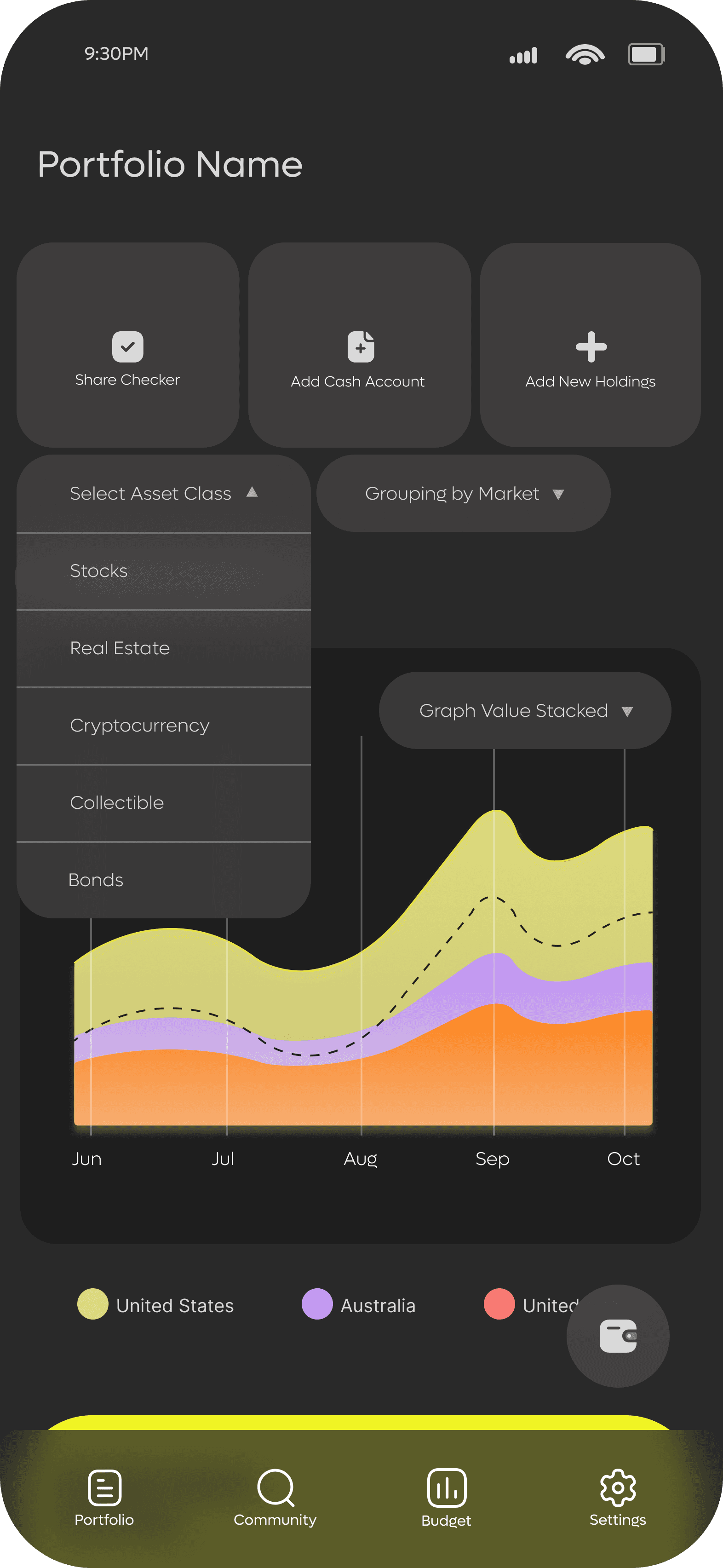

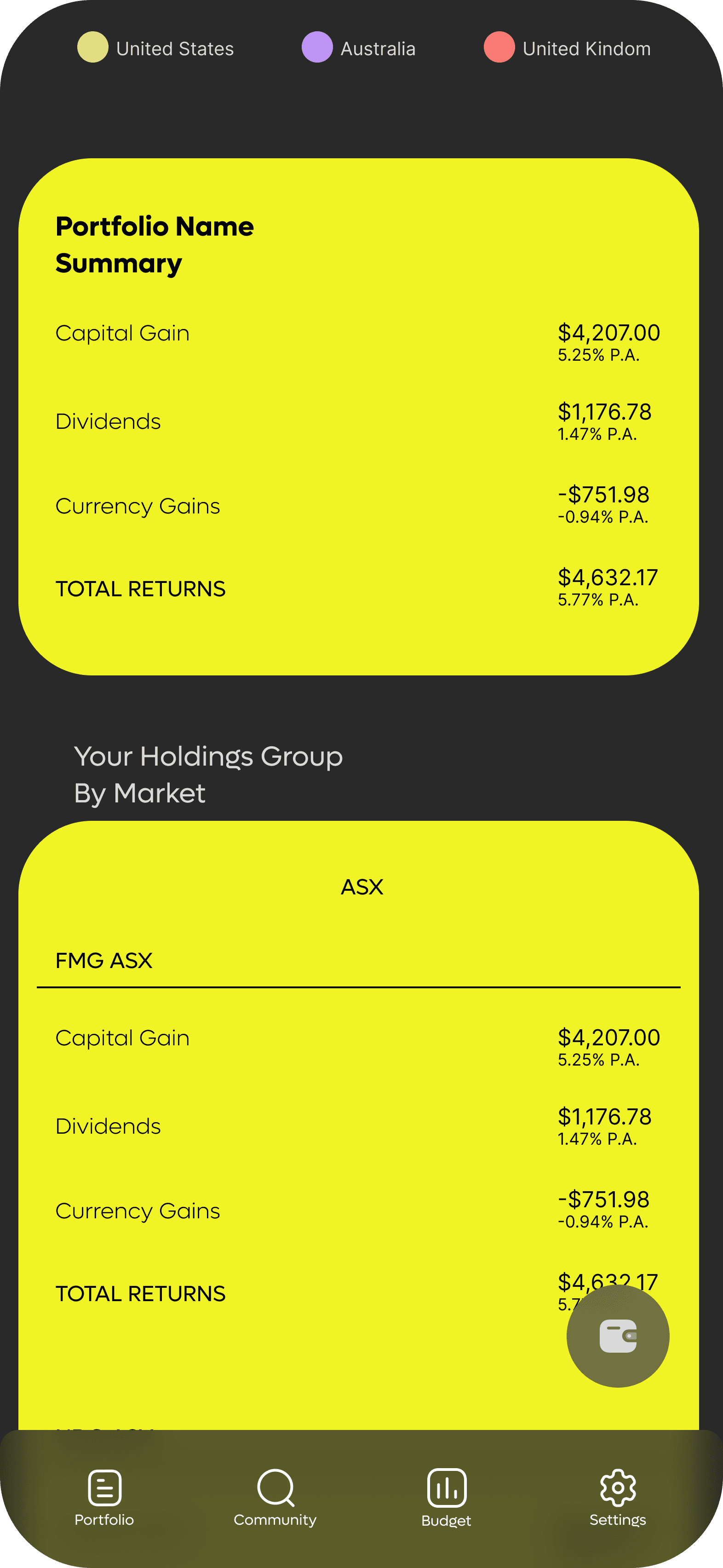

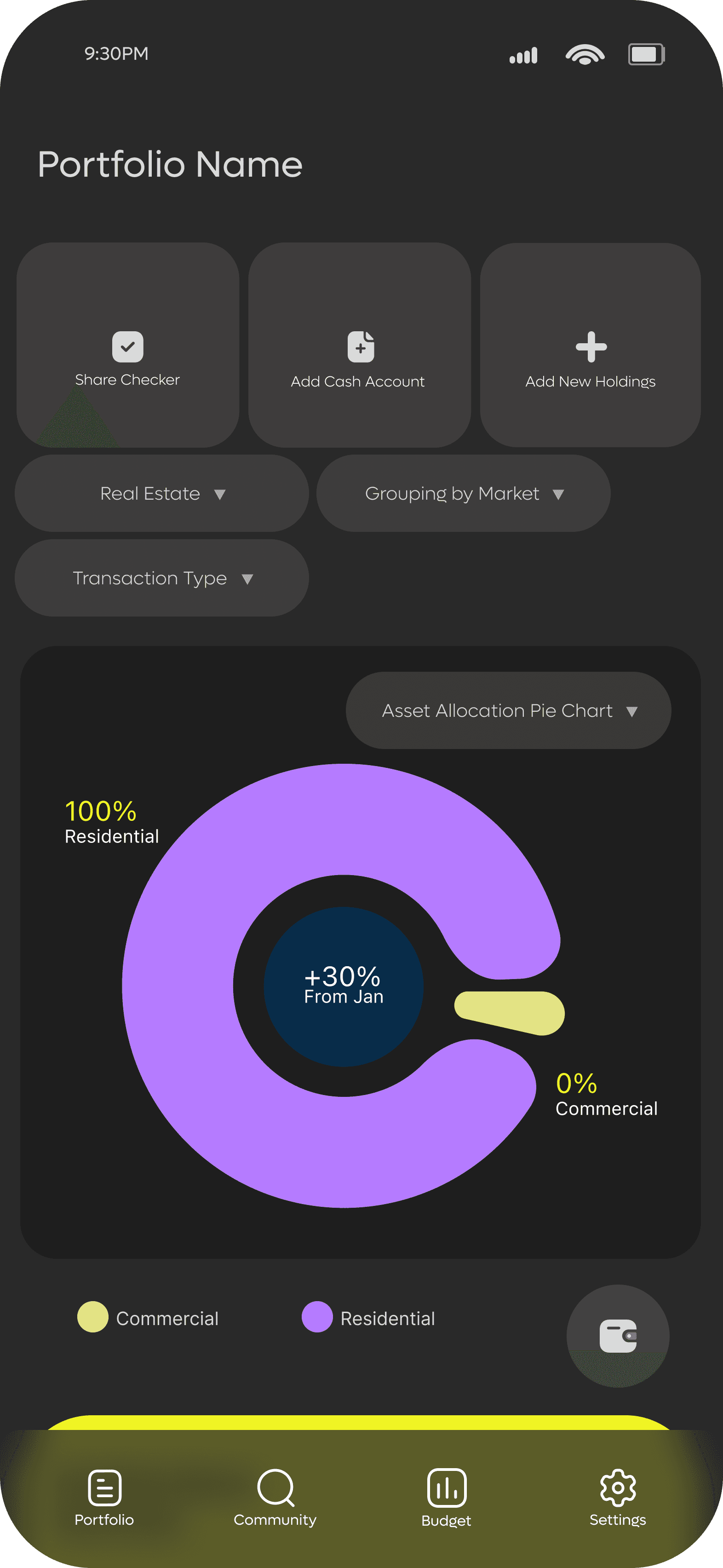

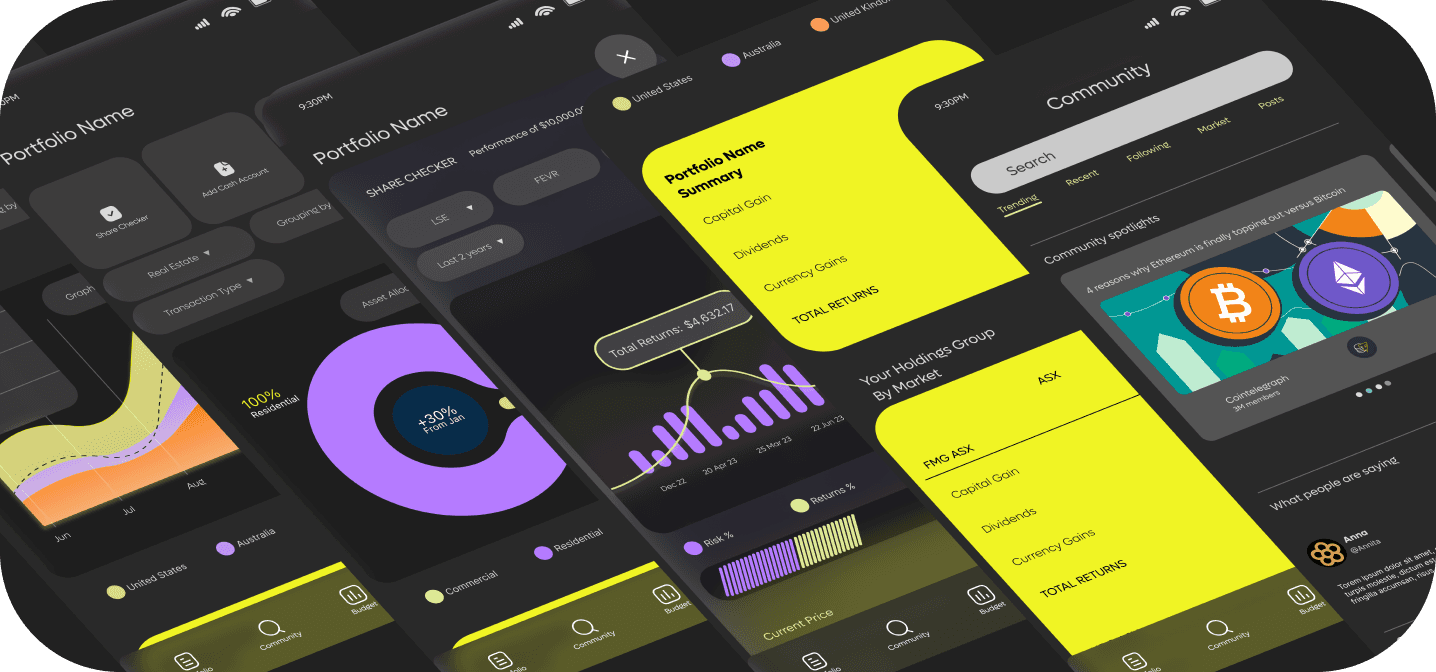

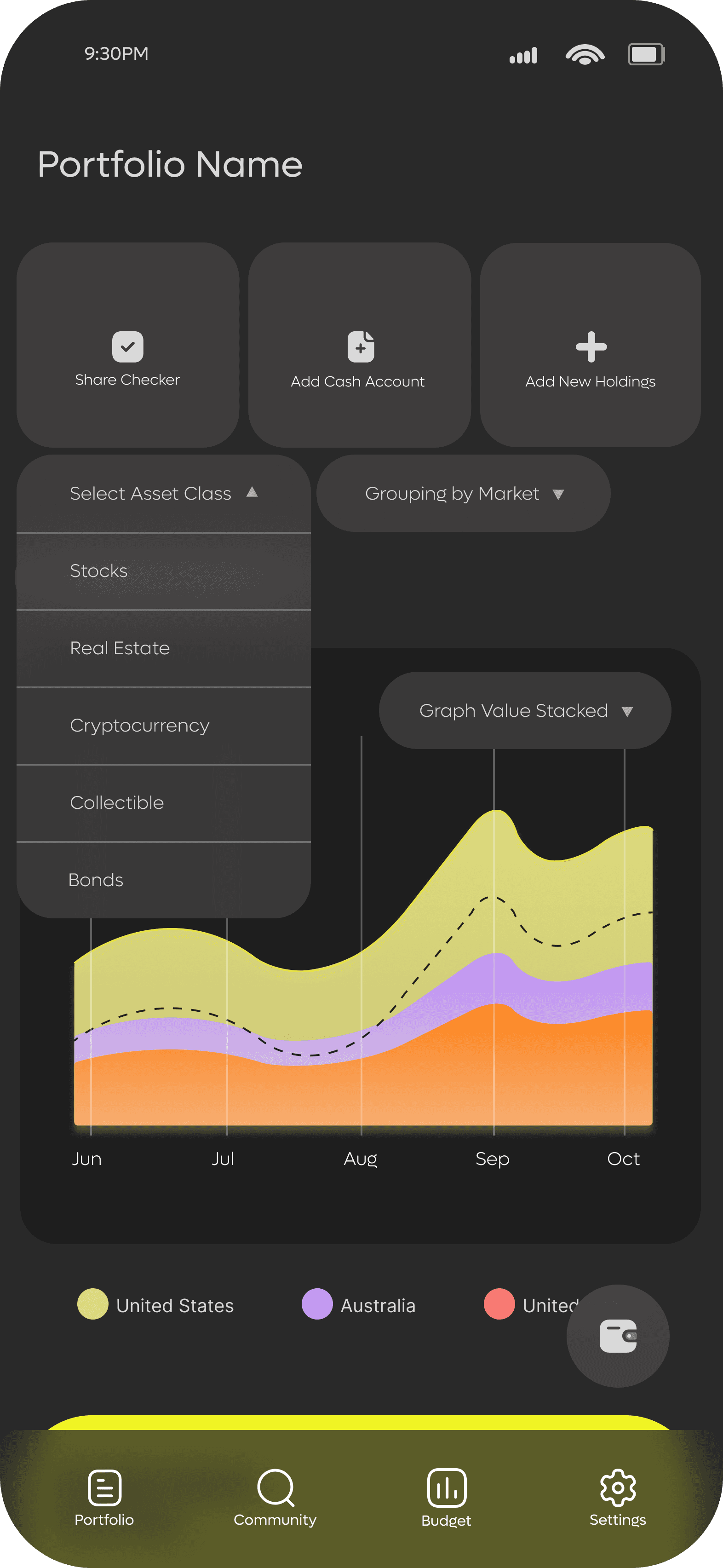

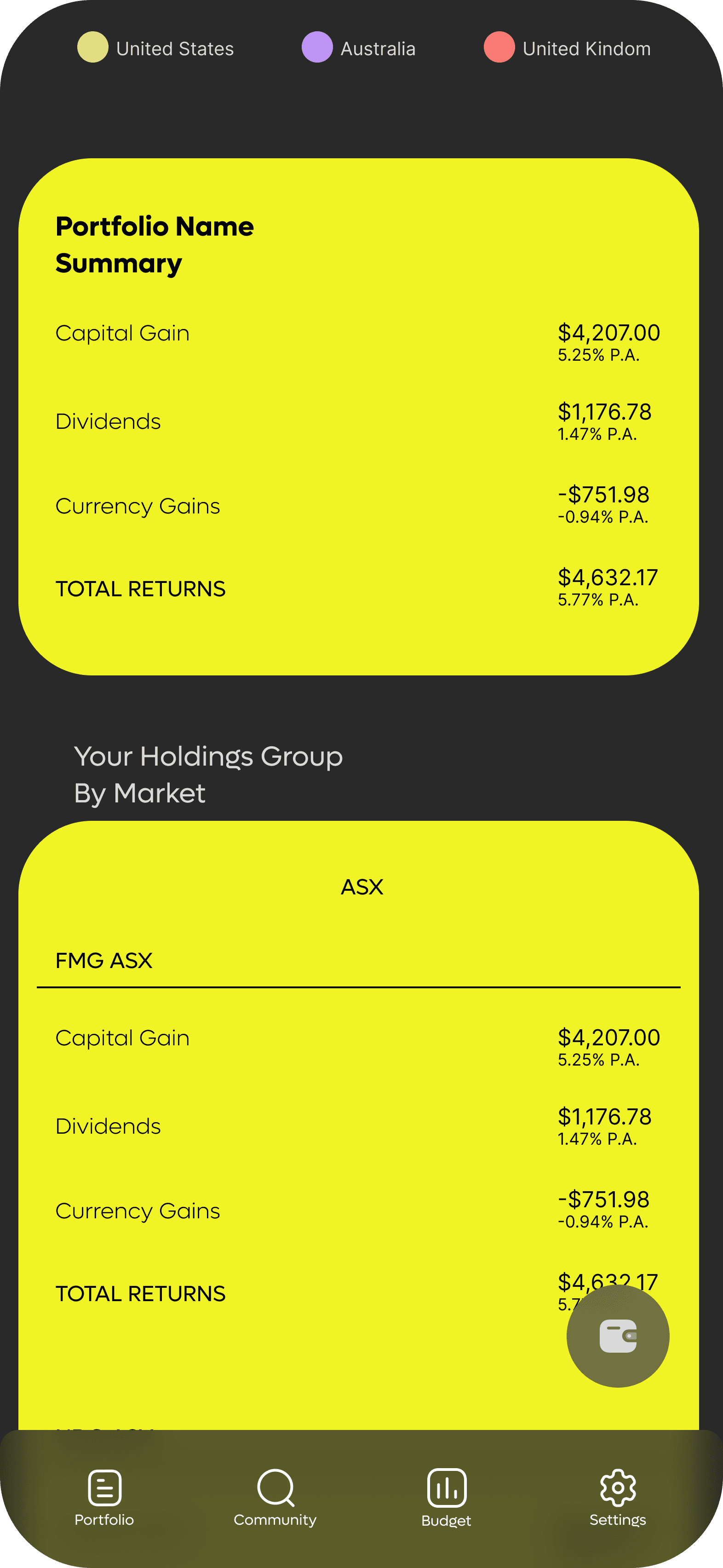

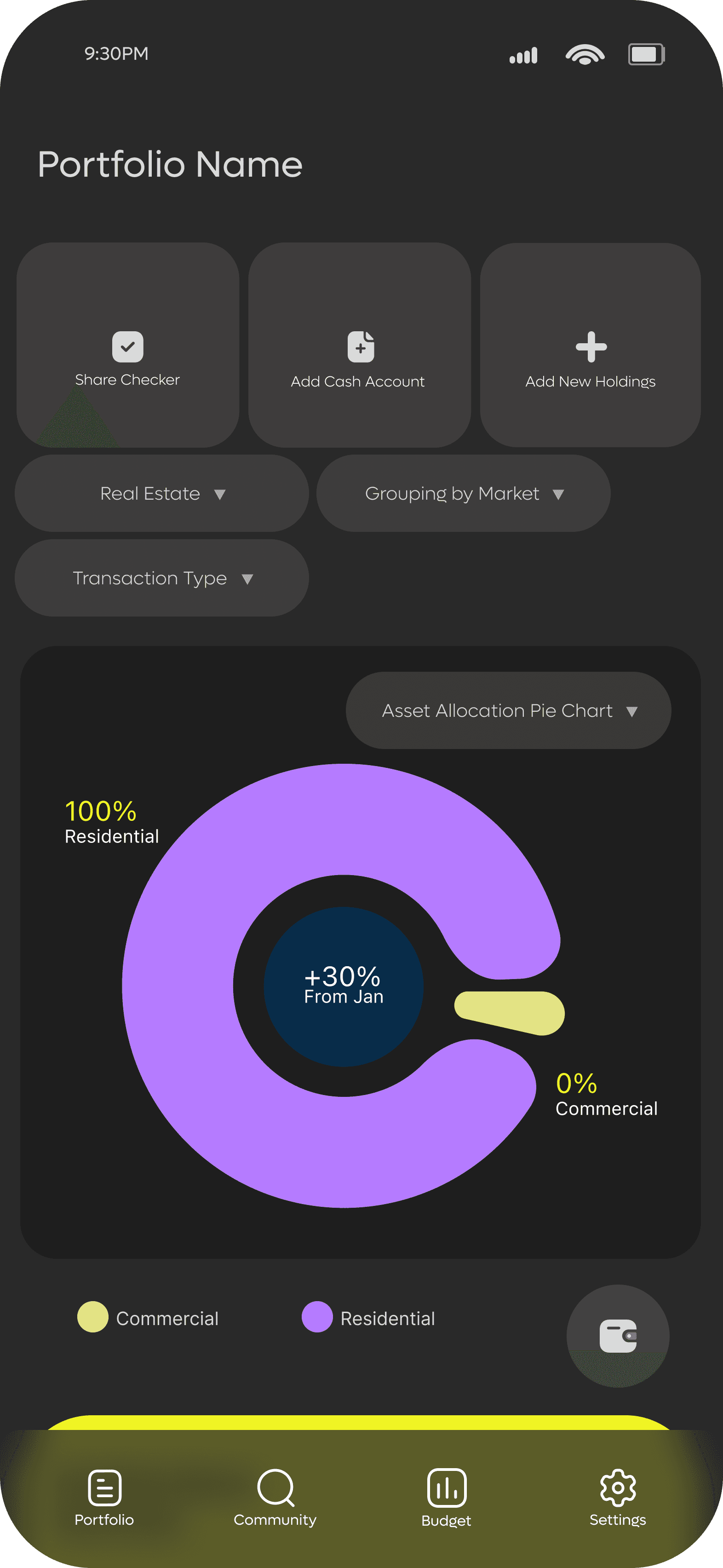

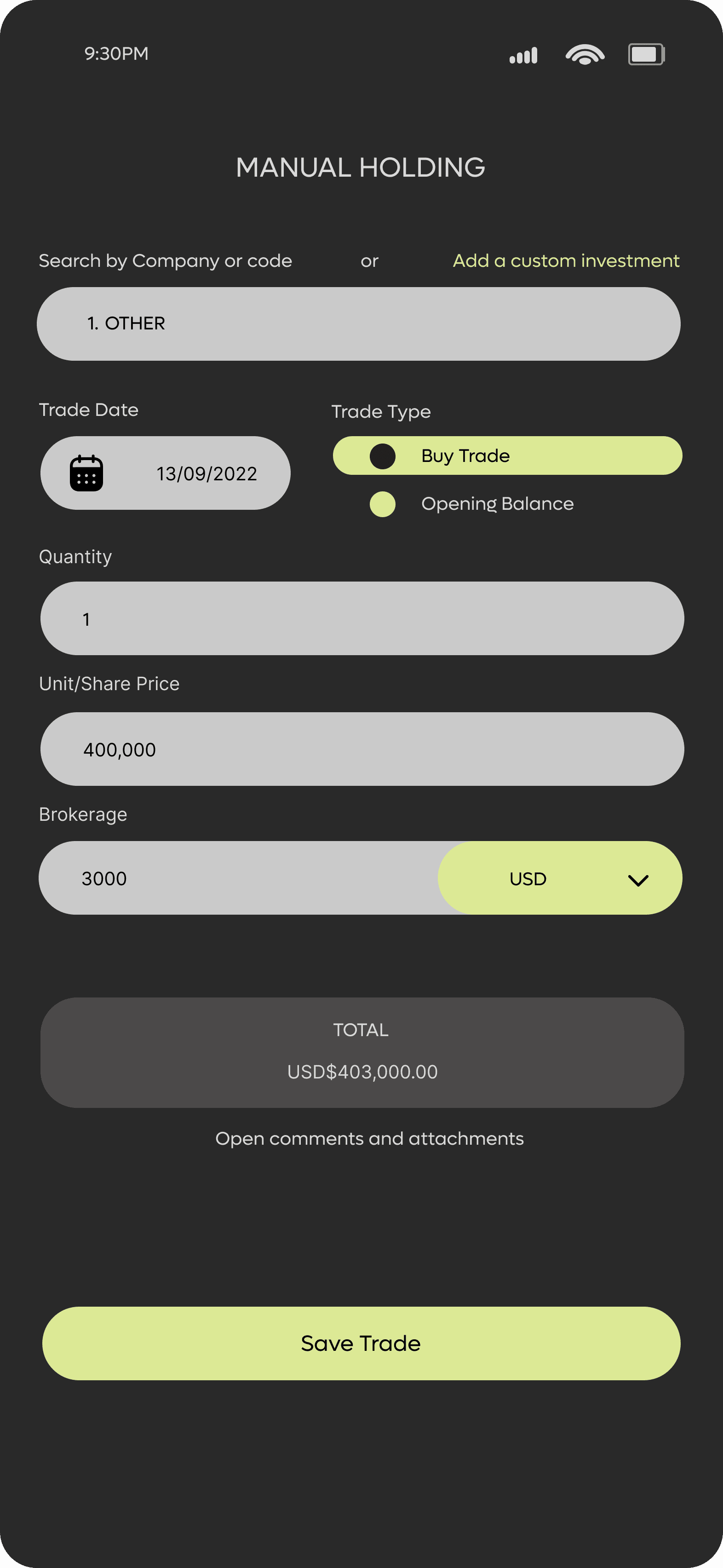

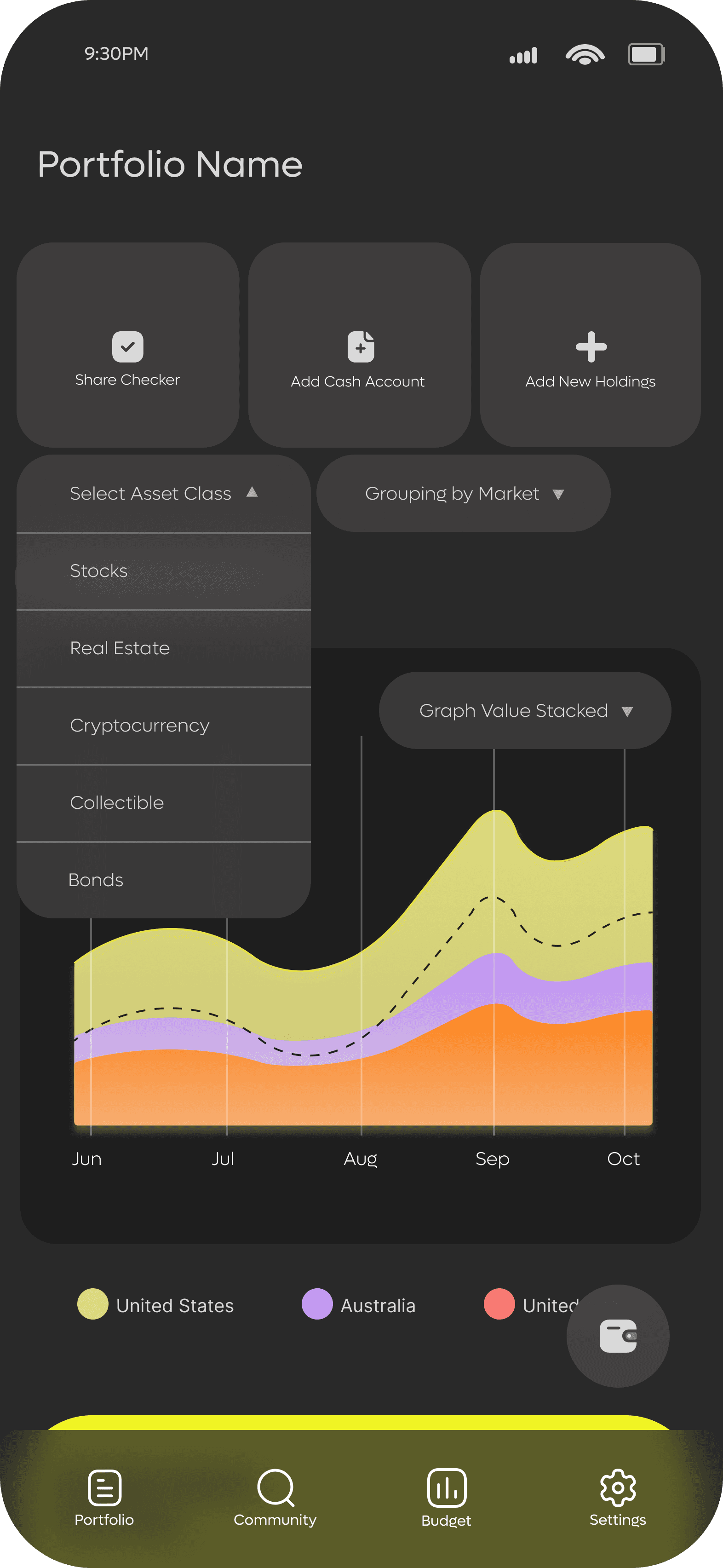

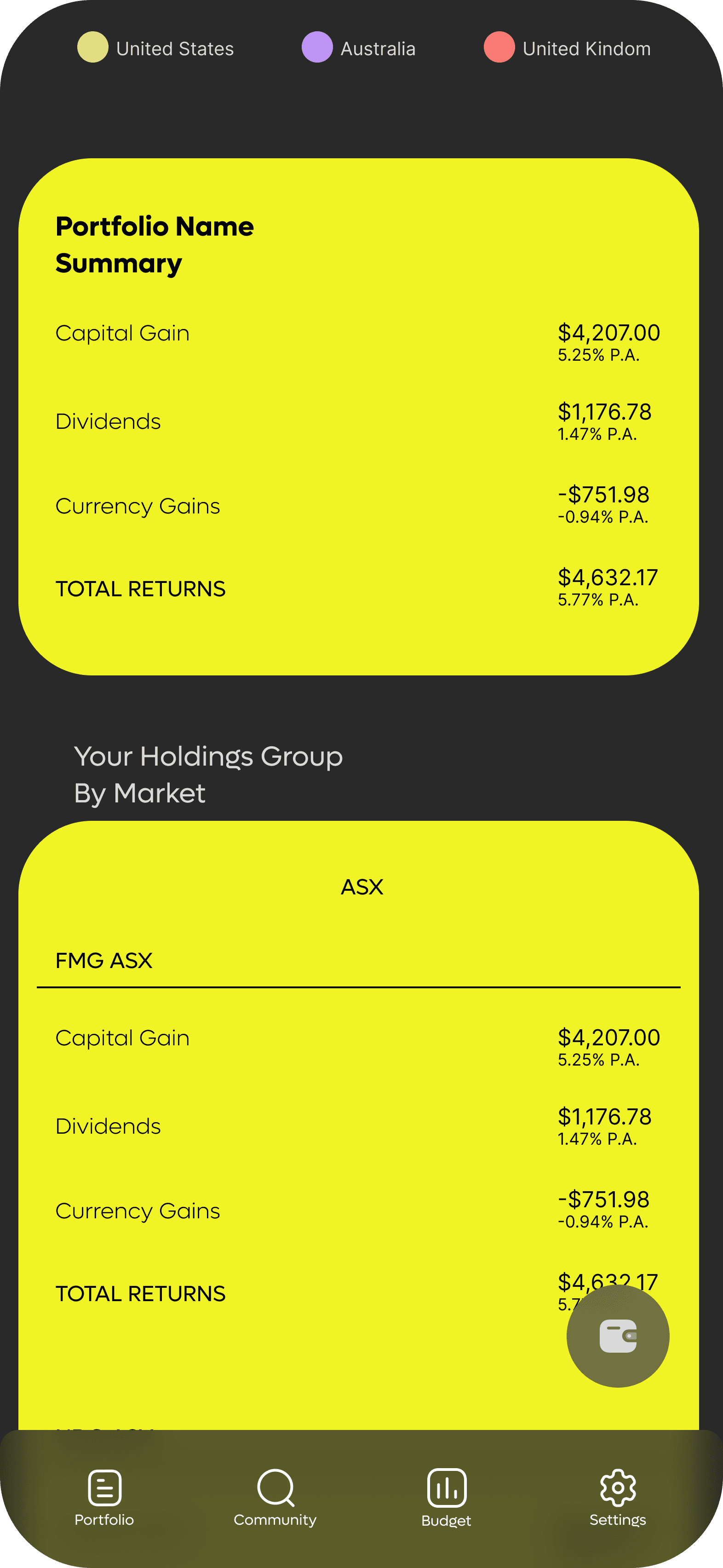

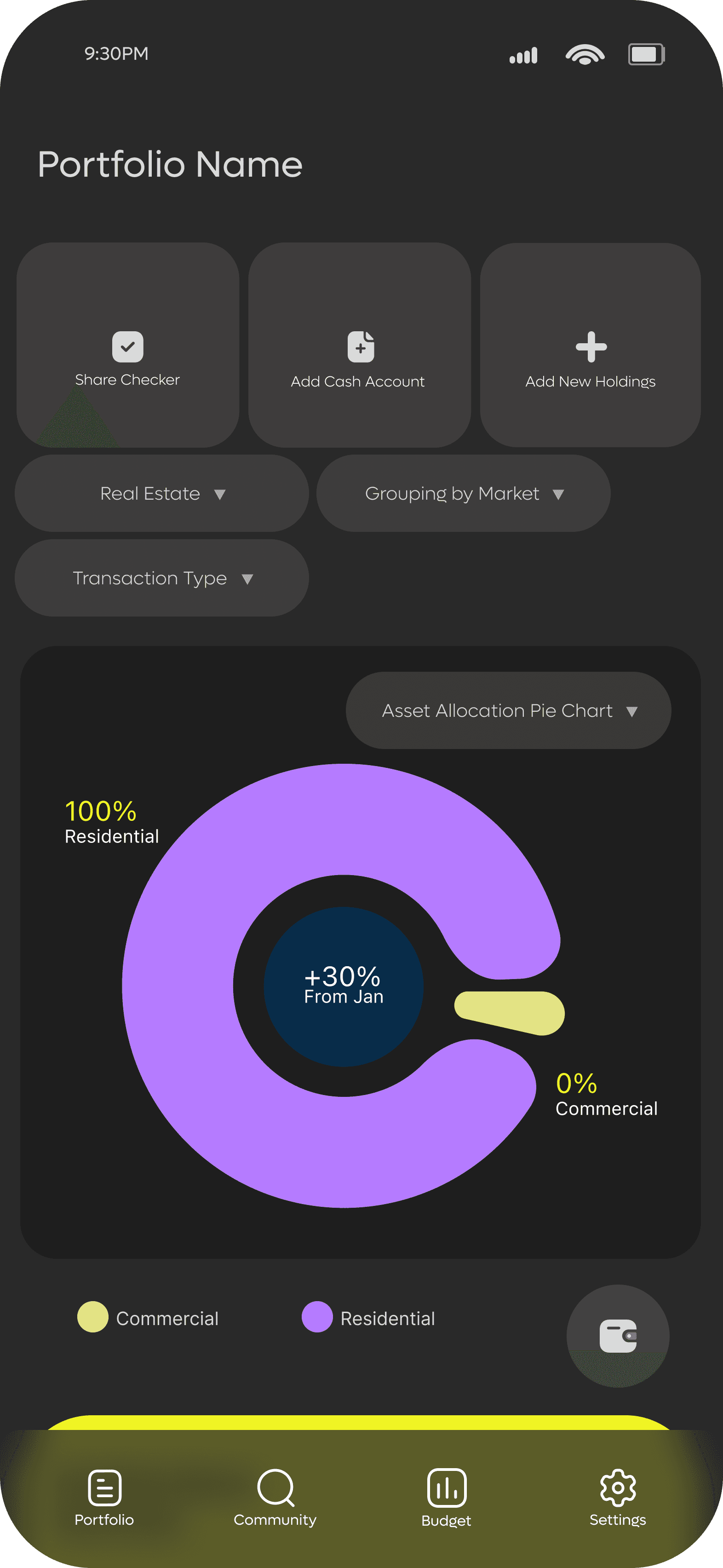

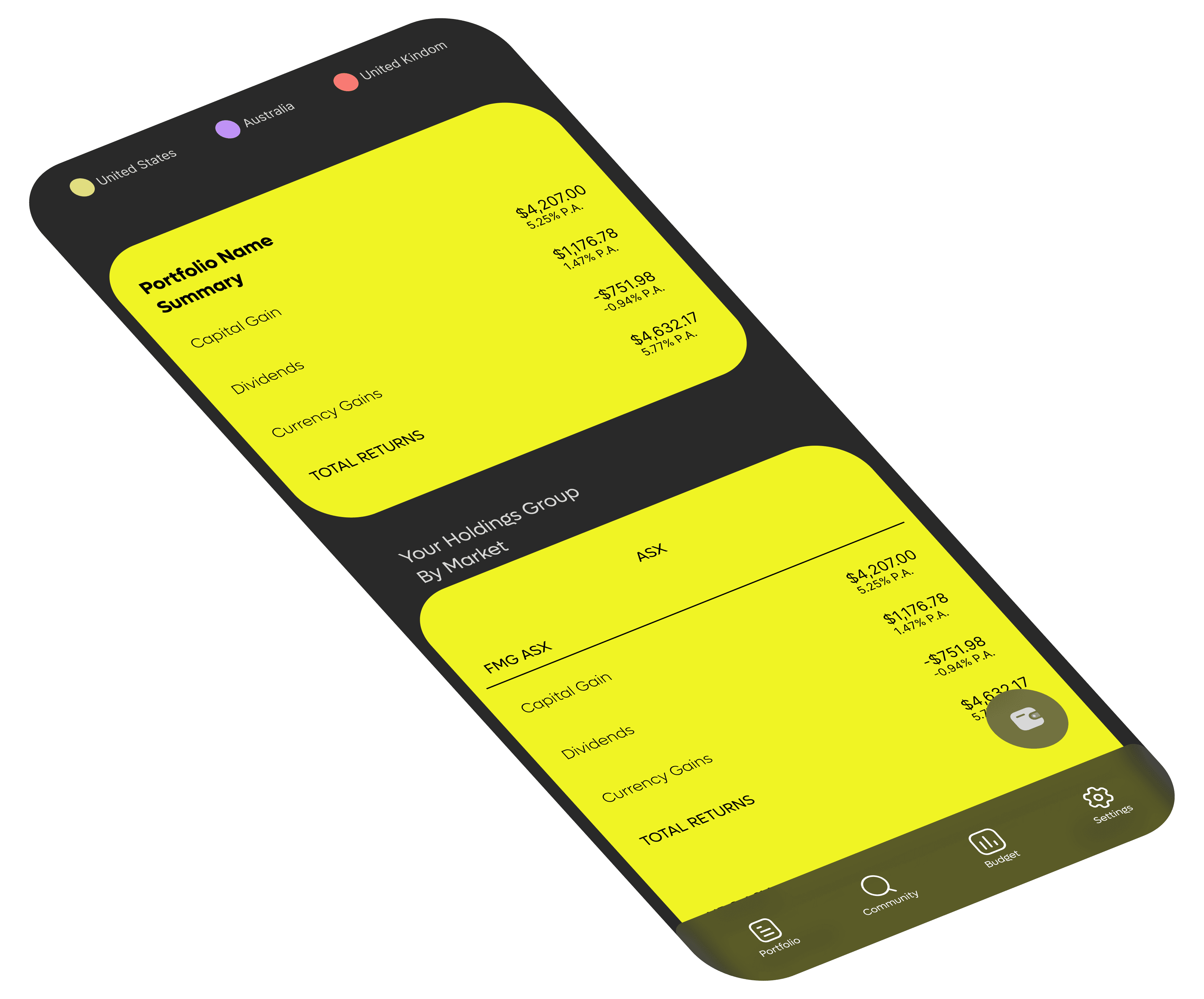

PORTFOLIO

At this stage multiple iterations were performed to the design.The portfolio section would be the first page the user is prompted to after signing in. Here the user will be able to keep track of their assets as it shows the current value and as well as the assets trajectory by using the filters for better organization and management.

The share checker page was eliminated and introduced into the portfolio page as an option for the user to consult if curiosity arises regarding performance of a specific hypothetical investment. This would help the user make informed decisions when adding future investments to their portfolio.

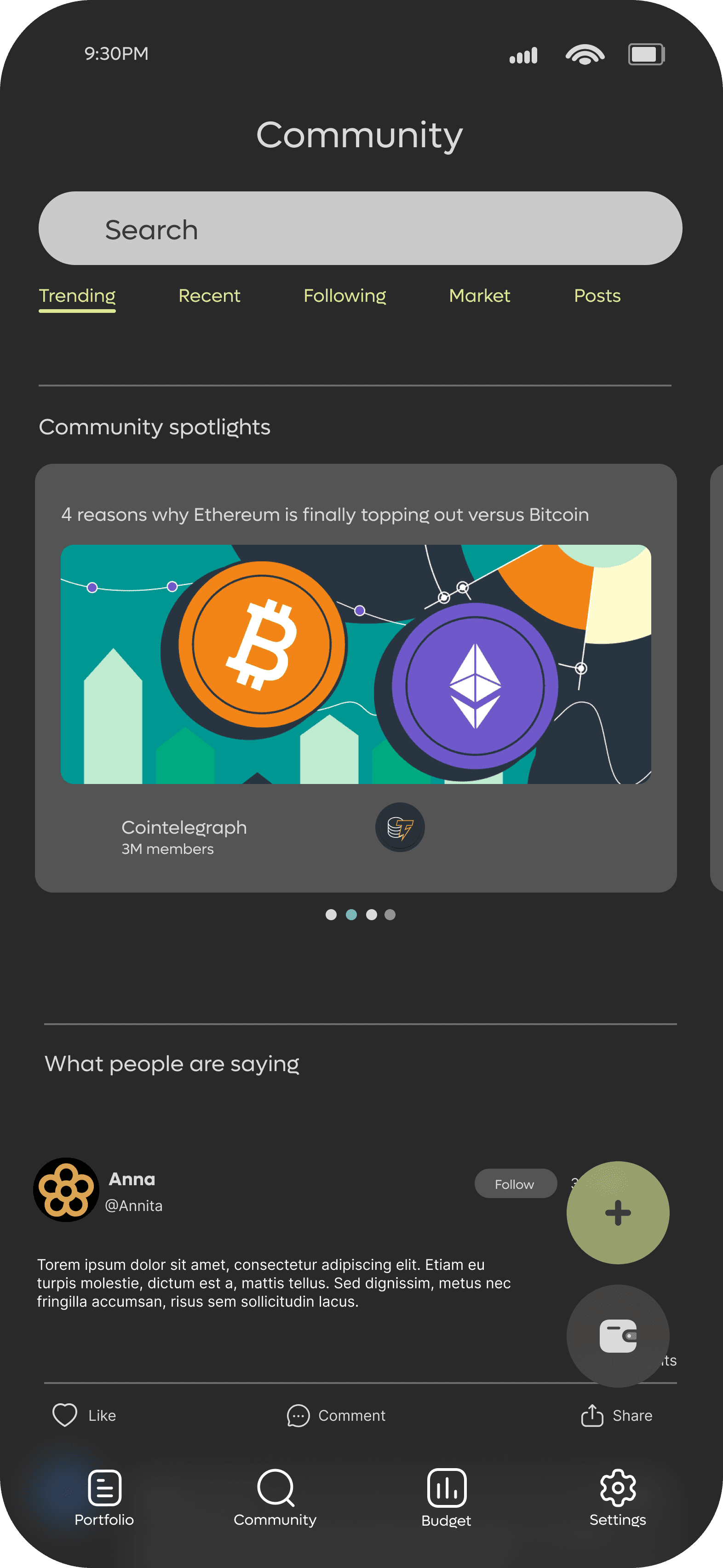

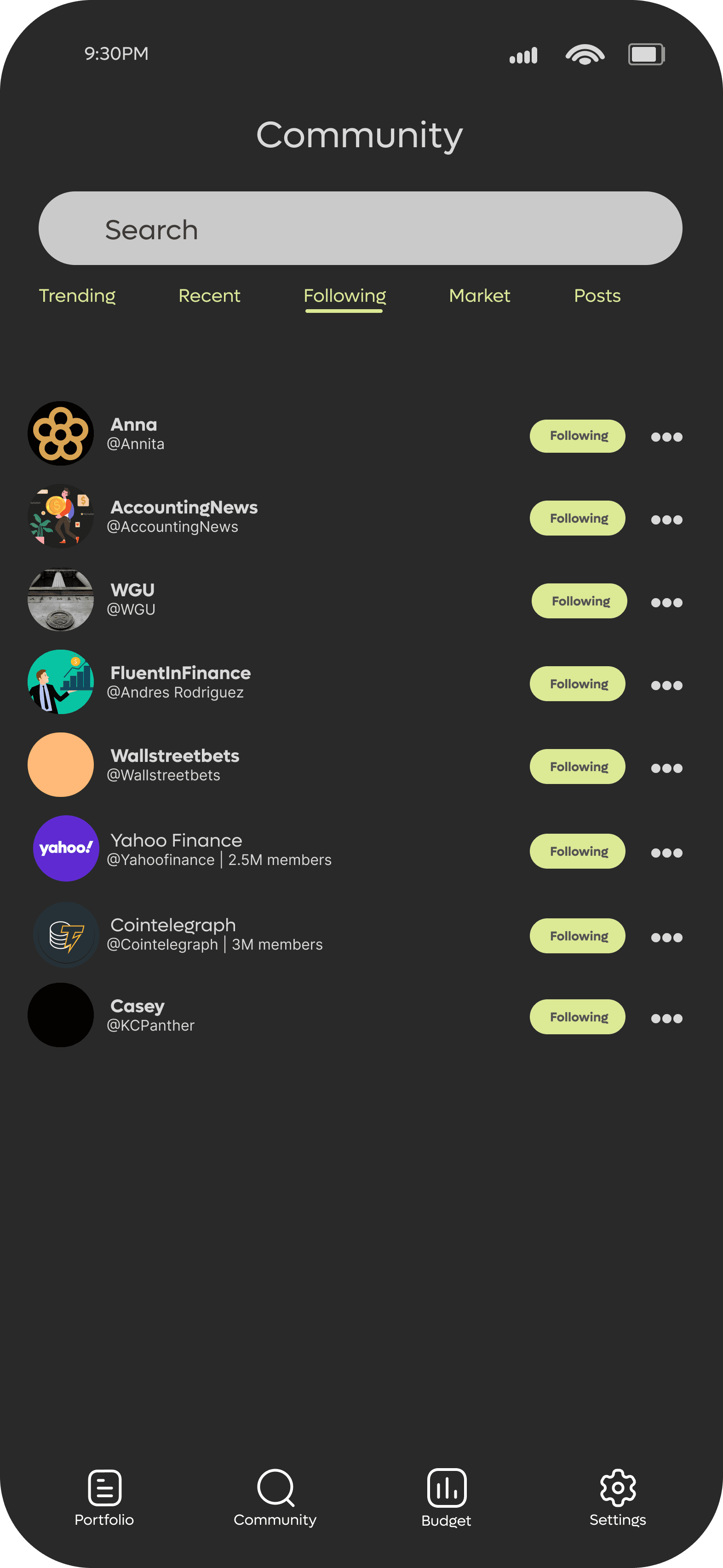

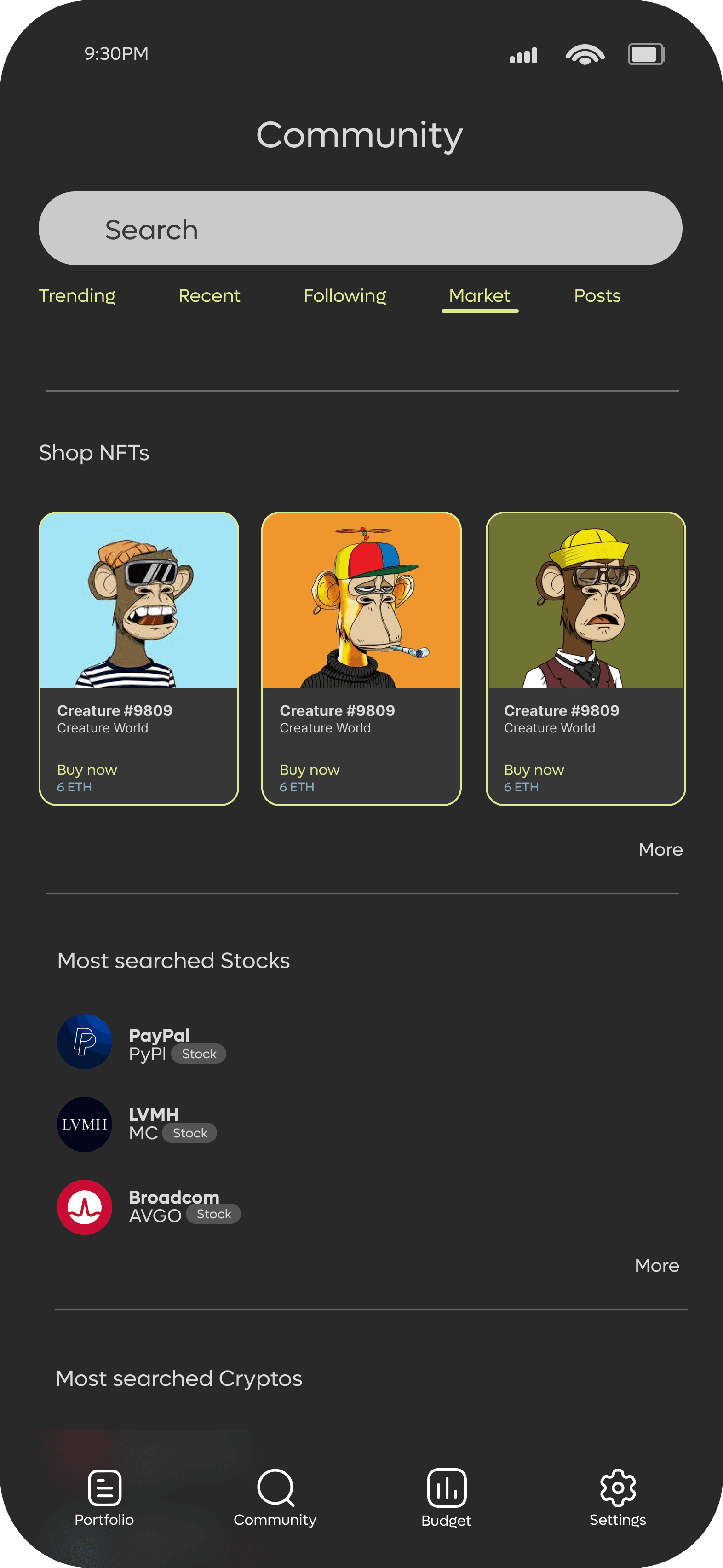

DISCOVER/ COMMUNITY

In the community page the user will be able to connect with like-minded people and stay informed on the events within the financial world. The user will be able to follow other accounts, post and check recent searches.

In the community section the user also has the opportunity to invest in digital assets as the market section was integrated for better accessibility performance.

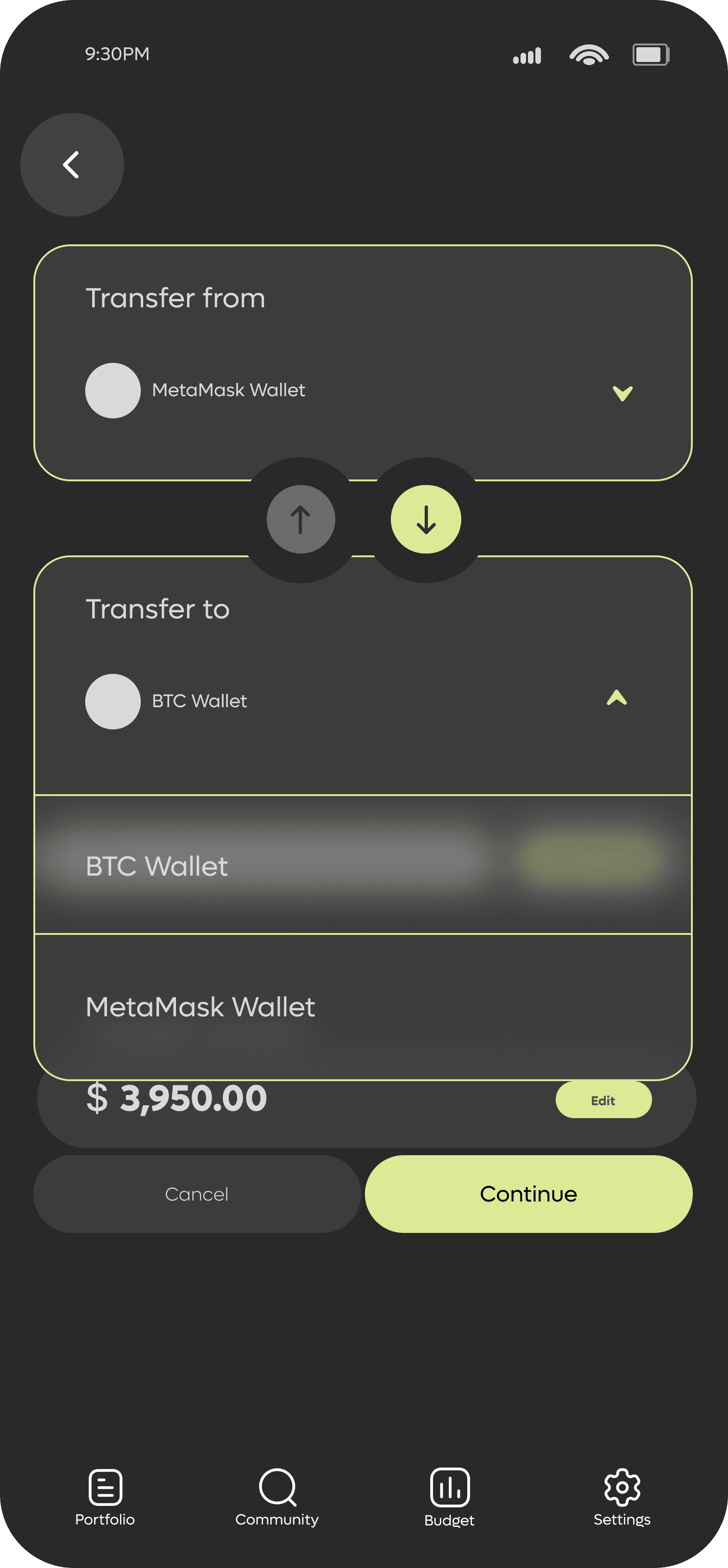

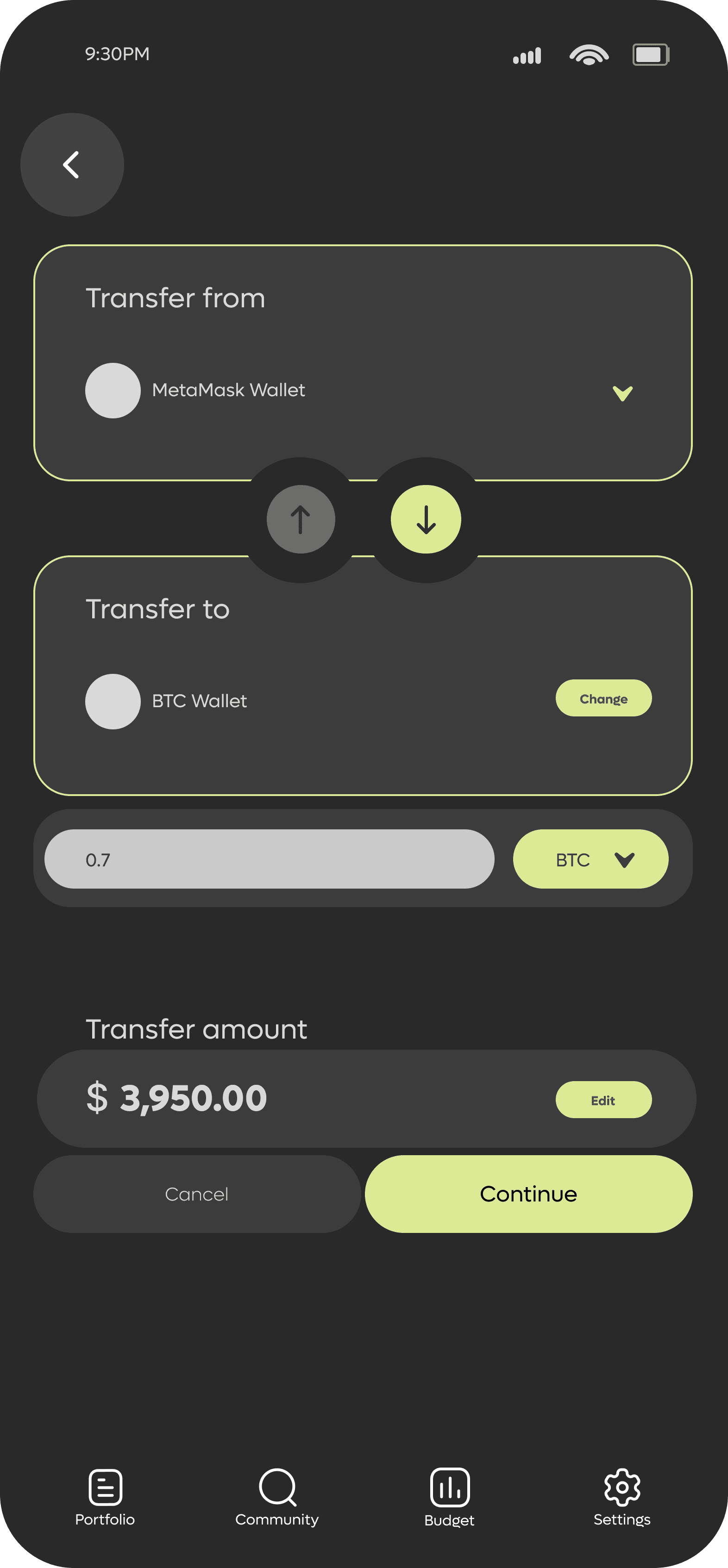

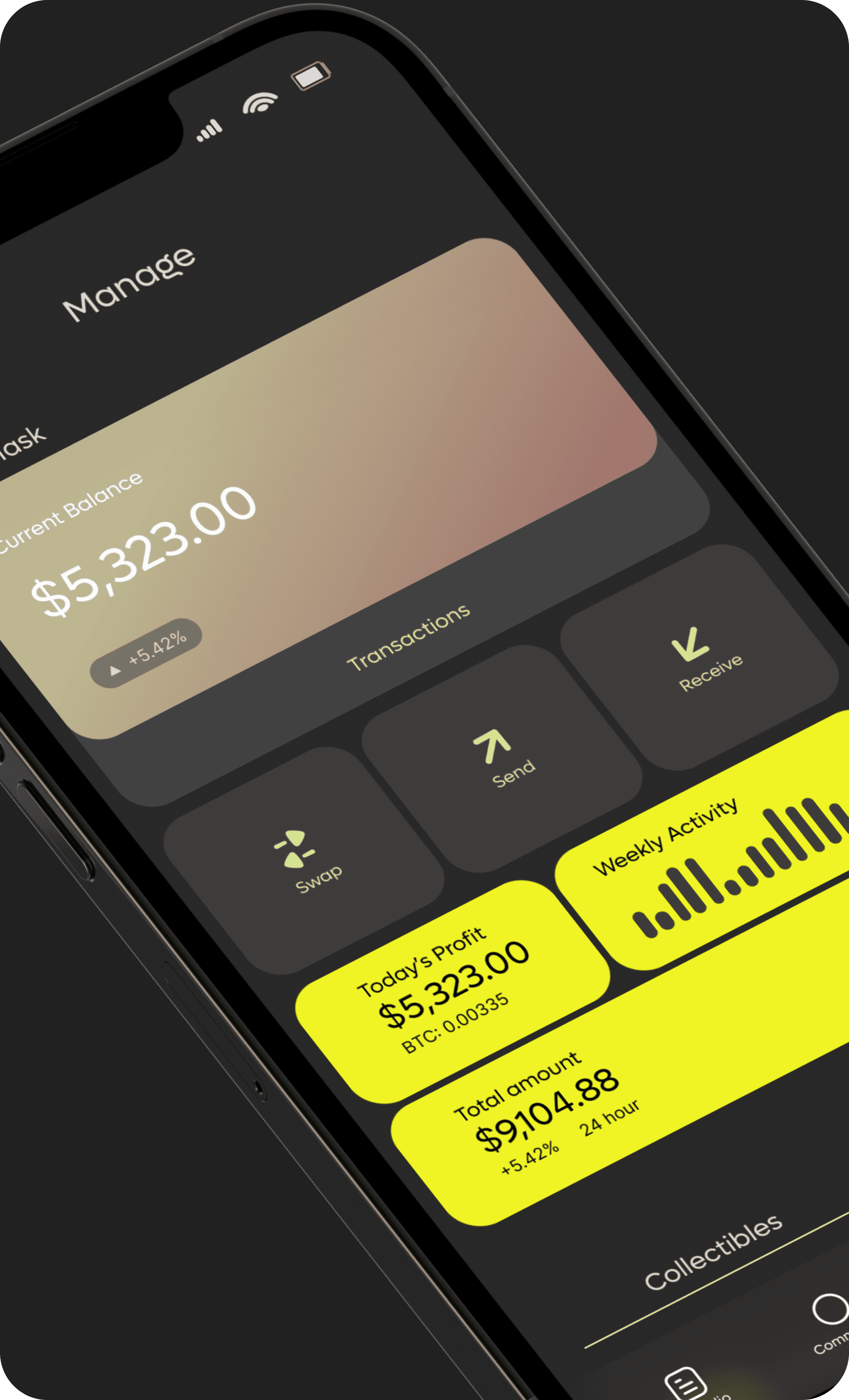

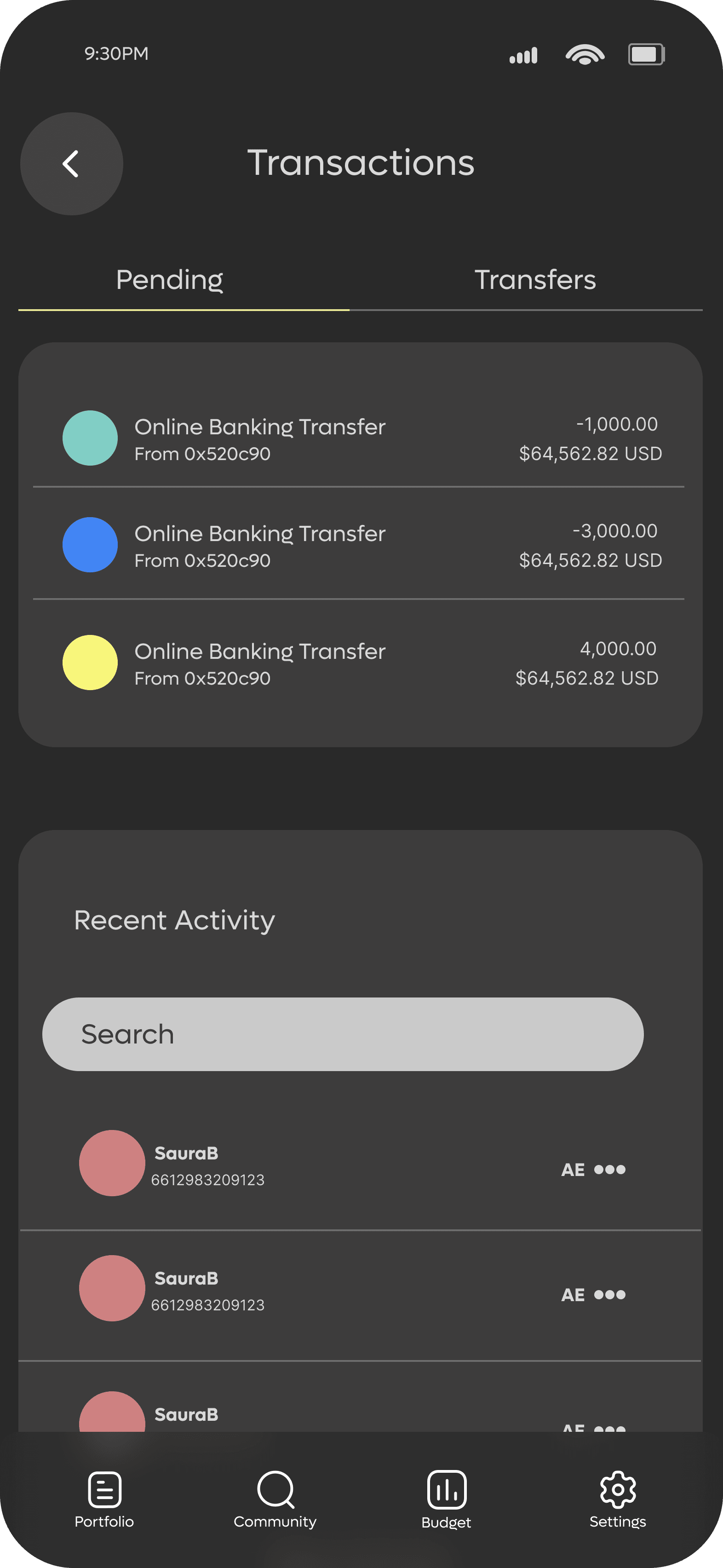

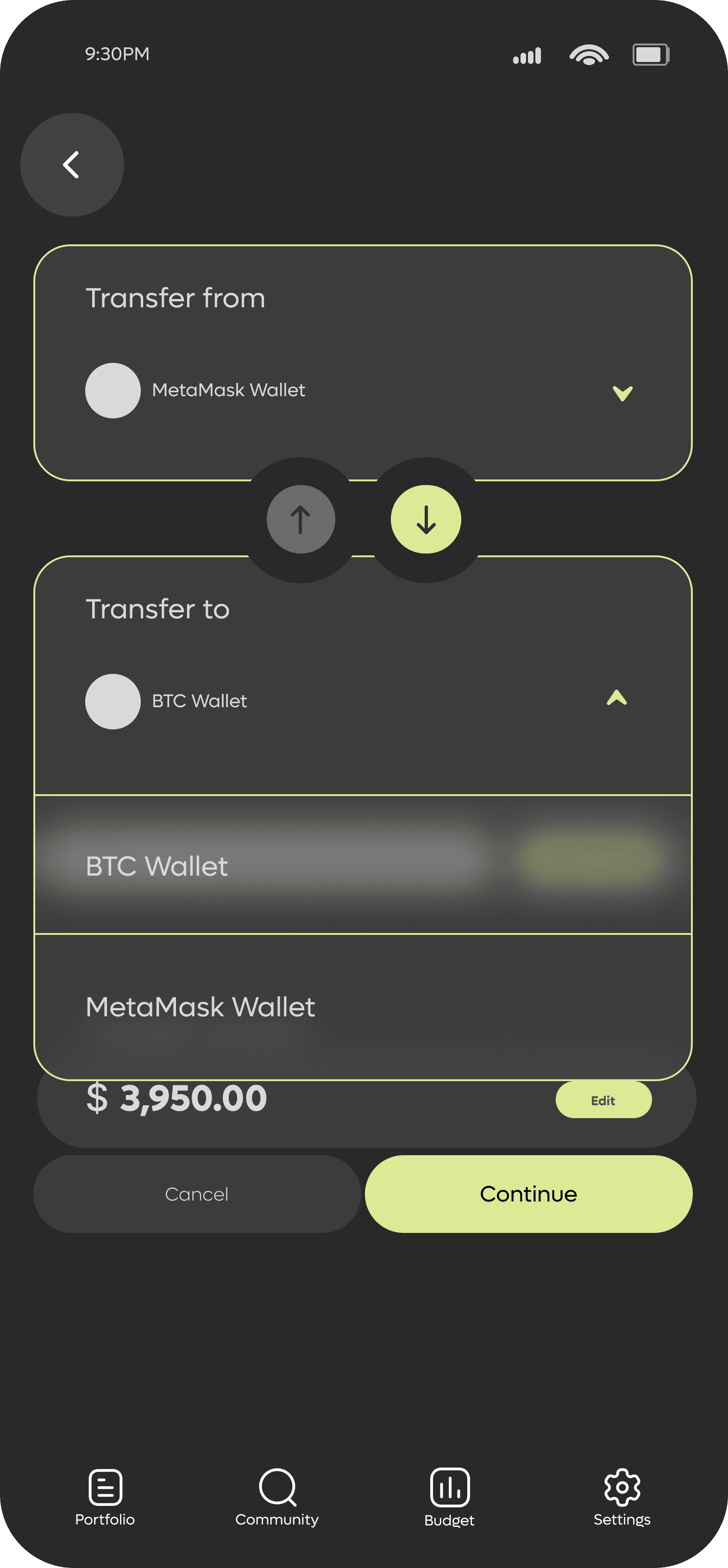

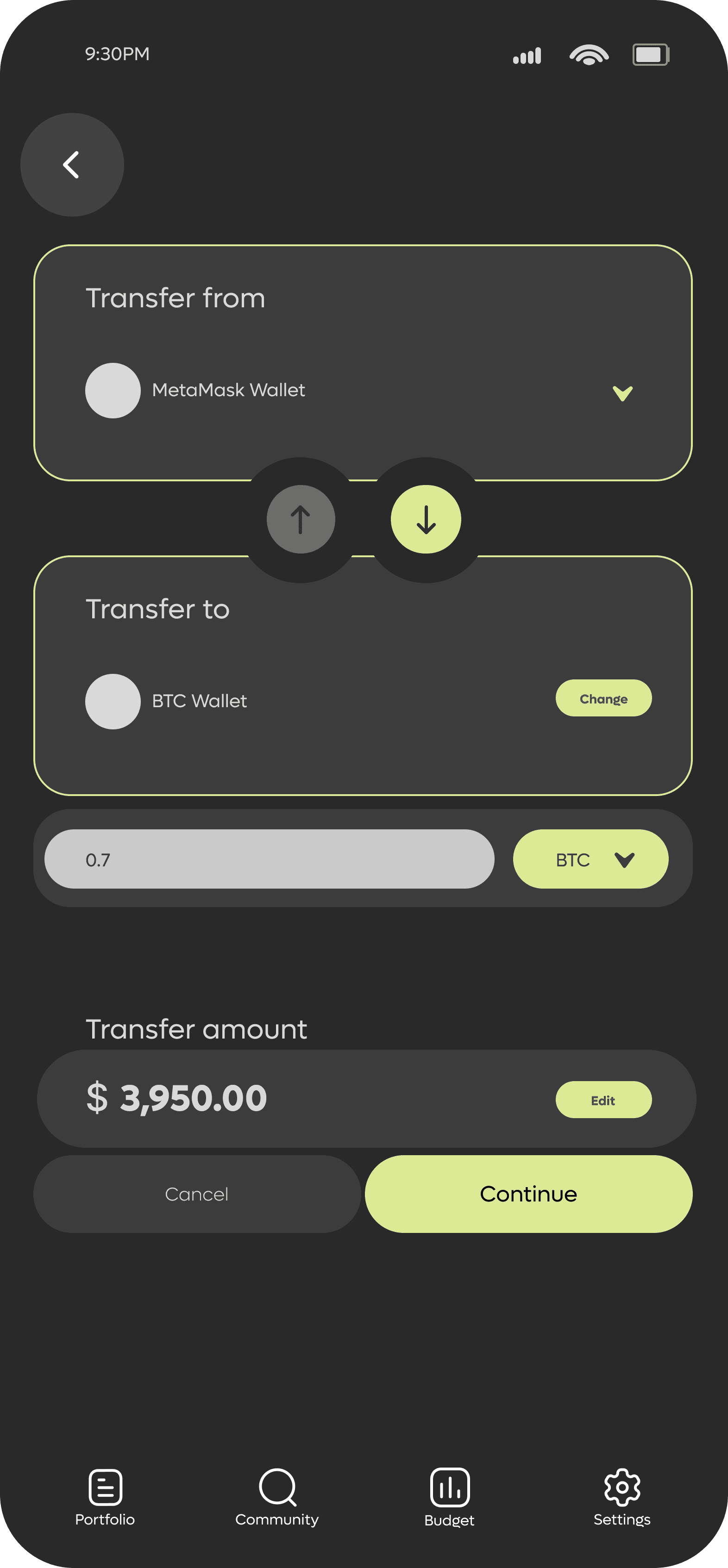

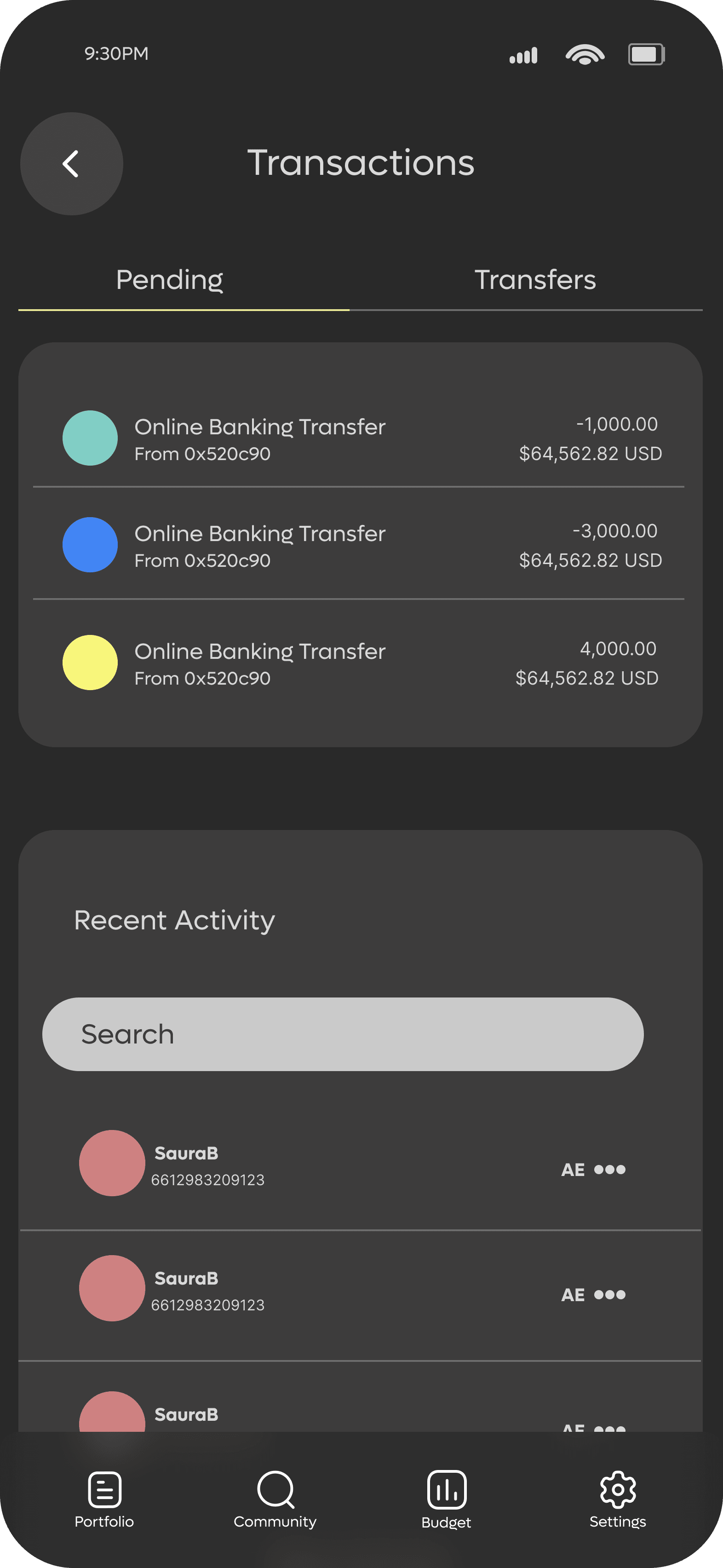

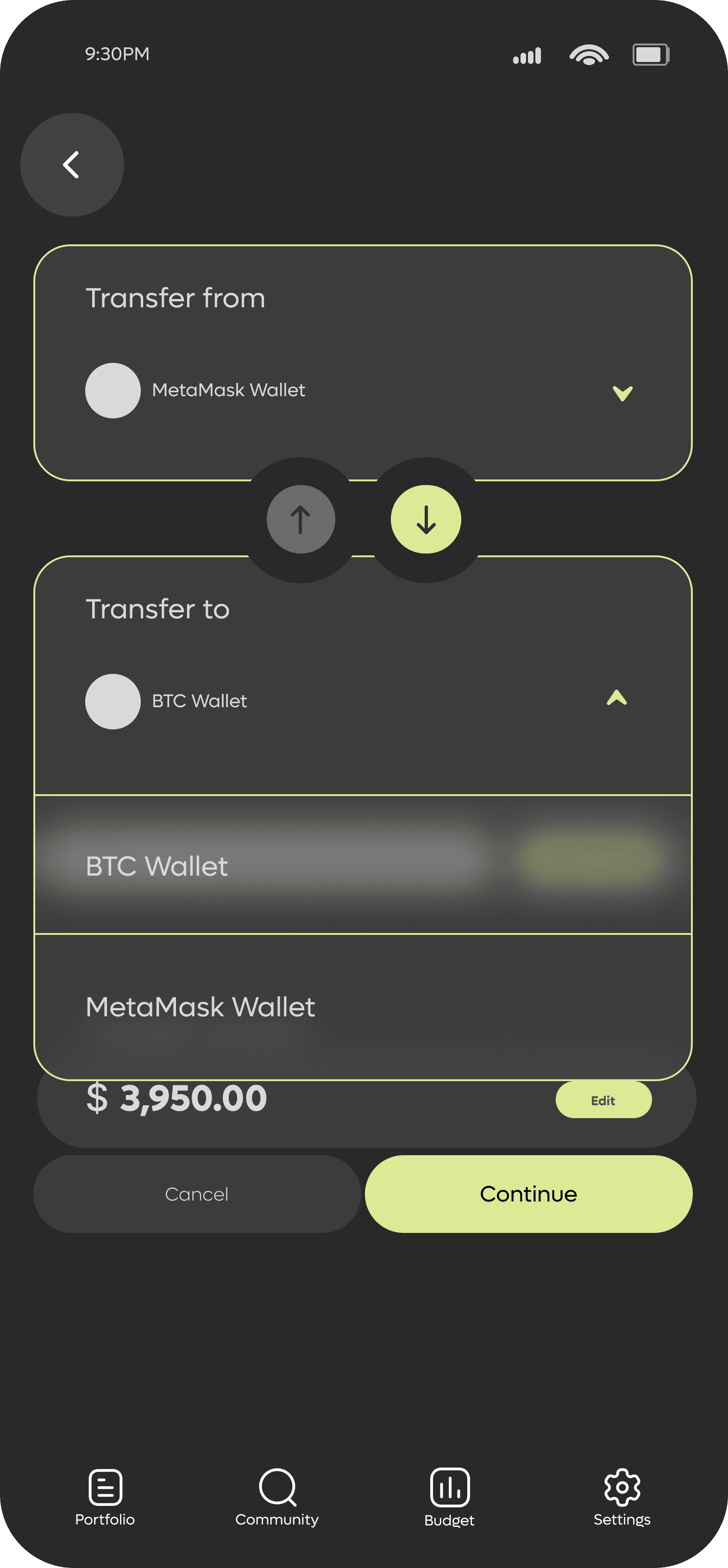

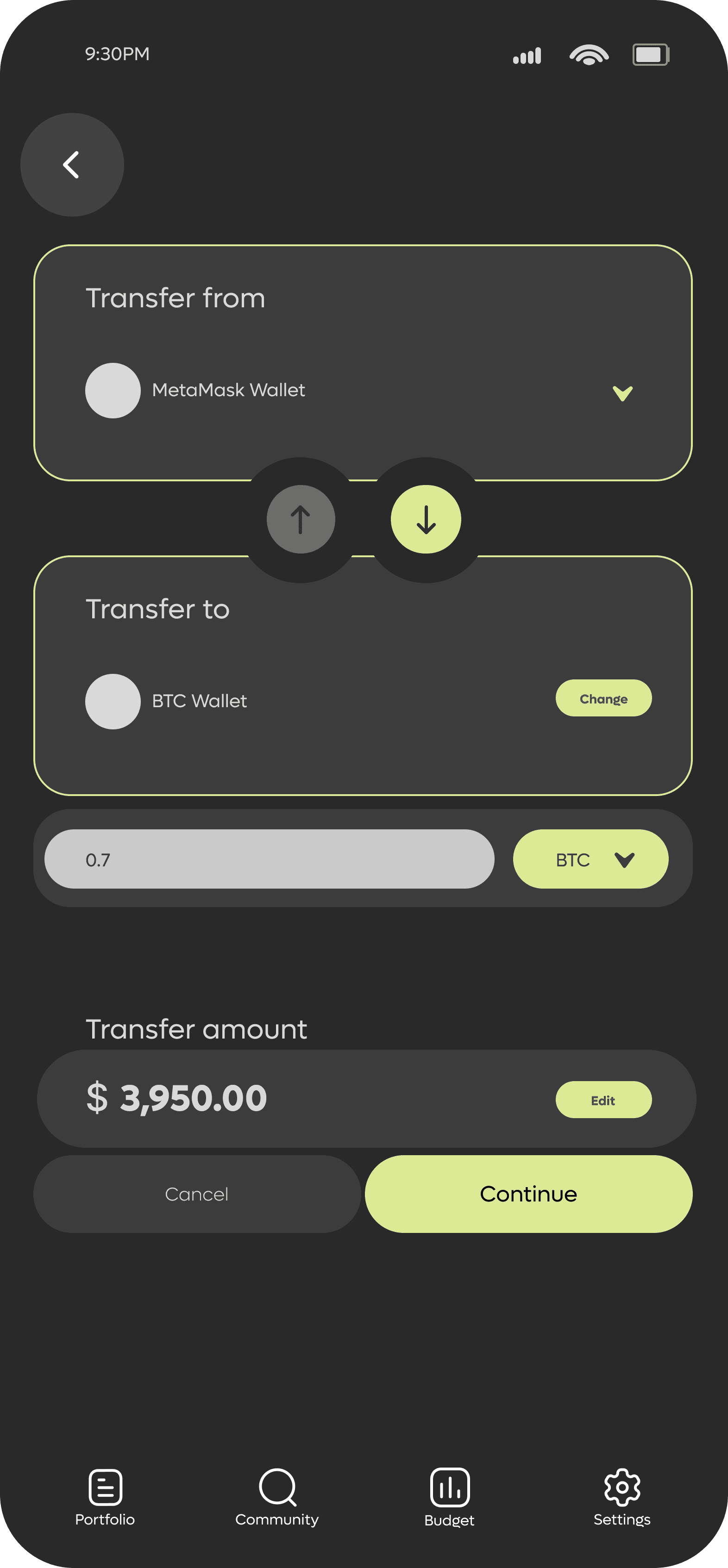

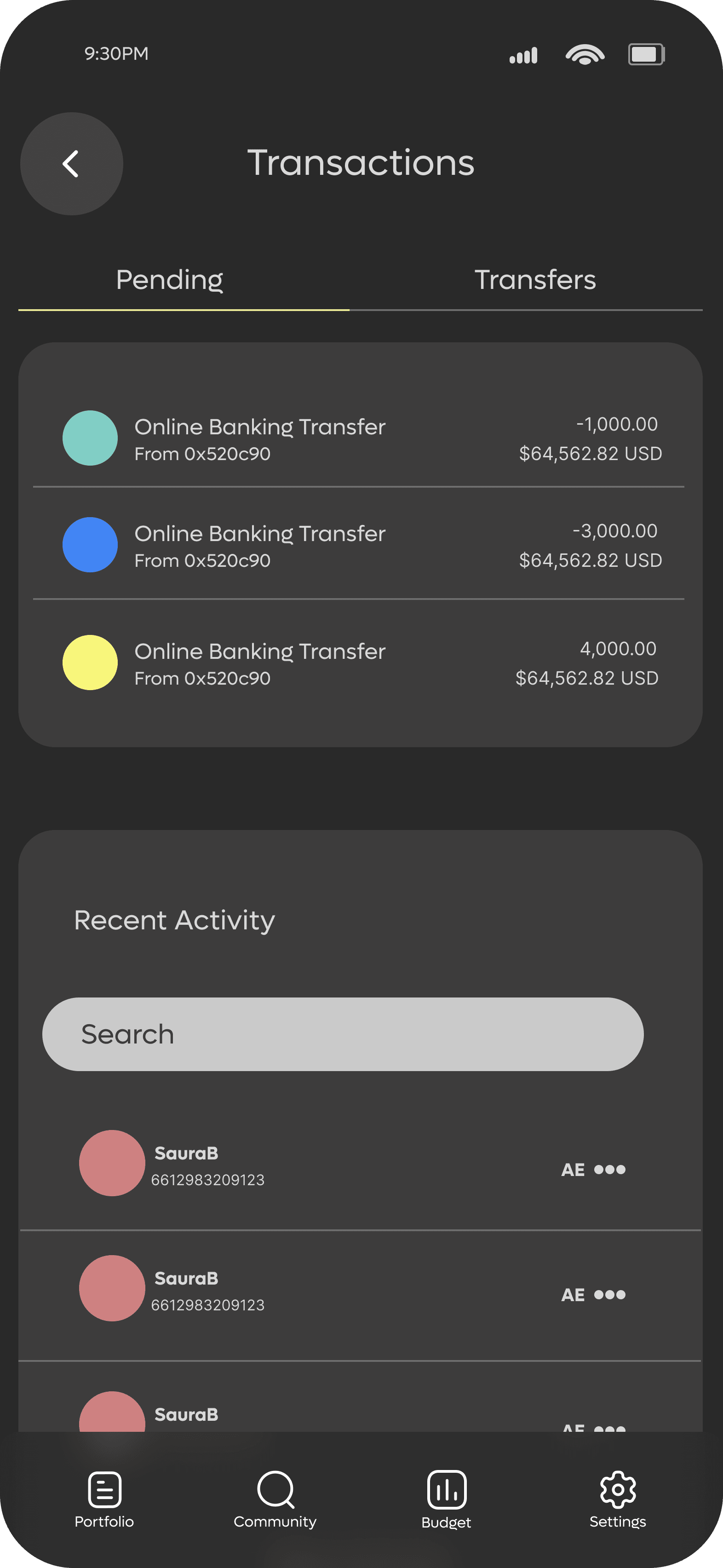

BUDGET & WALLET

The budget section was created with the objective in mind to provide the user with a summary and overview of all assets performance for a quick assessment of any progress or simply to stay updated with any improvements. Using the history information from the portfolio tips and suggestions on next steps will be provided to the user.

Providing at the same time easy access to the wallet which will be located on a separate button that will be available throughout all the sections of the app.

The wallet option essentially will connect your regular banking services with your digital services. Here user’s crypto wallet and banking accounts can be found in the same place. The design allows a seamless navigation between one account to another while also providing accessible account management.

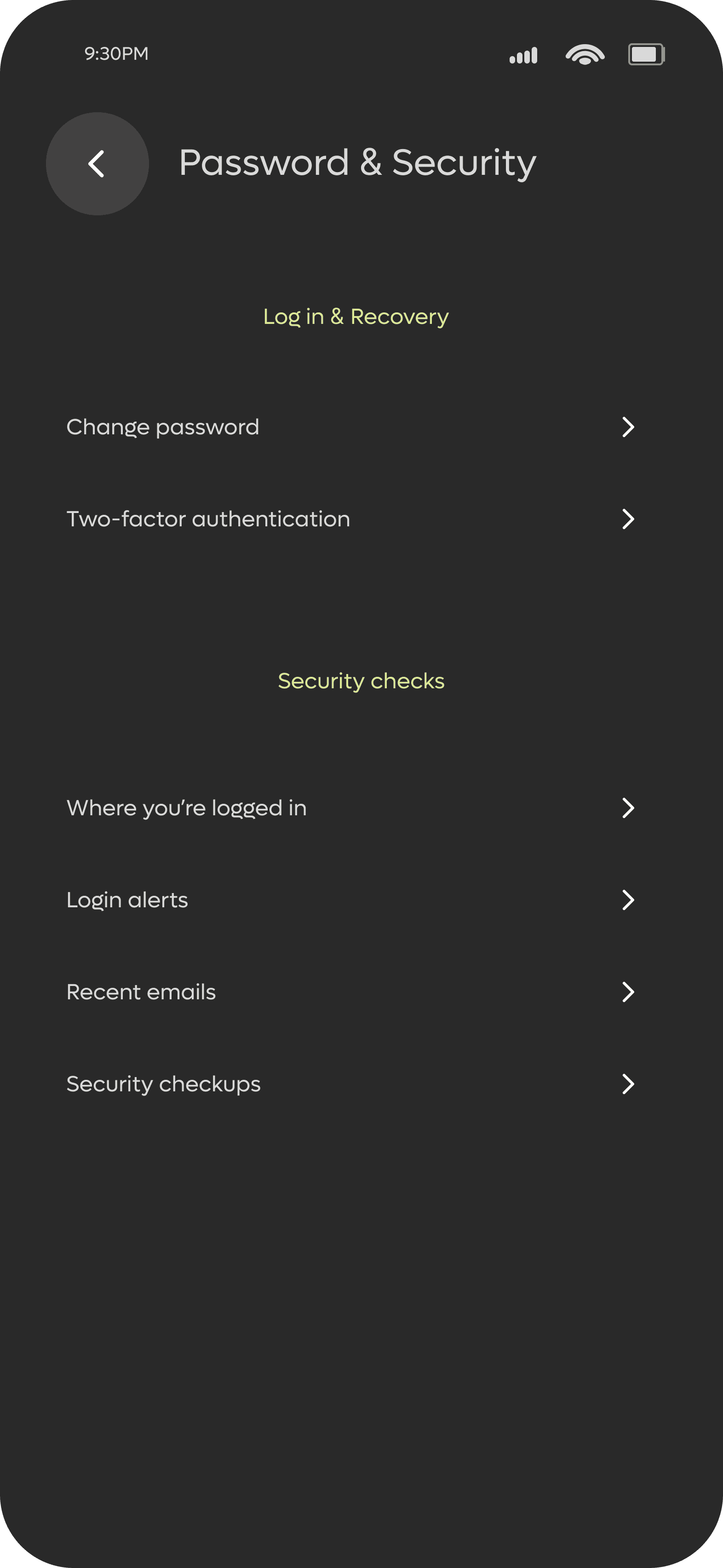

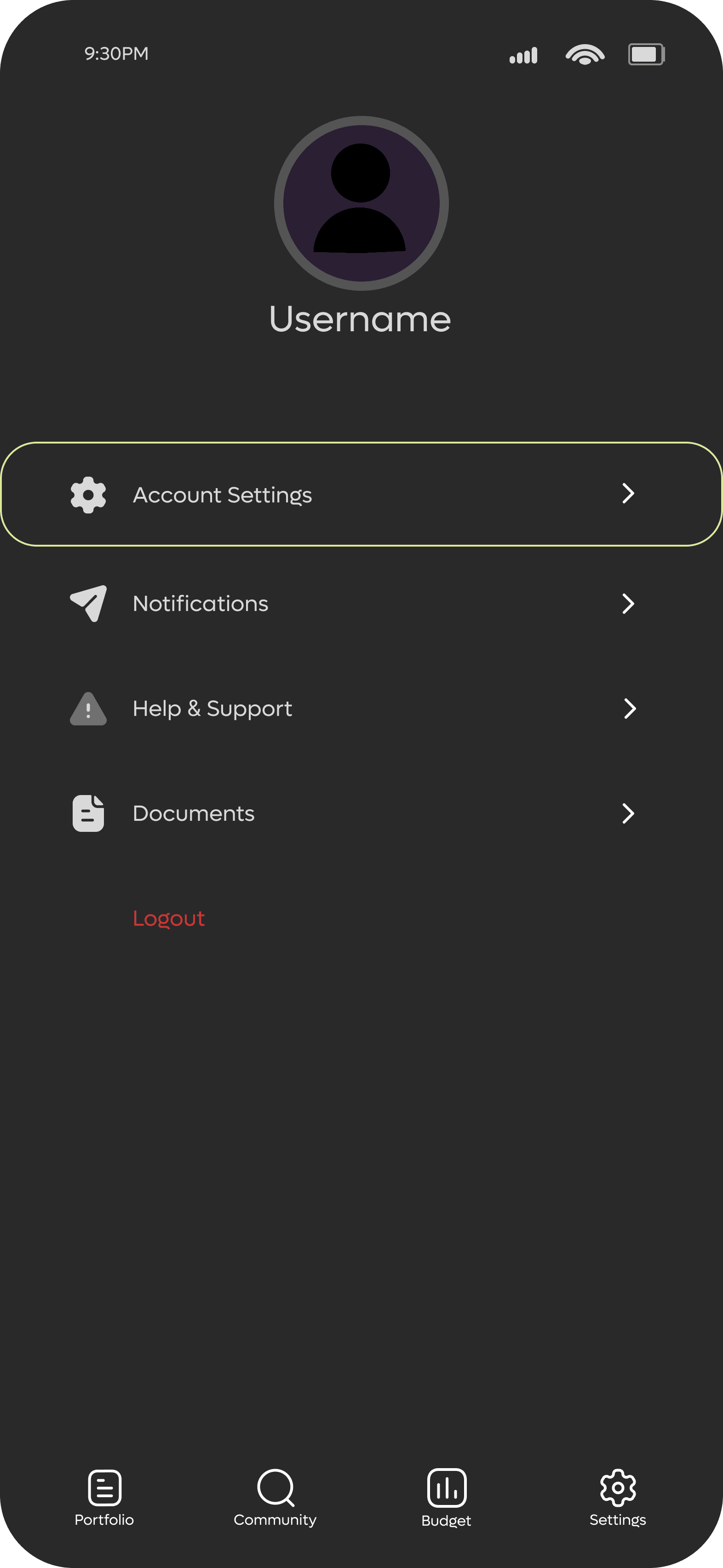

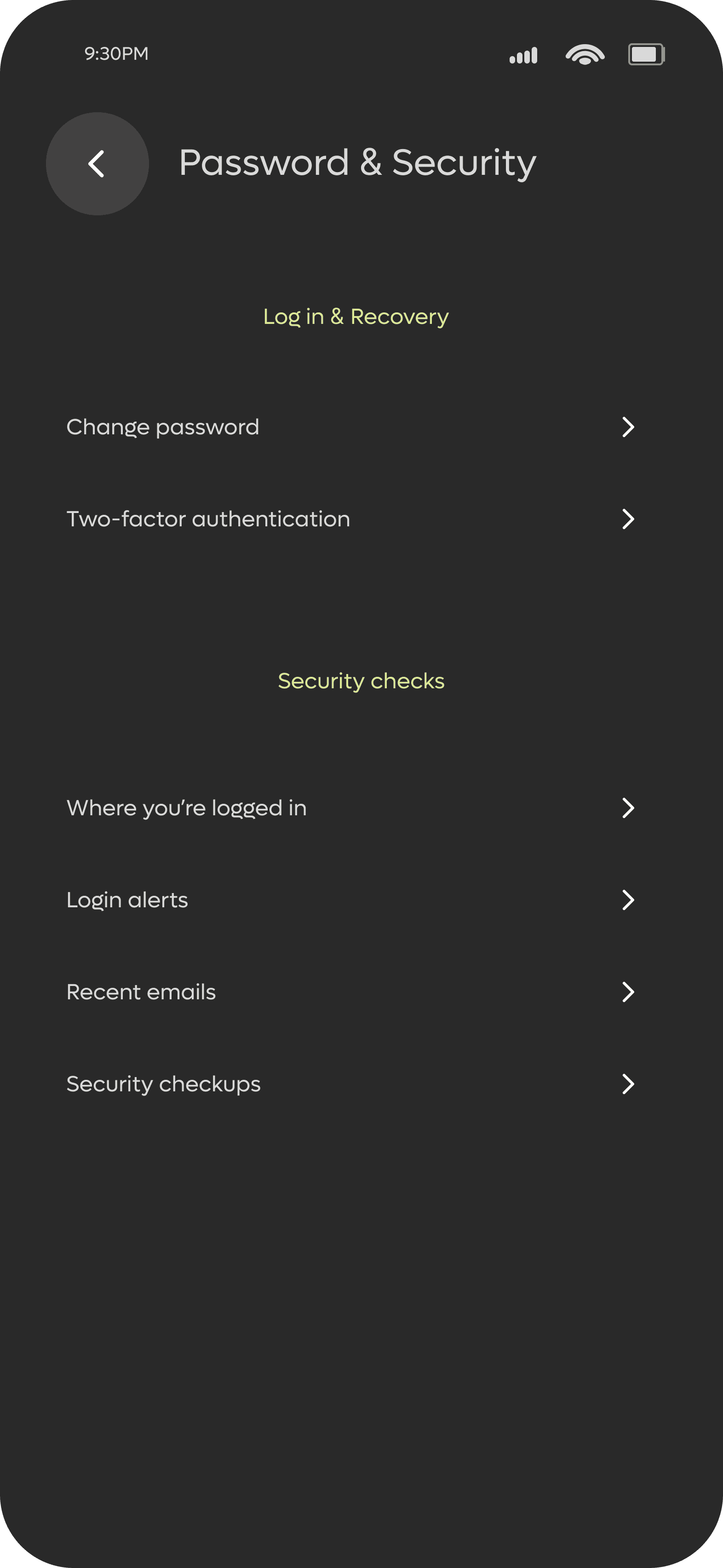

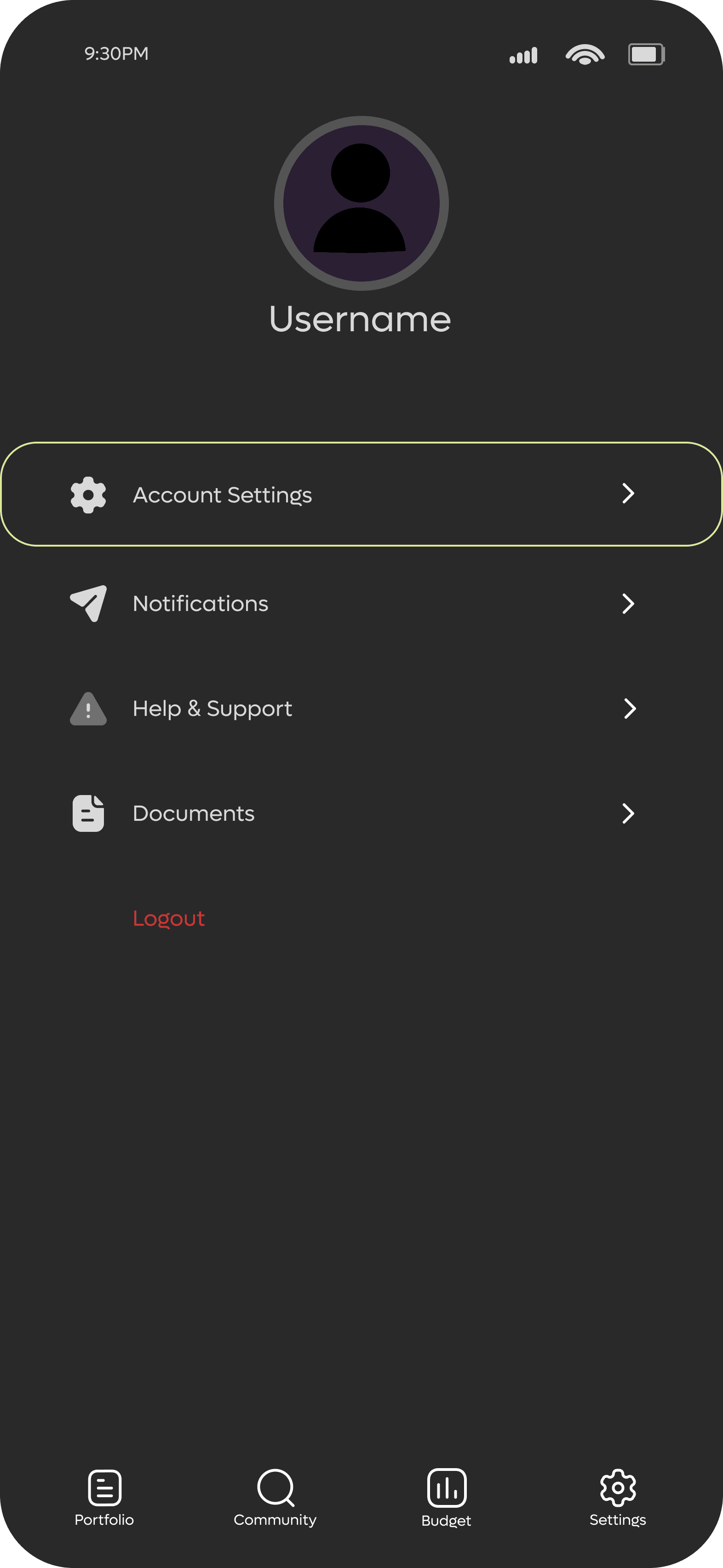

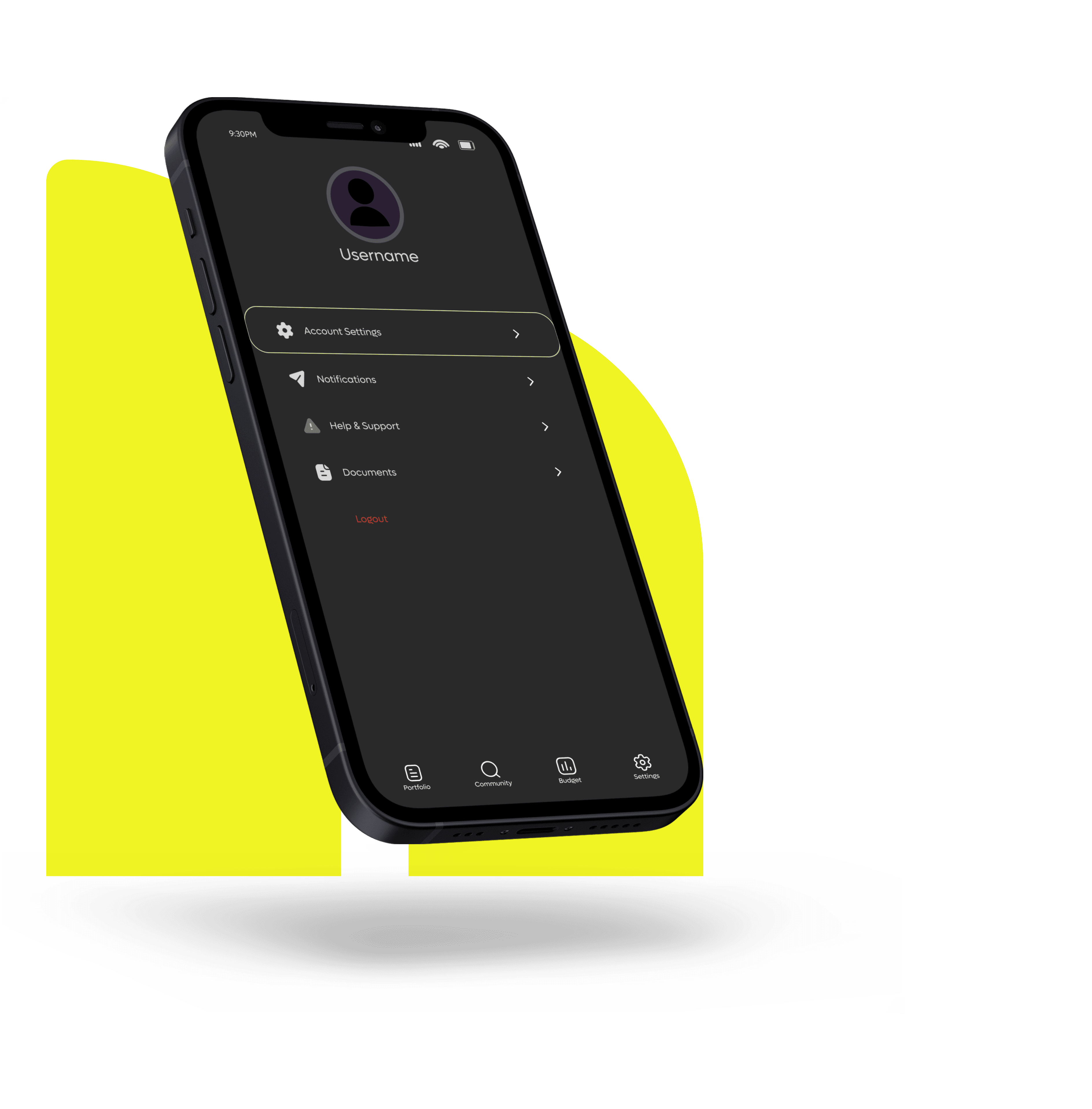

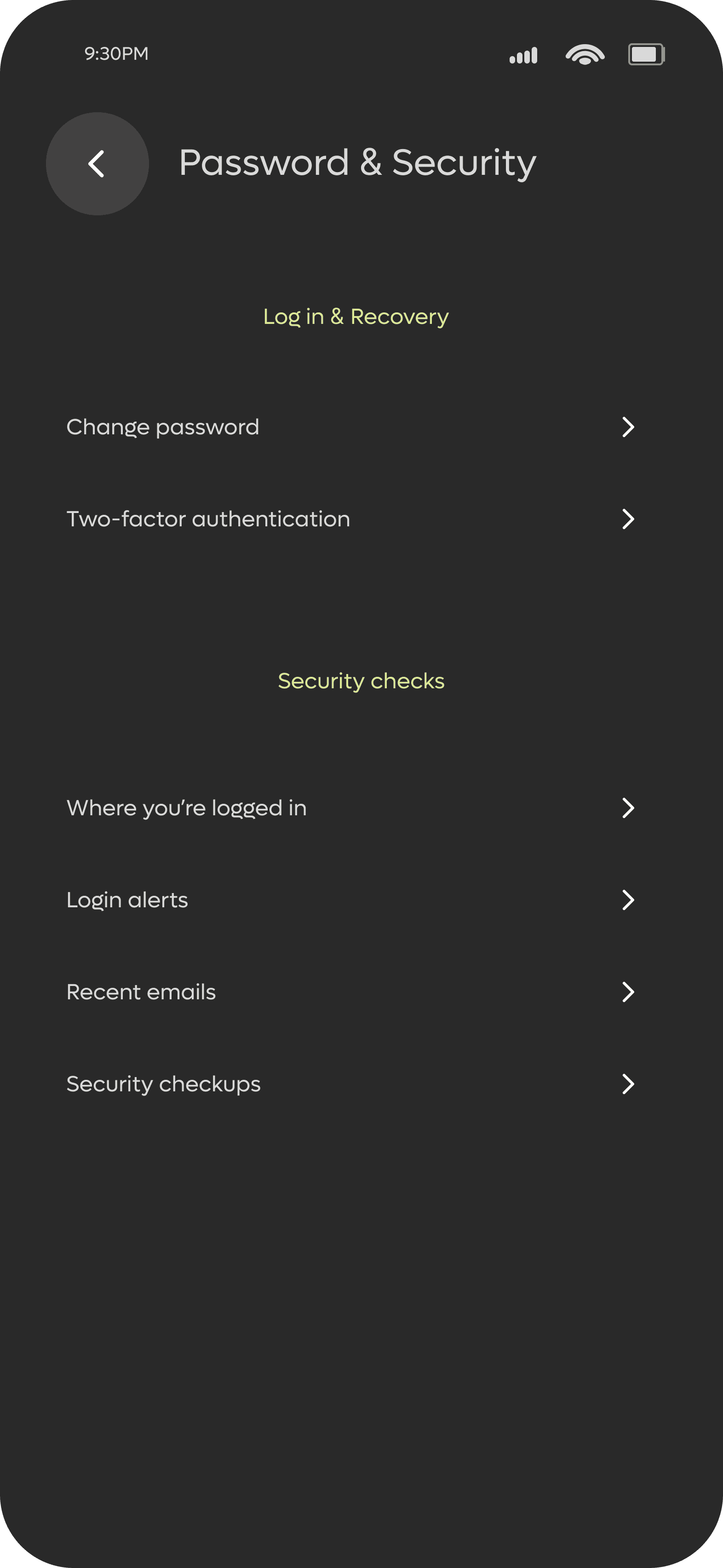

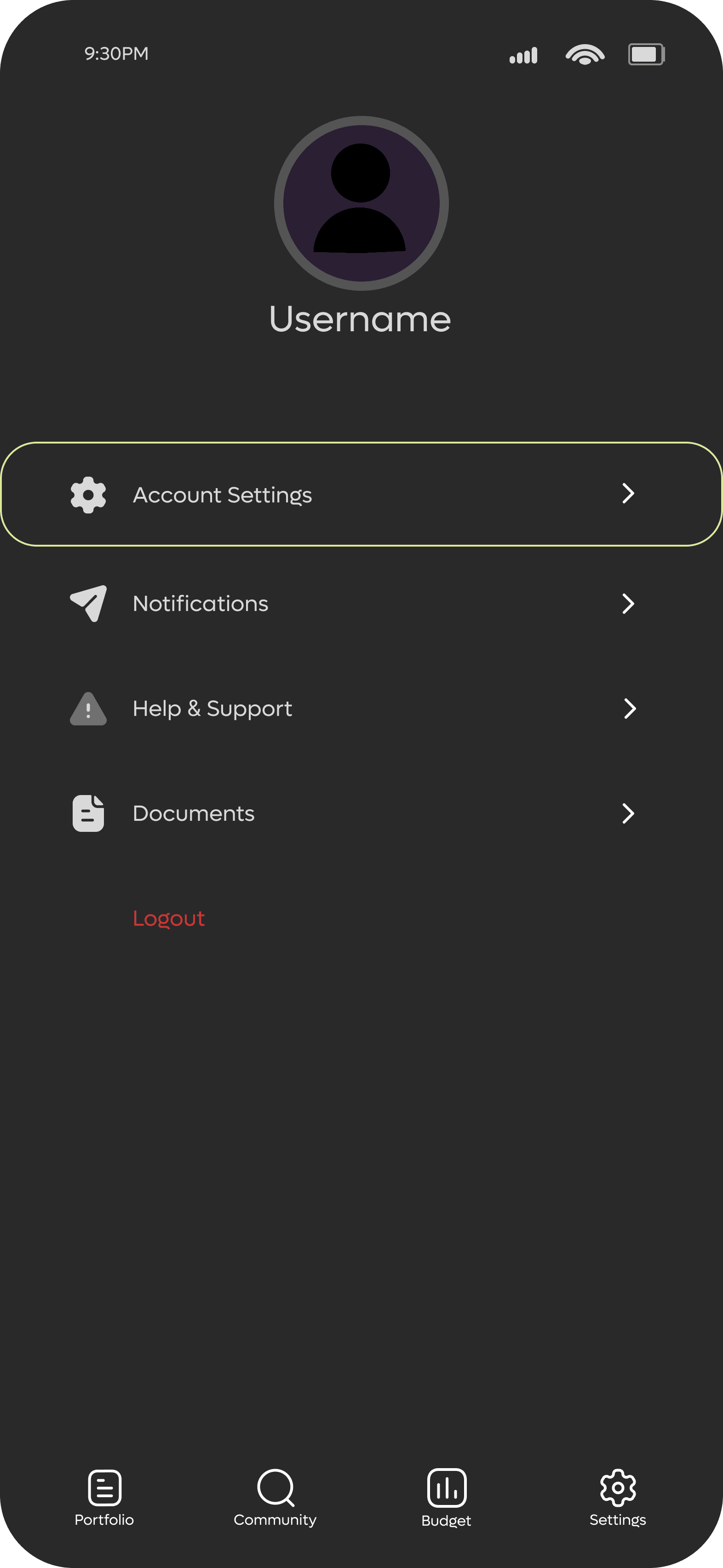

SETTINGS

FUTURE UPDATES

The user will be able to control their accounts settings in the profile section such as name account, documents that have been previously saved, their account notifications and costumer service for any issue the user might present.

User testing: The app will be tested within a group of users regularly to make sure features are kept up to date and iterations are made along the way to ensure a successful user experience.

1

Improvements to portfolio section: As it seems pretty complete at the stage of the project, there are still multiple factors to be taken into consideration for a thorough user experience.

2

Continuing improving the UI aspect of the project in order to provide a service that can be use effectively through different generations.

3

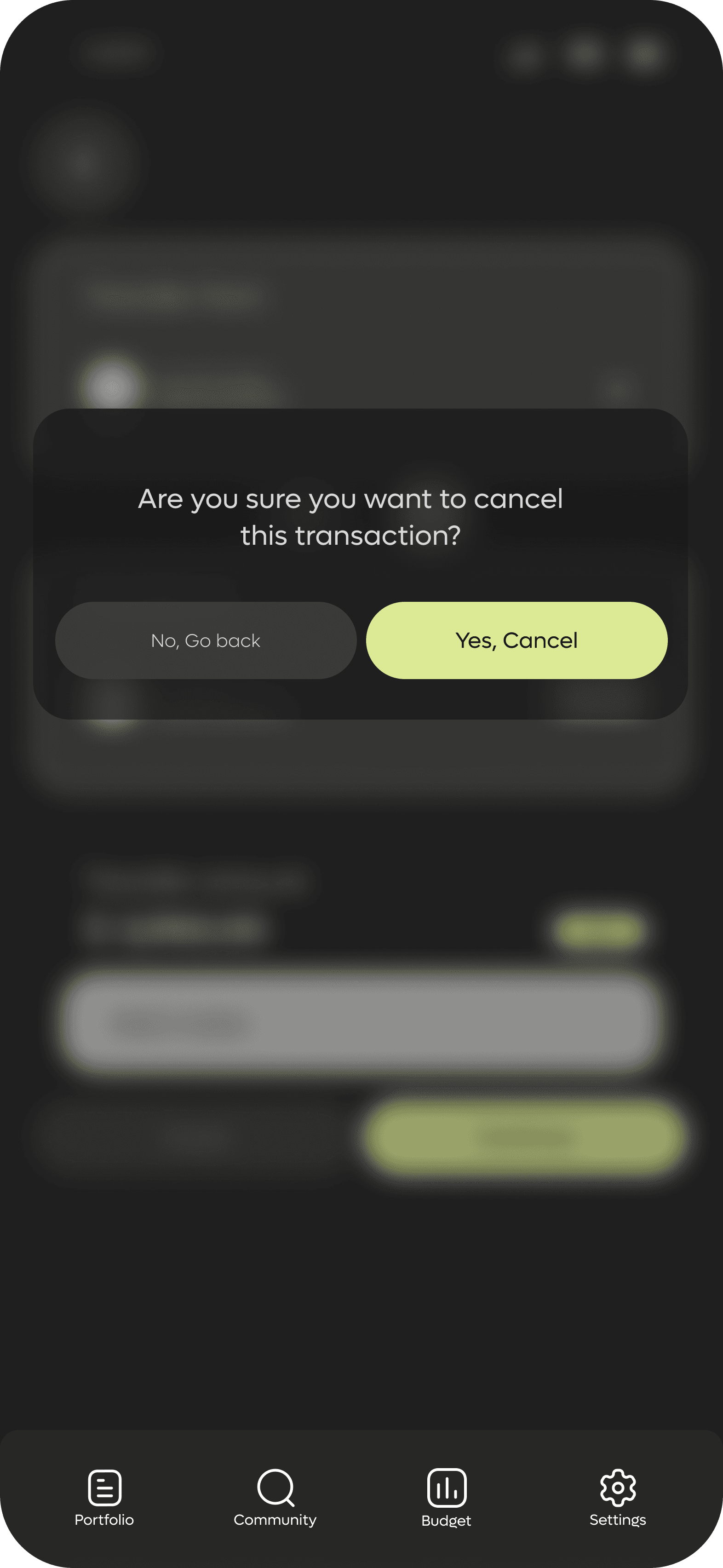

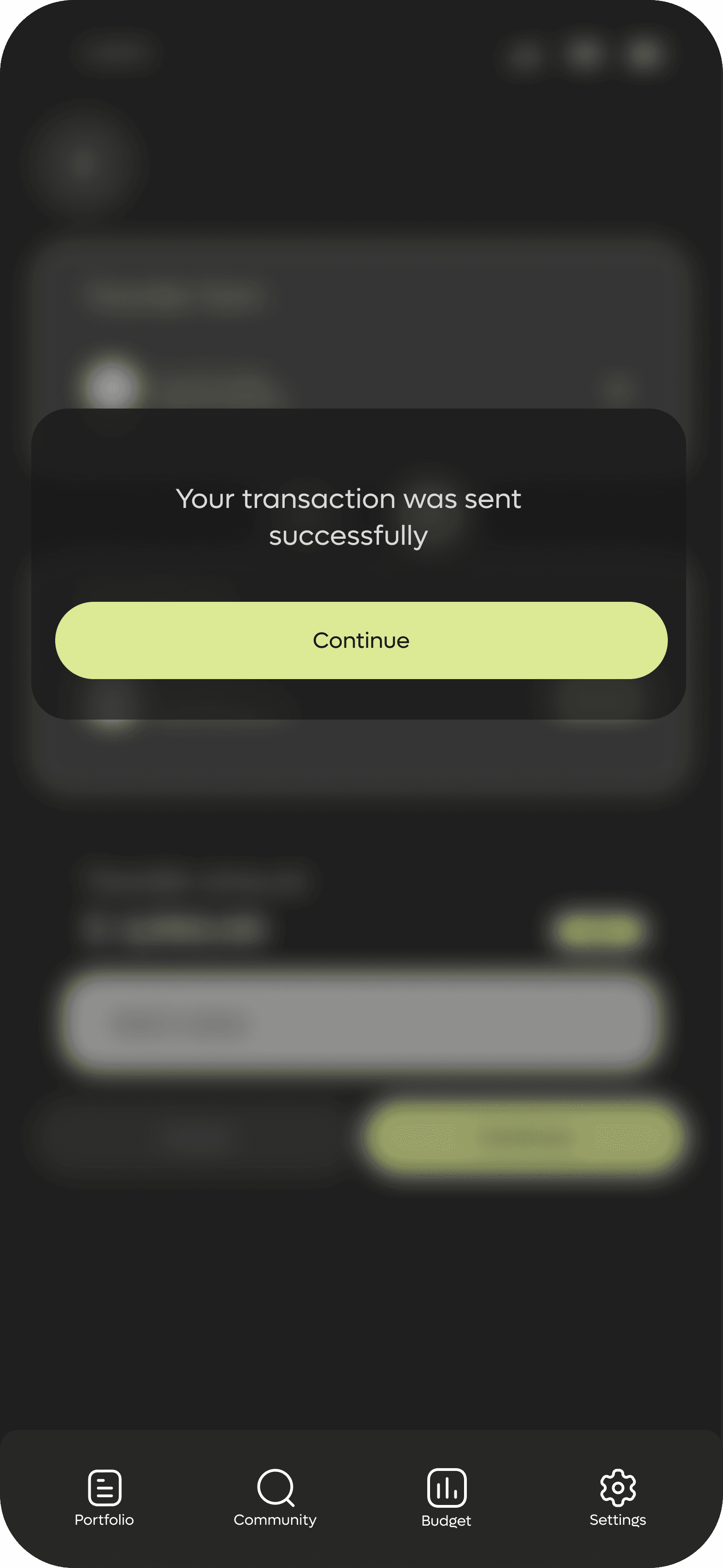

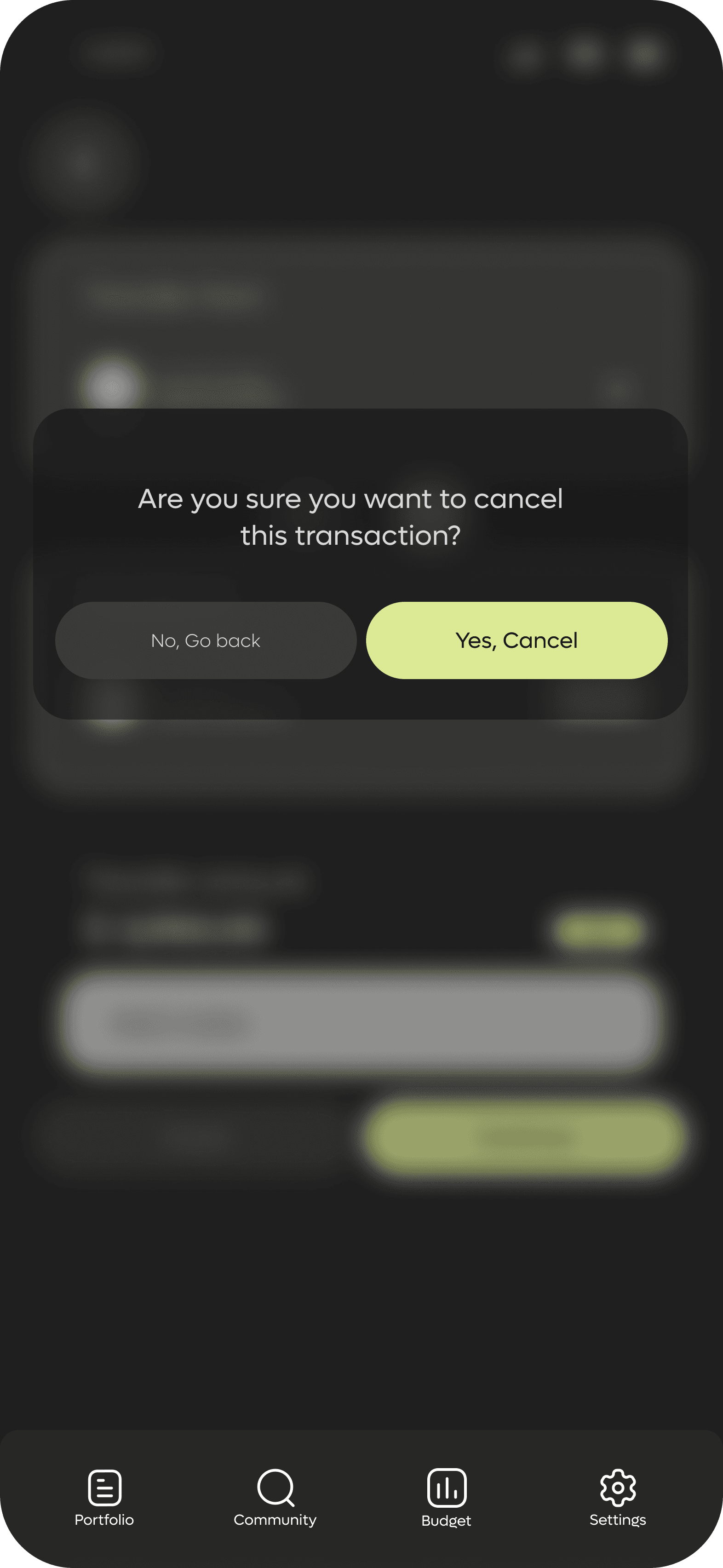

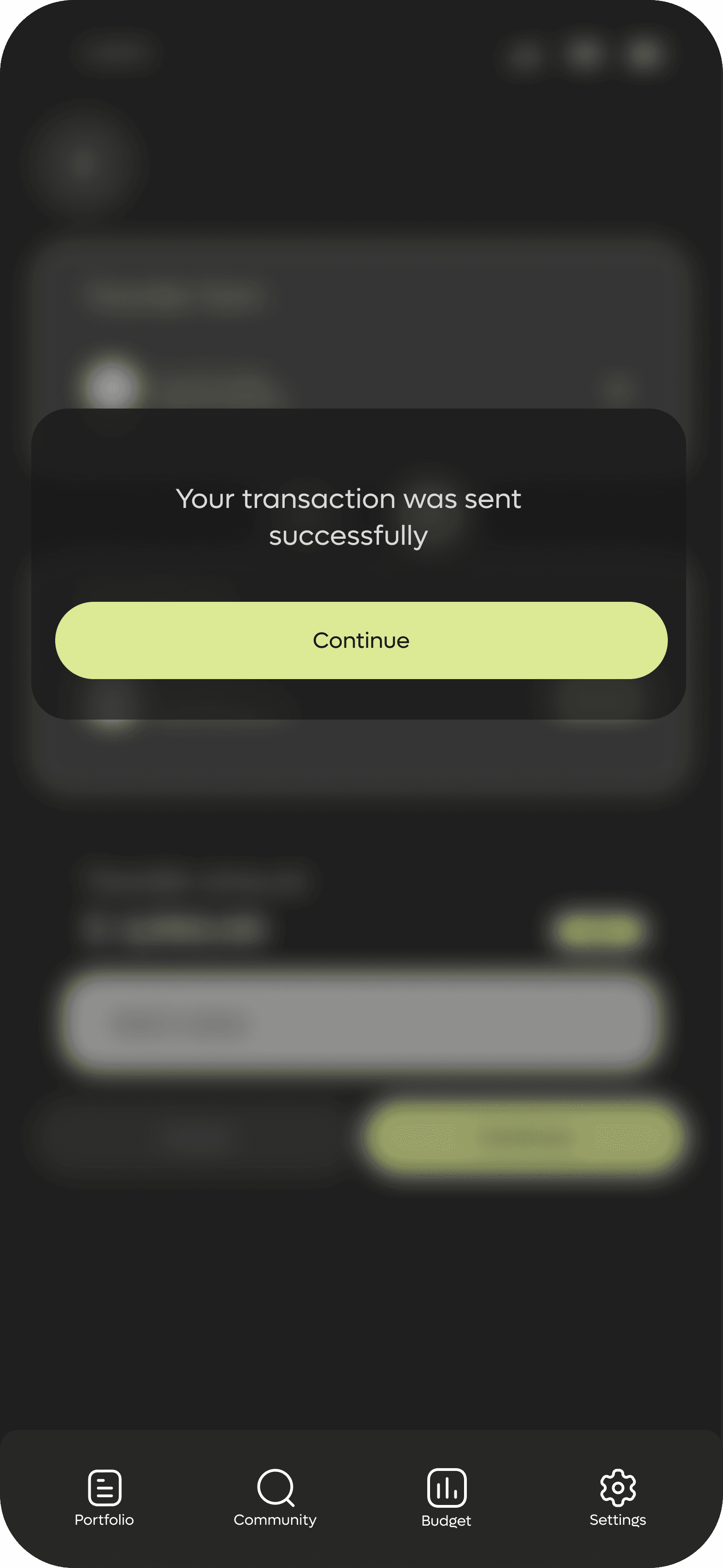

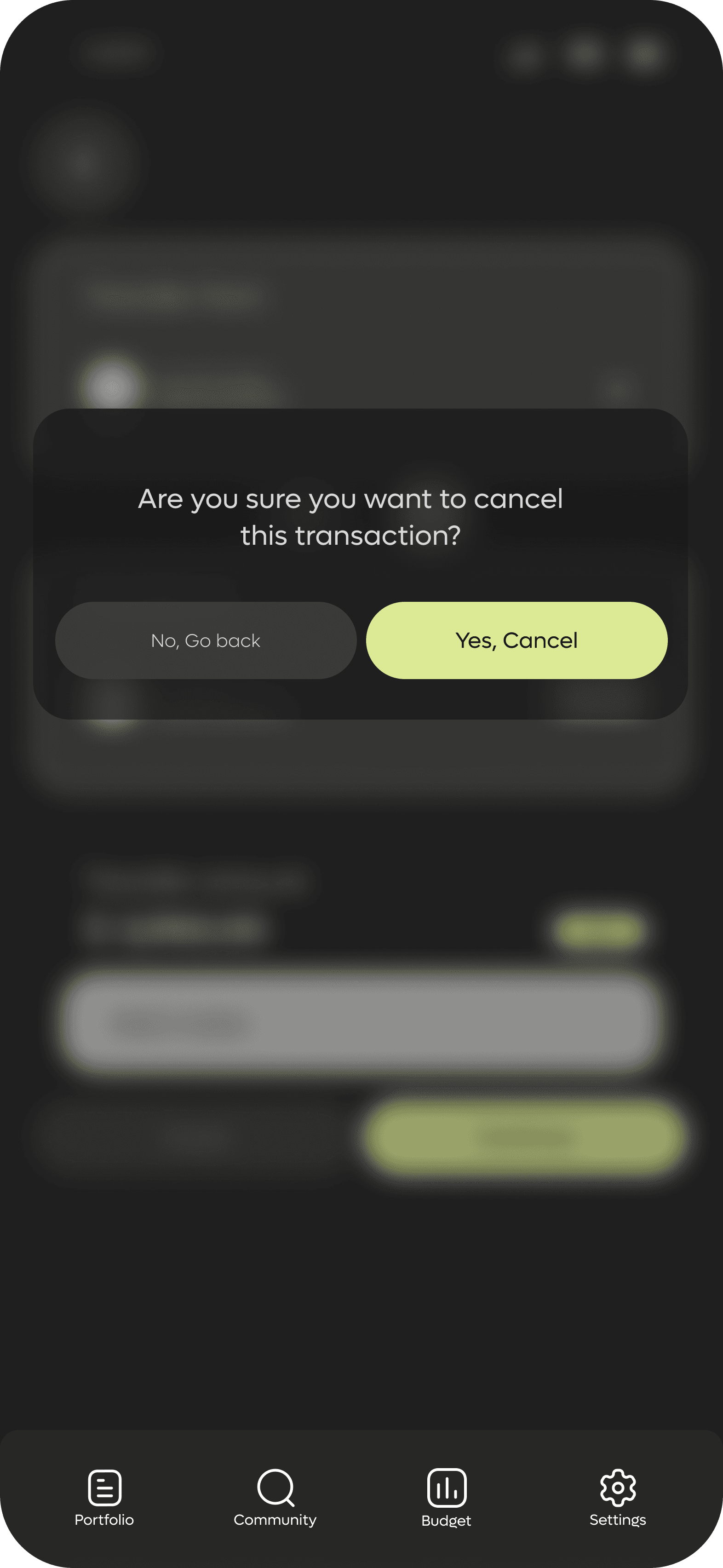

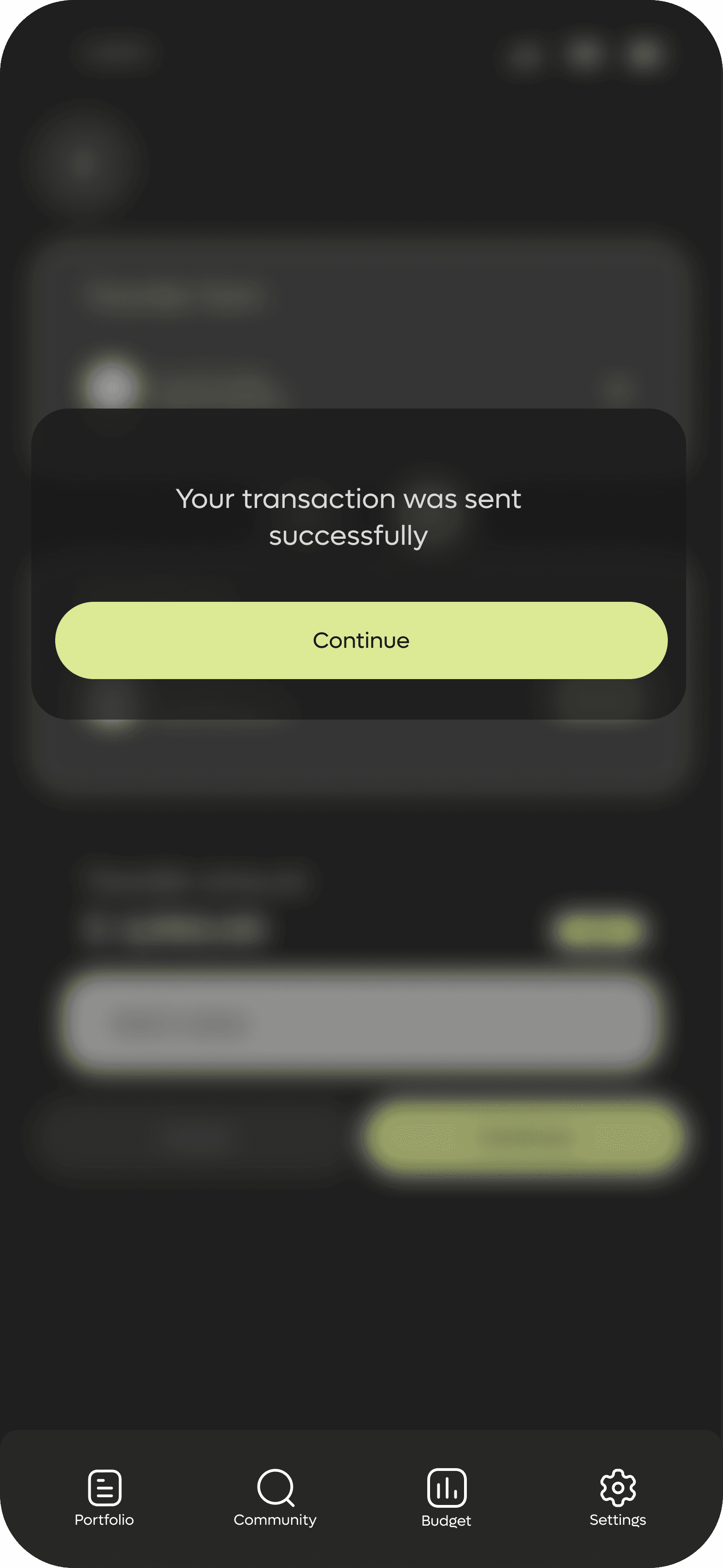

The app will show a message letting the user know if a transactions was successful as well as confirming whether the user wants to cancel a transaction or not.

WHAT WAS GATHERED FROM

THE RESEARCH

By incorporating these key insights into the development of the app, we can offer a unique and valuable platform that bridges the gap between digital assets and traditional banking, catering to the evolving needs of modern investors providing a seamless experience to the user on the go.

Provide detailed portfolio tracking and performance analysis tools similar to Sharesight, allowing users to monitor their investments across various asset classes easily.

Offer Comprehensive Portfolio Tracking

Integrate Banking Services

Ensure User-Friendly Interface

Bridge the gap between digital assets and traditional banking by offering banking services such as savings accounts, debit cards, and lending options within the app.

Design an intuitive and user-friendly interface that appeals to both novice and experienced investors. Make it easy for users to navigate between digital assets and traditional banking services seamlessly.

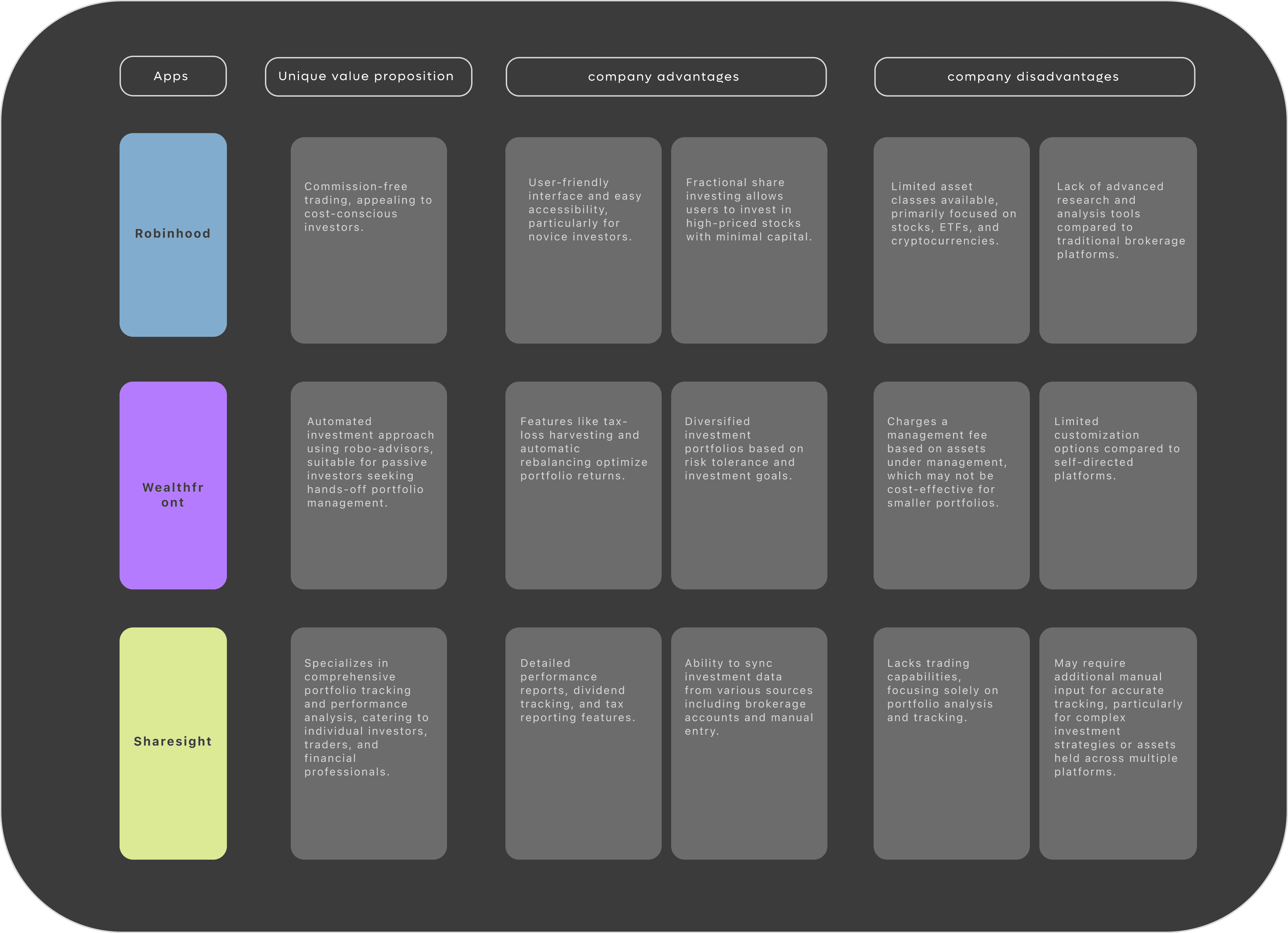

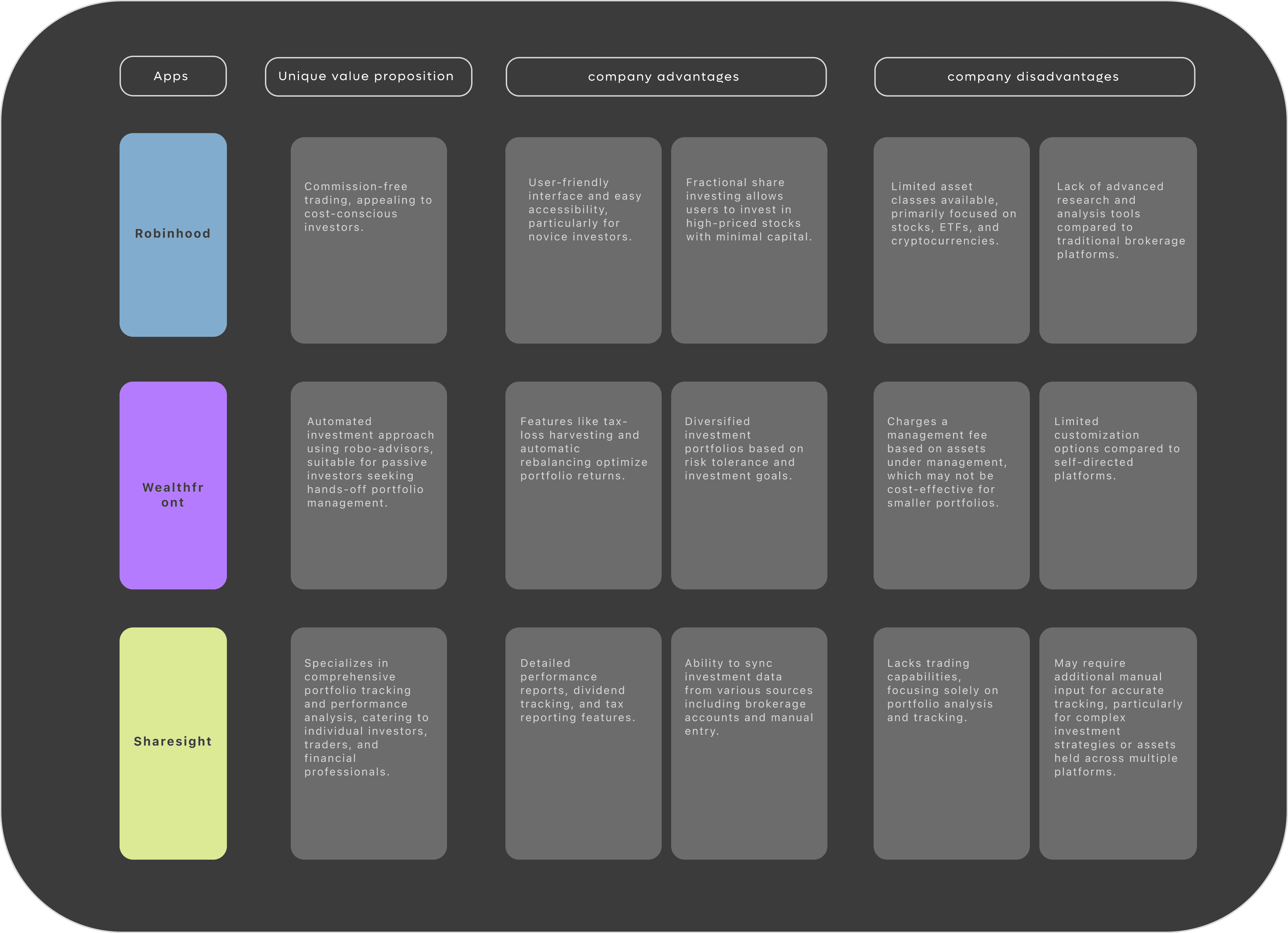

COMPETITOR ANALYSIS

COSTUMER JOURNEY MAPPING

USER PERSONA

Name: John Smith

Age: 40

Occupation: Marketing Manager

Financial Situation:

John has a stable job as a marketing manager at a mid-sized company, earning a comfortable salary.

He has been diligently saving for retirement and his children's education but wants to maximize the growth of his investments.

John has a diversified investment portfolio, including stocks, bonds, mutual funds, and some cryptocurrency holdings.

He owns a home with a mortgage and contributes regularly to his retirement accounts, such as a 401(k) and IRA.

Goals and Objectives:

John's primary financial goal is to build long-term wealth and achieve financial independence by retirement age.

He wants to optimize his investment portfolio to generate consistent returns while managing risk effectively.

John is also interested in exploring alternative investments, such as real estate or peer-to-peer lending, to diversify his portfolio further.

He aims to stay informed about market trends and economic developments to make informed investment decisions.

Challenges:

John finds it challenging to track and manage his diverse investment holdings across multiple accounts and platforms.

He wants to ensure that his investment strategy aligns with his risk tolerance, financial goals, and time horizon.

John is concerned about market volatility and wants to protect his portfolio from significant losses during market downturns.

Key Needs from the App:

A centralized platform where John can monitor and manage his entire investment portfolio in real-time.

Tools and resources to analyze portfolio performance, track progress towards financial goals, and identify investment opportunities.

Customization options to tailor his investment dashboard, alerts, and notifications based on his preferences and priorities.

Educational content and insights to help John stay informed about market trends, investment strategies, and financial planning best practices.

Will delve into the intricacies of this concept app, exploring its key features and functionalities designed to streamline asset management, enhance accessibility, and provide unparalleled convenience for users navigating the complexities of modern finance.

In the rapidly evolving landscape of finance, there exists a significant challenge for individuals seeking to manage their assets across both digital and traditional banking platforms. Despite the proliferation of digital assets and the continued reliance on traditional banking services, users face a fragmented and disjointed experience when attempting to navigate and manage their diverse portfolio of assets. This lack of integration between digital assets and traditional banking poses a barrier to efficient asset management, hindering users' ability to monitor, track, and optimize their financial holdings effectively.

Consequently, there is a clear need for the development of a financial app that seamlessly bridges the gap between digital assets and traditional banking, providing users with a unified platform to efficiently manage their diverse portfolio of assets across digital and bank platforms.

AXIS APP

AXIS APP

Will delve into the intricacies of this concept app, exploring its key features and functionalities designed to streamline asset management, enhance accessibility, and provide unparalleled convenience for users navigating the complexities of modern finance.

In the rapidly evolving landscape of finance, there exists a significant challenge for individuals seeking to manage their assets across both digital and traditional banking platforms. Despite the proliferation of digital assets and the continued reliance on traditional banking services, users face a fragmented and disjointed experience when attempting to navigate and manage their diverse portfolio of assets. This lack of integration between digital assets and traditional banking poses a barrier to efficient asset management, hindering users' ability to monitor, track, and optimize their financial holdings effectively.

Consequently, there is a clear need for the development of a financial app that seamlessly bridges the gap between digital assets and traditional banking, providing users with a unified platform to efficiently manage their diverse portfolio of assets across digital and bank platforms.

About Project

This platform aims to empower and facilitates users to efficiently manage their diverse portfolio of assets across digital and bank platforms, providing them with a seamless and comprehensive financial management experience.

Problem

In today's ever-evolving world of finance, where digital assets and traditional banking coexist, there's a growing need for a seamless solution that bridges the gap between these two realms.

Solution

To address the challenge of efficiently managing diverse assets across digital and traditional banking platforms, the development of a Unified Asset Management Platform was proposed. This solution integrates digital assets and traditional banking services into a single, user-friendly app, empowering users to streamline their financial management processes effectively.

PROJECT PROCESS

The best approach to tackling the issue of bridging the gap between digital assets and traditional banking involves a combination of strategic planning, innovative technology solutions, and user-centric design.

To better understand our users, we completed a competitive analysis, surveys, white paper research and analyzed the results later.

USER RESEARCH

Name: John Smith

Age: 40

Occupation: Marketing Manager

Financial Situation:

John has a stable job as a marketing manager at a mid-sized company, earning a comfortable salary.

He has been diligently saving for retirement and his children's education but wants to maximize the growth of his investments.

John has a diversified investment portfolio, including stocks, bonds, mutual funds, and some cryptocurrency holdings.

He owns a home with a mortgage and contributes regularly to his retirement accounts, such as a 401(k) and IRA.

Goals and Objectives:

John's primary financial goal is to build long-term wealth and achieve financial independence by retirement age.

He wants to optimize his investment portfolio to generate consistent returns while managing risk effectively.

John is also interested in exploring alternative investments, such as real estate or peer-to-peer lending, to diversify his portfolio further.

He aims to stay informed about market trends and economic developments to make informed investment decisions.

Challenges:

John finds it challenging to track and manage his diverse investment holdings across multiple accounts and platforms.

He wants to ensure that his investment strategy aligns with his risk tolerance, financial goals, and time horizon.

John is concerned about market volatility and wants to protect his portfolio from significant losses during market downturns.

Key Needs from the App:

A centralized platform where John can monitor and manage his entire investment portfolio in real-time.

Tools and resources to analyze portfolio performance, track progress towards financial goals, and identify investment opportunities.

Customization options to tailor his investment dashboard, alerts, and notifications based on his preferences and priorities.

Educational content and insights to help John stay informed about market trends, investment strategies, and financial planning best practices.

USER PERSONA

COSTUMER JOURNEY MAPPING

COMPETITOR ANALYSIS

WHAT WAS GATHERED FROM THE RESEARCH

By incorporating these key insights into the development of the app, we can offer a unique and valuable platform that bridges the gap between digital assets and traditional banking, catering to the evolving needs of modern investors providing a seamless experience to the user on the go.

SITE MAP

WIREFRAMES

First set of wireframes were created with a vague idea in mind of how all the information could be distributed. The app design went through multiple iterations even after hi-fi designs were made and is still going through changes as new features and feedback are taken into consideration.

Homepage: Initially the idea of having a homepage as a first stop for the user seemed right as in this section tips, news and other features would keep the user up to date about the financial world. Eventually this section was discarded as the same content could be located in the community section as well as in the budget section. it was in the best interest to keep the app simple regarding functionality and information to avoid overwhelming the user with redundant information.

Portfolio: The app will provide the portfolio section with multiple options within to be able to keep track of important information about the users asset such as filters that would help with organization, graphs for visual representation, share checker to evaluate market conditions and options to keep adding holdings or assets to the portfolio.

Community: It was ideal to keep in the design a way to maintain the user informed of the market conditions, people’s insights and at the same time providing a place for the user to invest in digital assets. The community provides exactly this, using similar designs of other social networks to keep the familiarity around usability of this new concept app.

Wallet: This is were both traditional banking and digital assets would converge. The user would be able to manage their multiple accounts from this one place. it would provide a summary of the users financial history and provide custom insights and tips on how to advance in future decisions.

Share Checker: at this stage the idea of incorporating a share checker where the user would be able to get some market insights on specific stocks during a specific period of time was a must. This would provide clarity in the decision making process of the user.

Homepage

Portfolio

Community

Wallet

Share Checker

Share Checker

TYPOGRAPHY

LUFGA

Font 1

SF PRO TEXT

Font 2

Header 1

Size: 20px wight: regular

Header 2

Size: 15px weight: regular

Header 3

Size: 12px weight: regular

Header 4

Size: 12px weight: regular

Header 5

Size: 10px weight: regular

Paragraph

Size: 10px weight: regular

Header 1

Size: 20px wight: regular

Header 2

Size: 15px weight: regular

Header 3

Size: 12px weight: regular

Header 4

Size: 12px weight: regular

Header 5

Size: 10px weight: regular

Paragraph

Size: 10px weight: regular

COLORS

#F0F424

Primary Green

#DCE995

Primary Washed Green

#B57BFF

Accent purple

#D9D9D9

Light Grey

#4B4949

Washed Grey

#292929

Dark Grey

UI KIT

ONBOARDING

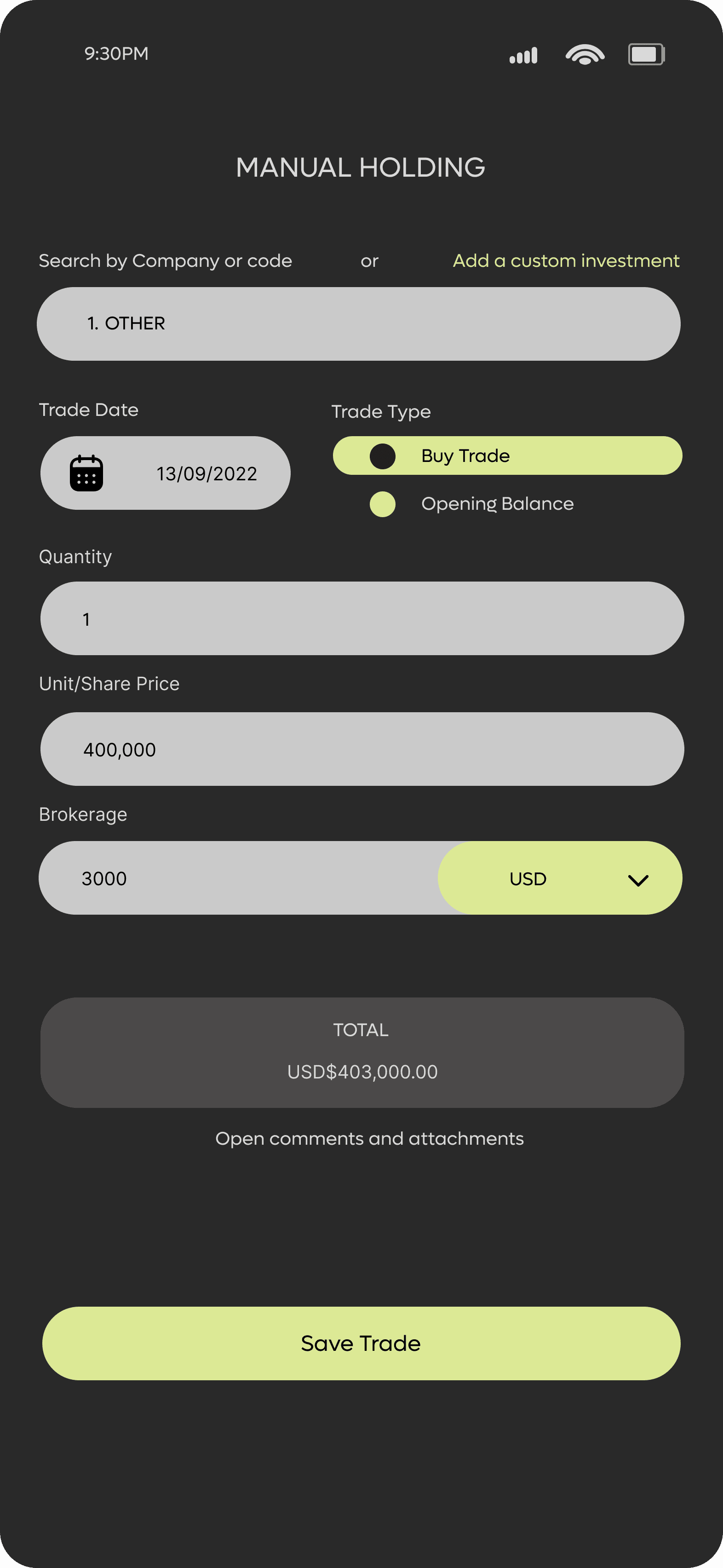

In the case of a new user, once they signed in they will be immediately prompted to create a portfolio, after placing general information such as name of portfolio, country, etc. the user will start uploading the corresponded information of their investments. In this case the user will have 3 options to facilitate the process by manually adding trades, importing from a broker or by uploading a file such as an excel document where all the information was previously located.

PORTFOLIO

At this stage multiple iterations were performed to the design.The portfolio section would be the first page the user is prompted to after signing in. Here the user will be able to keep track of their assets as it shows the current value and as well as the assets trajectory by using the filters for better organization and management.

The share checker page was eliminated and introduced into the portfolio page as an option for the user to consult if curiosity arises regarding performance of a specific hypothetical investment. This would help the user make informed decisions when adding future investments to their portfolio.

DISCOVER/ COMMUNITY

In the community page the user will be able to connect with like-minded people and stay informed on the events within the financial world. The user will be able to follow other accounts, post and check recent searches.

In the community section the user also has the opportunity to invest in digital assets as the market section was integrated for better accessibility performance.

BUDGET & WALLET

SETTINGS

FUTURE UPDATES

The budget section was created with the objective in mind to provide the user with a summary and overview of all assets performance for a quick assessment of any progress or simply to stay updated with any improvements. Using the history information from the portfolio tips and suggestions on next steps will be provided to the user.

Providing at the same time easy access to the wallet which will be located on a separate button that will be available throughout all the sections of the app.

The wallet option essentially will connect your regular banking services with your digital services. Here user’s crypto wallet and banking accounts can be found in the same place. The design allows a seamless navigation between one account to another while also providing accessible account management.

The app will show a message letting the user know if a transactions was successful as well as confirming whether the user wants to cancel a transaction or not.

The user will be able to control their accounts settings in the profile section such as name account, documents that have been previously saved, their account notifications and costumer service for any issue the user might present.

Thank you for scrolling along!

User testing: The app will be tested within a group of users regularly to make sure features are kept up to date and iterations are made along the way to ensure a successful user experience.

1

Improvements to portfolio section: As it seems pretty complete at the stage of the project, there are still multiple factors to be taken into consideration for a thorough user experience.

2

Continuing improving the UI aspect of the project in order to provide a service that can be use effectively through different generations.

3

BUDGET & WALLET

The budget section was created with the objective in mind to provide the user with a summary and overview of all assets performance for a quick assessment of any progress or simply to stay updated with any improvements. Using the history information from the portfolio tips and suggestions on next steps will be provided to the user.

Providing at the same time easy access to the wallet which will be located on a separate button that will be available throughout all the sections of the app.

The wallet option essentially will connect your regular banking services with your digital services. Here user’s crypto wallet and banking accounts can be found in the same place. The design allows a seamless navigation between one account to another while also providing accessible account management.

SETTINGS

The user will be able to control their accounts settings in the profile section such as name account, documents that have been previously saved, their account notifications and costumer service for any issue the user might present.

FUTURE UPDATES

User testing: The app will be tested within a group of users regularly to make sure features are kept up to date and iterations are made along the way to ensure a successful user experience.

1

Improvements to portfolio section: As it seems pretty complete at the stage of the project, there are still multiple factors to be taken into consideration for a thorough user experience.

2

Continuing improving the UI aspect of the project in order to provide a service that can be use effectively through different generations.

3

The app will show a message letting the user know if a transactions was successful as well as confirming whether the user wants to cancel a transaction or not.

Thank you for scrolling along!

AXIS APP

PORTFOLIO

ONBOARDING

In the case of a new user, once they signed in they will be immediately prompted to create a portfolio, after placing general information such as name of portfolio, country, etc. the user will start uploading the corresponded information of their investments. In this case the user will have 3 options to facilitate the process by manually adding trades, importing from a broker or by uploading a file such as an excel document where all the information was previously located.

At this stage multiple iterations were performed to the design.The portfolio section would be the first page the user is prompted to after signing in. Here the user will be able to keep track of their assets as it shows the current value and as well as the assets trajectory by using the filters for better organization and management.

In the community page the user will be able to connect with like-minded people and stay informed on the events within the financial world. The user will be able to follow other accounts, post and check recent searches.

In the community section the user also has the opportunity to invest in digital assets as the market section was integrated for better accessibility performance.

DISCOVER/ COMMUNITY

The share checker page was eliminated and introduced into the portfolio page as an option for the user to consult if curiosity arises regarding performance of a specific hypothetical investment. This would help the user make informed decisions when adding future investments to their portfolio.

Upload a file

Upload a CSV of trades or opening balances

Manually add trades

Add trades or opening balances

Import from your broker

Select from our list of supported services

TYPOGRAPHY

COLORS

UI KIT

#F0F424

Primary Green

#DCE995

Primary Washed Green

#B57BFF

Accent purple

#D9D9D9

Light Grey

#4B4949

Washed Grey

#292929

Dark Grey

LUFGA

Font 1

SF PRO TEXT

Font 2

Header 1

Size: 20px wight: regular

Header 2

Size: 15px weight: regular

Header 3

Size: 12px weight: regular

Header 4

Size: 12px weight: regular

Header 5

Size: 10px weight: regular

Paragraph

Size: 10px weight: regular

Header 1

Size: 20px wight: regular

Header 2

Size: 15px weight: regular

Header 3

Size: 12px weight: regular

Header 4

Size: 12px weight: regular

Header 5

Size: 10px weight: regular

Paragraph

Size: 10px weight: regular

WIREFRAMES

First set of wireframes were created with a vague idea in mind of how all the information could be distributed. The app design went through multiple iterations even after hi-fi designs were made and is still going through changes as new features and feedback are taken into consideration.

Homepage: Initially the idea of having a homepage as a first stop for the user seemed right as in this section tips, news and other features would keep the user up to date about the financial world. Eventually this section was discarded as the same content could be located in the community section as well as in the budget section. it was in the best interest to keep the app simple regarding functionality and information to avoid overwhelming the user with redundant information.

Portfolio: The app will provide the portfolio section with multiple options within to be able to keep track of important information about the users asset such as filters that would help with organization, graphs for visual representation, share checker to evaluate market conditions and options to keep adding holdings or assets to the portfolio.

Community: It was ideal to keep in the design a way to maintain the user informed of the market conditions, people’s insights and at the same time providing a place for the user to invest in digital assets. The community provides exactly this, using similar designs of other social networks to keep the familiarity around usability of this new concept app.

Wallet: This is were both traditional banking and digital assets would converge. The user would be able to manage their multiple accounts from this one place. it would provide a summary of the users financial history and provide custom insights and tips on how to advance in future decisions.

Share Checker: at this stage the idea of incorporating a share checker where the user would be able to get some market insights on specific stocks during a specific period of time was a must. This would provide clarity in the decision making process of the user.

Homepage

Portfolio

Community

Wallet

Share Checker

Share Checker

SITE MAP

WHAT WAS GATHERED FROM THE RESEARCH

Provide detailed portfolio tracking and performance analysis tools similar to Sharesight, allowing users to monitor their investments across various asset classes easily.

Offer Comprehensive Portfolio Tracking

Integrate Banking Services

Ensure User-Friendly Interface

Bridge the gap between digital assets and traditional banking by offering banking services such as savings accounts, debit cards, and lending options within the app.

Design an intuitive and user-friendly interface that appeals to both novice and experienced investors. Make it easy for users to navigate between digital assets and traditional banking services seamlessly.

By incorporating these key insights into the development of the app, we can offer a unique and valuable platform that bridges the gap between digital assets and traditional banking, catering to the evolving needs of modern investors providing a seamless experience to the user on the go.

COMPETITOR ANALYSIS

Apps

Robinhood

Commission-free trading, appealing to cost-conscious investors.

Fractional share investing allows users to invest in high-priced stocks with minimal capital.

Unique value proposition

company advantages

company disadvantages

Wealthfront

Sharesight

User-friendly interface and easy accessibility, particularly for novice investors.

Features like tax-loss harvesting and automatic rebalancing optimize portfolio returns.

Diversified investment portfolios based on risk tolerance and investment goals.

Limited asset classes available, primarily focused on stocks, ETFs, and cryptocurrencies.

Lack of advanced research and analysis tools compared to traditional brokerage platforms.

Charges a management fee based on assets under management, which may not be cost-effective for smaller portfolios.

Limited customization options compared to self-directed platforms.

Automated investment approach using robo-advisors, suitable for passive investors seeking hands-off portfolio management.

Detailed performance reports, dividend tracking, and tax reporting features.

Ability to sync investment data from various sources including brokerage accounts and manual entry.

Lacks trading capabilities, focusing solely on portfolio analysis and tracking.

May require additional manual input for accurate tracking, particularly for complex investment strategies or assets held across multiple platforms.

Specializes in comprehensive portfolio tracking and performance analysis, catering to individual investors, traders, and financial professionals.

Apps

Robinhood

Commission-free trading, appealing to cost-conscious investors.

Fractional share investing allows users to invest in high-priced stocks with minimal capital.

Unique value proposition

company advantages

company disadvantages

Wealthfront

Sharesight

User-friendly interface and easy accessibility, particularly for novice investors.

Features like tax-loss harvesting and automatic rebalancing optimize portfolio returns.

Diversified investment portfolios based on risk tolerance and investment goals.

Limited asset classes available, primarily focused on stocks, ETFs, and cryptocurrencies.

Lack of advanced research and analysis tools compared to traditional brokerage platforms.

Charges a management fee based on assets under management, which may not be cost-effective for smaller portfolios.

Limited customization options compared to self-directed platforms.

Automated investment approach using robo-advisors, suitable for passive investors seeking hands-off portfolio management.

Detailed performance reports, dividend tracking, and tax reporting features.

Ability to sync investment data from various sources including brokerage accounts and manual entry.

Lacks trading capabilities, focusing solely on portfolio analysis and tracking.

May require additional manual input for accurate tracking, particularly for complex investment strategies or assets held across multiple platforms.

Specializes in comprehensive portfolio tracking and performance analysis, catering to individual investors, traders, and financial professionals.

COSTUMER JOURNEY MAPPING

‘’I want to manage my investments without moving from app to app’’

Managing digital assets across multiple platforms increases the risk of security breaches and potential loss of funds, especially if users need to input sensitive information repeatedly.

Can be done manually or by importing information from different sources

It will prompt the user to create a portfolio

Awareness

Adding portfolio

.

User wants to find an app that can allow them to manage all their investments in just one place

‘’It saves me time if I import my information from my broker’’

‘’Having detailed information is important for managing’’

‘’its very easy so far and for a mobile app is very efficient’’

Enter description and overall information of the portfolio that will be created

Click on ‘’create portfolio button’’

Axis App

Axis App

Axis App

The absence of seamless integration between traditional banking and digital asset management may lead to frustration and inconvenience for users who value a unified financial experience.

Create an app that offers multiple services in one place to avoid security breaches and better supervision of assets.

Provide ways to simplify information transfer to the app.

Provide as much as information about assets and easy ways to manage it.

Tedious process to fill out information.

Thinking

Feelings

Painpoints

Opportunities

Stages

Point

of contact

Action

of

the user

An app that is visually appealing an easy to navigate.

Information overload regarding UI.

Axis App

Opens the app and log in

‘’I hope the app is not confusing and its efficient for managing’’

App store

Search the app store for an app that fits user needs

‘’Which app can offer digital and banking assets management?’’

Difficulty finding an app that offers complete services.

Search for the Application, Install

Will delve into the intricacies of this concept app, exploring its key features and functionalities designed to streamline asset management, enhance accessibility, and provide unparalleled convenience for users navigating the complexities of modern finance.

In the rapidly evolving landscape of finance, there exists a significant challenge for individuals seeking to manage their assets across both digital and traditional banking platforms. Despite the proliferation of digital assets and the continued reliance on traditional banking services, users face a fragmented and disjointed experience when attempting to navigate and manage their diverse portfolio of assets. This lack of integration between digital assets and traditional banking poses a barrier to efficient asset management, hindering users' ability to monitor, track, and optimize their financial holdings effectively.

Consequently, there is a clear need for the development of a financial app that seamlessly bridges the gap between digital assets and traditional banking, providing users with a unified platform to efficiently manage their diverse portfolio of assets across digital and bank platforms.

About Project

This platform aims to empower and facilitates users to efficiently manage their diverse portfolio of assets across digital and bank platforms, providing them with a seamless and comprehensive financial management experience.

Problem

In today's ever-evolving world of finance, where digital assets and traditional banking coexist, there's a growing need for a seamless solution that bridges the gap between these two realms.

Solution

To address the challenge of efficiently managing diverse assets across digital and traditional banking platforms, the development of a Unified Asset Management Platform was proposed. This solution integrates digital assets and traditional banking services into a single, user-friendly app, empowering users to streamline their financial management processes effectively.

Empathize

Define

Ideate

Prototype

The best approach to tackling the issue of bridging the gap between digital assets and traditional banking involves a combination of strategic planning, innovative technology solutions, and user-centric design.

PROJECT PROCESS

USER PERSONA

Name: John Smith

Age: 40

Occupation: Marketing Manager

Financial Situation:

John has a stable job as a marketing manager at a mid-sized company, earning a comfortable salary.

He has been diligently saving for retirement and his children's education but wants to maximize the growth of his investments.

John has a diversified investment portfolio, including stocks, bonds, mutual funds, and some cryptocurrency holdings.

He owns a home with a mortgage and contributes regularly to his retirement accounts, such as a 401(k) and IRA.

Goals and Objectives:

John's primary financial goal is to build long-term wealth and achieve financial independence by retirement age.

He wants to optimize his investment portfolio to generate consistent returns while managing risk effectively.

John is also interested in exploring alternative investments, such as real estate or peer-to-peer lending, to diversify his portfolio further.

He aims to stay informed about market trends and economic developments to make informed investment decisions.

Challenges:

John finds it challenging to track and manage his diverse investment holdings across multiple accounts and platforms.

He wants to ensure that his investment strategy aligns with his risk tolerance, financial goals, and time horizon.

John is concerned about market volatility and wants to protect his portfolio from significant losses during market downturns.

Key Needs from the App:

A centralized platform where John can monitor and manage his entire investment portfolio in real-time.

Tools and resources to analyze portfolio performance, track progress towards financial goals, and identify investment opportunities.

Customization options to tailor his investment dashboard, alerts, and notifications based on his preferences and priorities.

Educational content and insights to help John stay informed about market trends, investment strategies, and financial planning best practices.

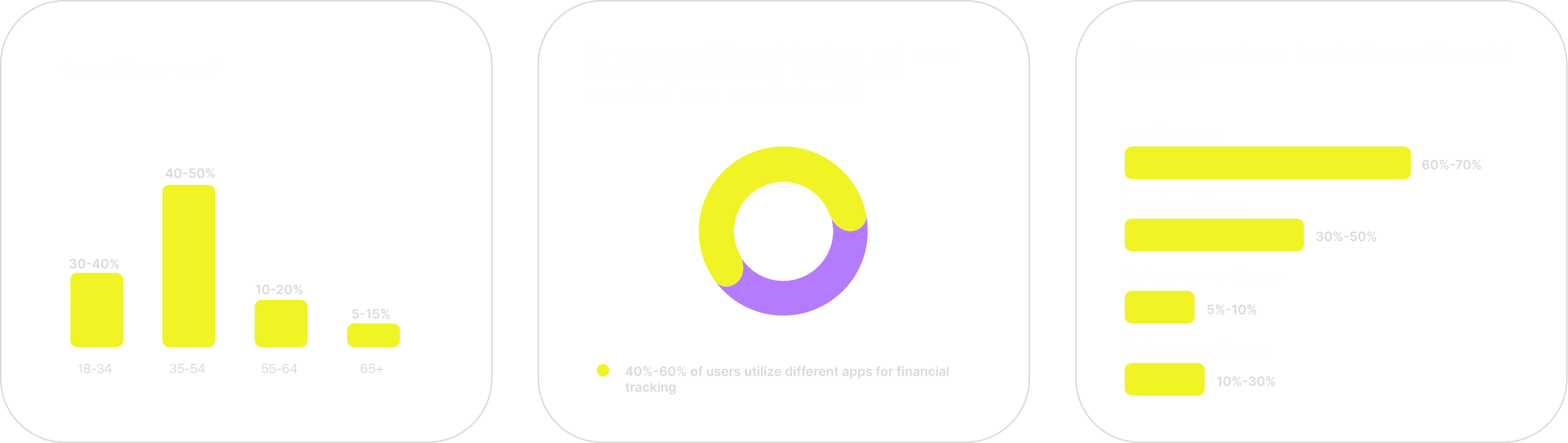

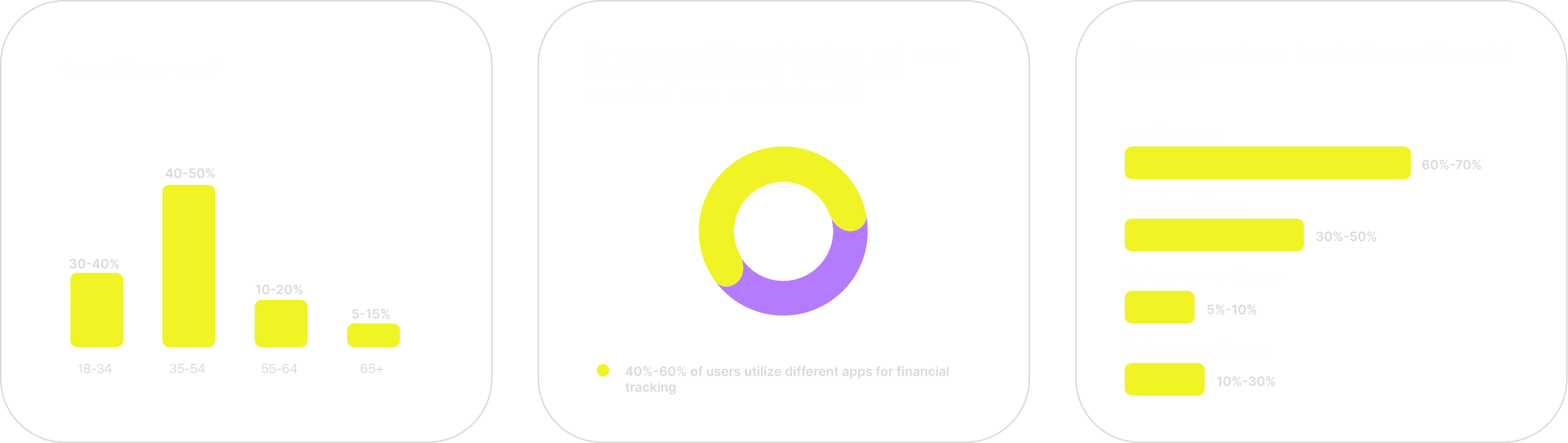

How old are you?

18-34

35-54

40-50%

55-64

10-20%

65+

30-40%

5-15%

40%-60% of users utilize different apps for financial tracking

How do you keep track of your financial assets?

10%-30%

30%-50%

60%-70%

5%-10%

Using spreadsheets

Banking Apps

Using a pen and paper

Investment Apps

Do you use different devices and apps to track your assets, income and spending on a regular basis?

USER RESEARCH

To better understand our users, we completed a competitive analysis, surveys, white paper research and analyzed the results later.